HSBC 2004 Annual Report Download - page 284

Download and view the complete annual report

Please find page 284 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

282

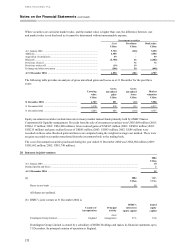

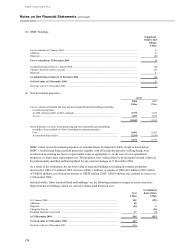

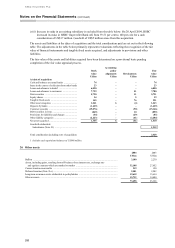

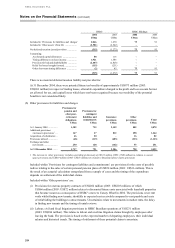

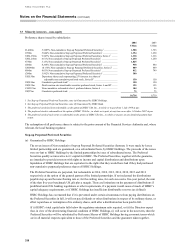

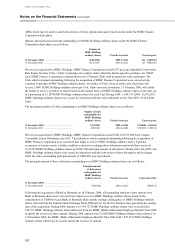

The composition of customer accounts on a geographical basis is set out below:

2004 2003

Interest-

bearing

Non

interest-

bearing Total

Interest-

bearing

Non

interest-

bearing Total

US$m US$m US$m US$m US$m US$m

Europe ................................................. 261,110 31,803 292,913 215,356 27,368 242,724

Hong Kong .......................................... 163,669 14,699 178,368 152,505 11,519 164,024

Rest of Asia-Pacific ............................ 67,861 10,752 78,613 58,651 6,790 65,441

North America .................................... 111,326 21,574 132,900 79,112 14,884 93,996

South America .................................... 9,017 1,940 10,957 5,533 1,412 6,945

612,983 80,768 693,751 511,157 61,973 573,130

The geographical analysis of customer accounts is based on the locations of the offices in which the customer

accounts are recorded.

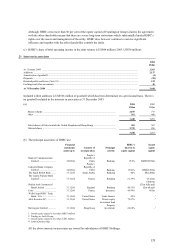

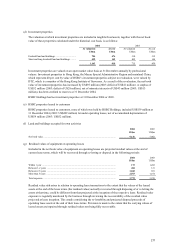

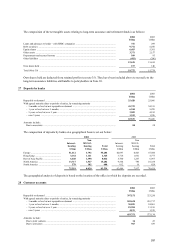

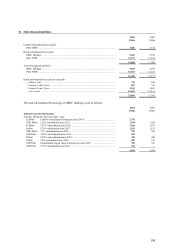

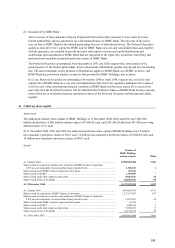

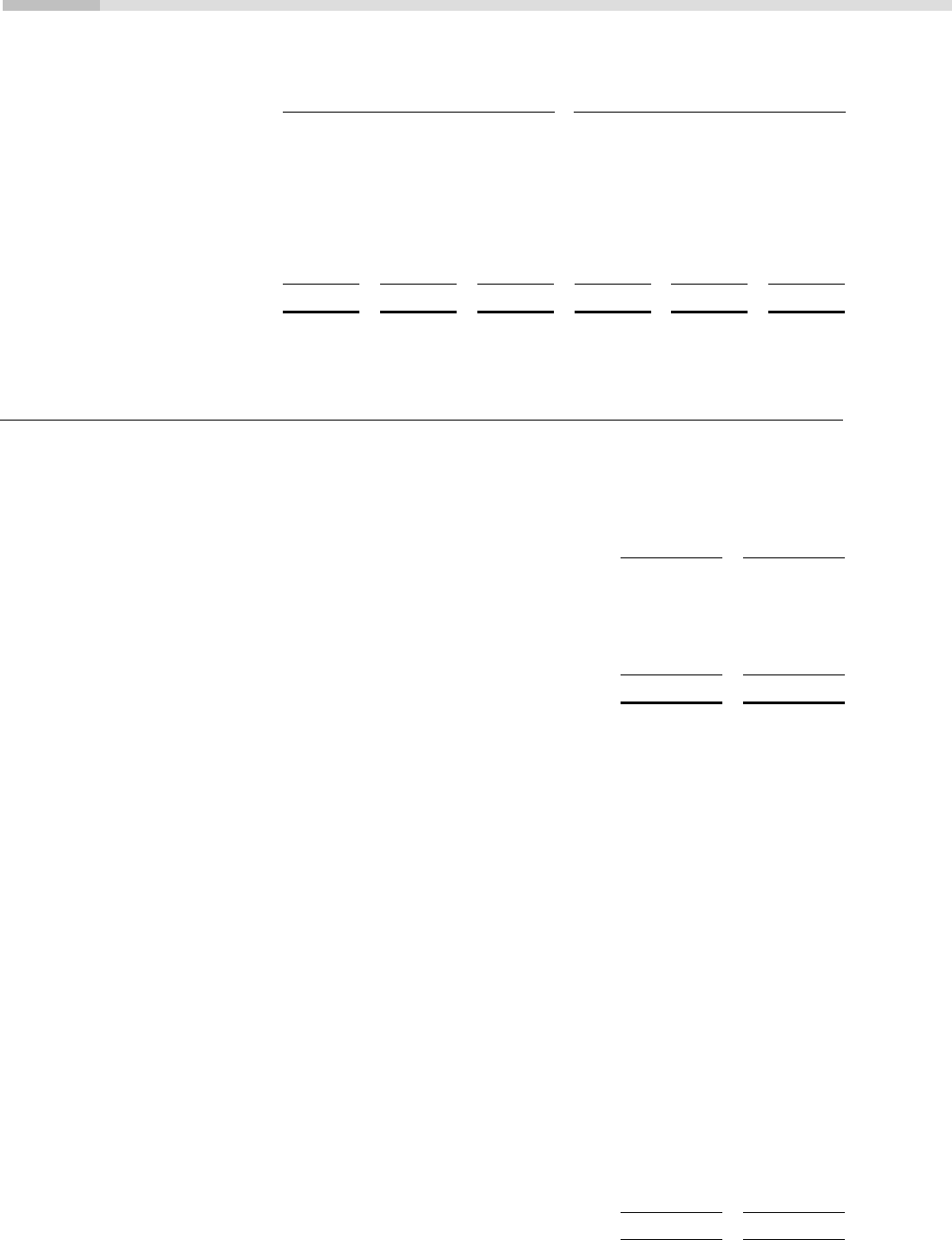

29 Debt securities in issue

2004 2003

US$m US$m

Bonds and medium-term notes, by remaining maturity

– within 1 year ........................................................................................................................... 34,987 29,979

– between 1 and 2 years ............................................................................................................. 25,808 16,950

– between 2 and 5 years ............................................................................................................. 49,985 33,578

– over 5 years ............................................................................................................................. 23,318 30,081

134,098 110,588

Other debt securities in issue, by remaining maturity

– 3 months or less ...................................................................................................................... 54,402 30,115

– 1 year or less but over 3 months ..............................................................................................10,052 3,716

– 5 years or less but over 1 year ................................................................................................. 8,753 8,726

– over 5 years ............................................................................................................................. 1,288 417

208,593 153,562

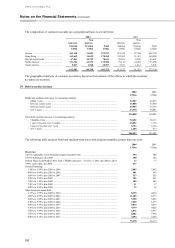

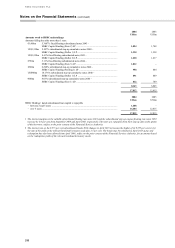

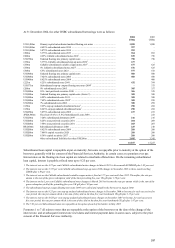

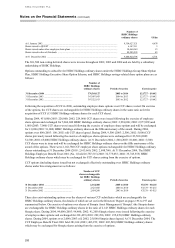

The following table analyses bond and medium-term notes with original maturities greater than one year:

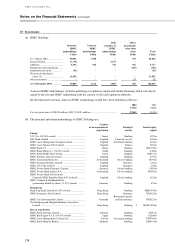

2004 2003

US$m US$m

Fixed rate:

8.875% Adjustable Conversion-Rate Equity Security Units ........................................................... 594 609

8.375% debentures; due 2007 ......................................................................................................... 100 102

Federal Home Loan Bank of New York (‘FHLB’ ) advances – 2.01% to 7.24%; due 2005 to 2033 13 17

3.99% senior debt; due 2044 ........................................................................................................... 557 –

Secured financing:

1.14% to 3.99%; due 2005 to 2008 ............................................................................................. 2,805 3,665

4.00% to 4.99%; due 2005 to 2006 ............................................................................................. 401 445

5.00% to 5.49%; due 2005 to 2007 ............................................................................................. 533 555

5.50% to 5.99%; due 2005 .......................................................................................................... 105 411

7.00% to 7.49%; due 2005 .......................................................................................................... 206 665

7.50% to 7.99%; due 2005 .......................................................................................................... 11 17

8.00% to 8.99%; due 2005 .......................................................................................................... 12 18

Other fixed rate senior debt:

2.15% to 3.99%; due 2005 to 2010 ............................................................................................. 8,378 4,014

4.00% to 4.99%; due 2005 to 2023 ............................................................................................. 11,685 8,373

5.00% to 5.49%; due 2005 to 2023 ............................................................................................. 5,358 5,052

5.50% to 5.99%; due 2005 to 2024 ............................................................................................. 7,495 6,375

6.00% to 6.49%; due 2005 to 2033 ............................................................................................. 9,074 9,834

6.50% to 6.99%; due 2005 to 2033 ............................................................................................. 9,779 9,442

7.00% to 7.49%; due 2005 to 2032 ............................................................................................. 6,876 6,917

7.50% to 7.99%; due 2005 to 2032 ............................................................................................. 8,002 7,968

8.00% to 9.25%; due 2005 to 2012 ............................................................................................. 3,694 3,636

75,678 68,115