Hertz 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Company is highly leveraged and a substantial portion of its liquidity needs arise from debt service on its indebtedness and from the funding

of its costs of operations, acquisitions and capital expenditures. The Company’s practice is to maintain sufficient liquidity through cash from

operations, credit facilities and other financing arrangements, so that its operations are unaffected by adverse financial market conditions.

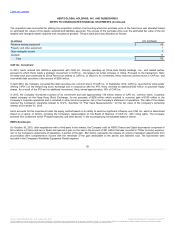

Senior Credit Facilities

Senior Term Facility: In March 2011, Hertz entered into a credit agreement that initially provided for a $1,400 million term loan (as amended, the

"Senior Term Facility"). In addition, the Senior Term Facility includes a separate incremental pre-funded synthetic letter of credit facility in an

aggregate principal amount of $200 million. Subject to the satisfaction of certain conditions and limitations, the Senior Term Facility allows for the

incurrence of incremental term and/or revolving loans.

In October 2012, Hertz entered into an Incremental Commitment Amendment to the Senior Term Facility which provided for commitments for term

loans of up to $750 million (the "Incremental Term Loans") under the Senior Term Facility. Contemporaneously with the consummation of the

Dollar Thrifty acquisition, the Incremental Term Loans were fully drawn and the proceeds therefrom were used in connection with funding the Dollar

Thrifty acquisition. The Incremental Term Loans are secured by the same collateral and guaranteed by the same guarantors as the term loans

under the Senior Term Facility and all such loans mature in March 2018.

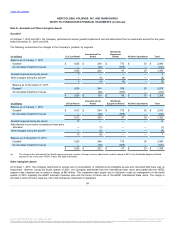

In April 2013, Hertz entered into an Amendment No. 2 ("Amendment No. 2") to the Senior Term Facility, primarily to reduce the interest rate

applicable to a portion of the outstanding term loans under the Senior Term Facility. Pursuant to Amendment No. 2, certain of the existing lenders

under the Senior Term Facility converted their existing Tranche B Term Loans into tranche B-2 term loans (the “Tranche B-2 Term Loans”), in an

aggregate principal amount, along with new loans advanced by certain new lenders, of approximately $1,372 million. The proceeds of Tranche B-2

Term Loans advanced by the new lenders were used to prepay in full all of the Tranche B Term Loans that were not converted into Tranche B-2

Term Loans. Except as described below, the Tranche B-2 Term Loans bear interest at a floating rate measured by reference to, at Hertz's option,

either (i) an adjusted London Inter-Bank Offered Rate ("LIBOR") not less than 0.75% plus a borrowing margin of 2.25% per annum or (ii) an

alternate base rate plus a borrowing margin of 1.25% per annum. The terms and conditions of the new Tranche B-2 Term Loans with respect to

maturity, collateral, and covenants are otherwise unchanged compared to the Tranche B Term Loans.

Senior ABL Facility: In March 2011, Hertz, HERC, and certain other of its subsidiaries entered into a credit agreement that initially provided for

aggregate maximum borrowings of $1,800 million (subject to borrowing base availability) on a revolving basis under an asset-based revolving credit

facility (as amended the “Senior ABL Facility”) Up to $1,500 million of the Senior ABL Facility was initially available for the issuance of letters of

credit, subject to certain conditions including issuing lender participation. Subject to the satisfaction of certain conditions and limitations, the

Senior ABL Facility allows for the addition of incremental revolving and/or term loan commitments.

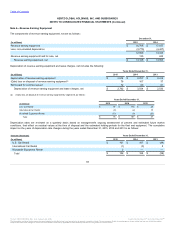

In July 2013, the Company increased the aggregate maximum borrowings under the Senior ABL Facility by $65 million (subject to borrowing base

availability).

In October 2014, Hertz entered into an agreement to amend certain terms of the Senior ABL Facility. The amendment, among other things (i)

extends the commitment period of $1,668 million of aggregate maximum borrowing capacity under the Senior ABL Facility to March 2017, with the

remaining $198 million of aggregate maximum borrowing capacity under the Senior ABL Facility, expiring, as previously scheduled, in March 2016

and (ii) provides for an increase in aggregate maximum borrowing capacity under the Senior ABL Facility of $235 million, such that (a) prior to

March 2016, aggregate maximum borrowing capacity will be $2,100 million and (b) after March 2016, aggregate maximum borrowing capacity will

be $1,903 million (in each case, subject to borrowing base availability).

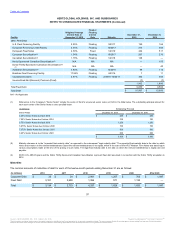

The Company refers to the Senior Term Facility and the Senior ABL Facility together as the “Senior Credit Facilities.” Hertz's obligations under the

Senior Credit Facilities are guaranteed by its immediate parent (Hertz Investors, Inc.) and certain of its direct and indirect U.S. subsidiaries

(subject to certain exceptions, including Hertz International Limited, which ultimately owns entities carrying on most of its international operations,

and subsidiaries involved in the HVF

98

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.