HSBC 2004 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

86

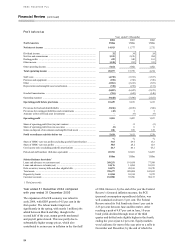

implementation of chip cards. Other general

expenses, including professional fees and

communications costs, increased to support

business expansion. Within the region HSBC

expanded the scale and range of services offered by

the Group Service Centres and additional staff were

recruited to support increased workflow. As new

business and cross-sales across the region grew

HSBC increased investment in sales support.

At US$117 million, the overall charge for bad

and doubtful debts was 21 per cent lower than in

2003. There was a release of general provision in

Malaysia which reflected the improvement in

economic outlook, and higher releases and

recoveries of specific provisions in several countries

across the region. New specific provisions raised

were 9 per cent higher than in 2003, notably in the

Middle East, Indonesia and Australia, reflecting

lending growth.

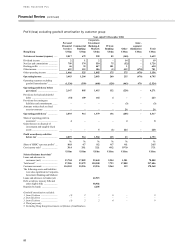

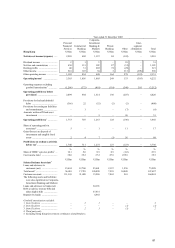

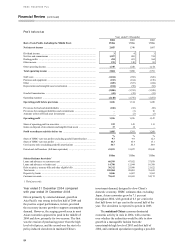

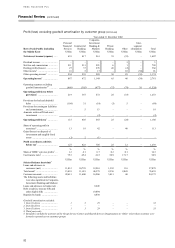

Commercial Banking reported pre-tax profits,

before goodwill amortisation, of US$496 million for

2004, 9 per cent ahead of 2003. A turnaround in

provisions, from a credit of US$52 million to a

charge of US$16 million, was more than offset by

additional income arising from growth in

international trade. Pre-provision profit before tax

increased by US$81 million, or 21 per cent. The

results also included, for the first time, a contribution

of US$24 million from the group’ s 19.9 per cent

stake in Bank of Communications.

Net interest income increased by 11 per cent,

compared with 2003, reflecting growth in the Middle

East, mainland China, Australia, New Zealand and

Singapore. The Middle East benefited from the

expansion of international trade, increased lending to

infrastructure projects, which took off on the back of

strong oil prices, and growth in current accounts. In

mainland China, HSBC benefited from increased

cross-referrals from Hong Kong, while a Taiwan

team seconded to mainland China helped to capture

substantial business from Taiwanese customers

investing there.

The expansion of trade business was also

reflected in other operating income, which grew by

18 per cent to US$347 million. Growth was

particularly strong in the Middle East, which also

benefited from increased fees associated with higher

lending, and in mainland China and Malaysia, where

dealing profits from foreign currency transactions

and trade services fees were both higher.

Operating expenses, before amortisation of

goodwill, were 6 per cent higher than last year.

Additional relationship managers, business

development and sales staff, credit analysts and

support staff were recruited in the latter part of 2004

in order to benefit from anticipated business

opportunities in 2005 arising from strong regional

economies. The continued migration of back office

work from Singapore, Australia, New Zealand and

Taiwan to the Global Service Centres contributed to

cost savings.

Provisions for bad and doubtful debts were

US$16 million, reversing a net release in 2003. New

provisions increased in mainland China, largely on a

single account and in the Middle East, reflecting

growth in lending. There were lower net recoveries

in Malaysia, while net recoveries and releases

increased in Indonesia and Singapore.

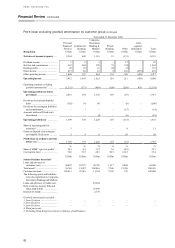

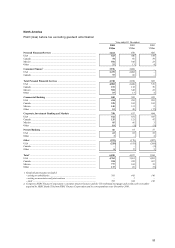

Corporate, Investment Banking and Markets

reported pre-tax profit, before amortisation of

goodwill, of US$940 million, an increase of 26 per

cent compared with 2003.

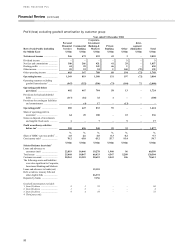

Net interest income of US$592 million grew by

7 per cent, in part reflecting strong Global Markets

performance from increased treasury earnings in

India and higher holdings of debt securities in China.

Corporate and Institutional Banking benefited from a

55 per cent increase in customer advances in

mainland China and a 58 per cent increase in the

Middle East. These gains were partly offset by a

decline in treasury interest income in Singapore as

higher yielding assets matured, and a reduction in

interest income in Japan from lower holdings of debt

securities.

Fees and commissions grew by 24 per cent to

US$421 million including a 3 per cent increase

resulting from Bank of Bermuda. Corporate and

Institutional Banking fee income rose in India,

Singapore, Taiwan and Japan, as client demand grew

for more sophisticated capital markets and related

risk management products. Performance in these

countries was improved further as an expansion in

business capabilities increased investment banking

advisory revenues and boosted Global Transaction

Banking volumes. In the Middle East, increases in

private equity revenues and corporate finance and

advisory fees reflected the expansion of the private

equity business and an enhancement of HSBC’ s

advisory function. In Malaysia, higher fees were

attributable to an increase in global custody and

transactional fees and an improvement in debt

origination and loan syndication activity. The

realignment of Corporate and Institutional Banking

business with Global Markets capabilities enabled

debt finance advisory to double the number of bond

and syndicated loan transactions, following effective

marketing initiatives and the identification of capital

market opportunities.