Hertz 2015 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

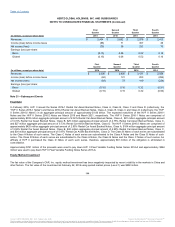

These material weaknesses in the control environment resulted in certain instances of inappropriate accounting decisions and in inappropriate

accounting methodologies and contributed to the following additional material weaknesses:

•We did not design and maintain effective controls over certain accounting estimates. Specifically, we did not design and maintain controls

over the effective review of the models, assumptions, and data used in developing estimates or changes made to assumptions and data,

including those related to reserve estimates associated with allowances for uncollectible amounts receivable for renter obligations for

damaged vehicles.

•We did not design and maintain effective controls over the review, approval, and documentation of manual journal entries.

We did not effectively design controls in response to the risks of material misstatement. This material weakness contributed to the following

additional material weaknesses:

•We did not design effective controls over certain business processes including our period-end financial reporting process. This includes

the identification and execution of controls over the preparation, analysis, and review of significant account reconciliations and closing

adjustments required to assess the appropriateness of certain account balances at period end.

We did not design and maintain effective monitoring controls related to the design and operational effectiveness of our internal controls.

Specifically, we did not maintain personnel and systems within the internal audit function that were sufficient to ensure the adequate monitoring of

control activities.

One or more of the foregoing control deficiencies contributed to the previously reported restatement of our financial statements for the years 2012

and 2013, each of the quarters of 2013 and the second quarter of 2015, including misstatements of direct operating expenses, accounts payable,

accrued liabilities, allowance for doubtful accounts, prepaid expenses and other assets, depreciation of vehicles sold through retail car sales

locations, and non-fleet property and equipment and the related accumulated depreciation and also resulted in audit adjustments to the Company's

consolidated financial statements for 2015. Additionally, the foregoing control deficiencies could result in material misstatements of the

consolidated financial statements that would not be prevented or detected. Accordingly, our management has determined these control

deficiencies constitute material weaknesses.

The effectiveness of our internal control over financial reporting as of December 31, 2015 has been audited by PricewaterhouseCoopers LLP, an

independent registered certified public accounting firm, as stated in their report, which appears in this Annual Report on Form 10-K.

Management Tone

We have taken actions to remediate the material weakness associated with an inappropriate tone at the top including (i) the previously disclosed

changes in our personnel with respect to the company’s senior management, (ii) the previously disclosed personnel changes in the financial

reporting and accounting function in order to ensure we have personnel with an appropriate level of knowledge, experience, and training to effect

appropriate tone at the top, (iii) the augmentation of these personnel with qualified consulting resources to ensure we have sufficient staffing to

meet our regulatory obligations, (iv) the reinforcement of adherence to established internal controls and Company policies and procedures through

formal communications, town hall meetings and employee trainings, (v) the establishment of procedures for ensuring clear reporting structures,

reporting lines, and decisional authority responsibilities in the organization and enhancement of communications with our operational departments,

accounting, Board and Audit Committee, (vi) new trainings administered and monitored by the Compliance Committee, (vii) the development of a

new enterprise risk assessment process to refine the company’s risk assessment, (viii) the enhancement of the annual

154

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.