HSBC 2004 Annual Report Download - page 289

Download and view the complete annual report

Please find page 289 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

287

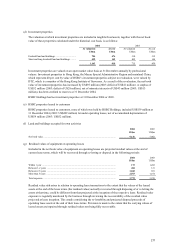

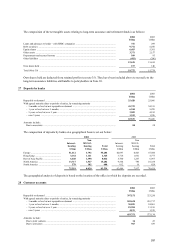

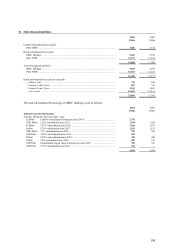

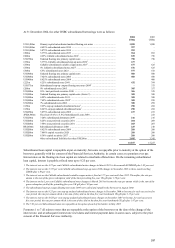

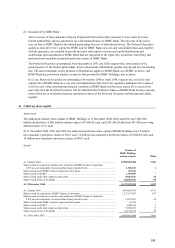

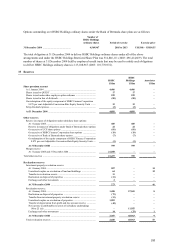

At 31 December 2004, the other HSBC subordinated borrowings were as follows:

2004 2003

US$m US$m

US$1,200m Primary capital subordinated undated floating rate notes .................................... 1,200 1,200

US$1,000m 4.625% subordinated notes 2014 ......................................................................... 997 –

US$1,000m 5.875% subordinated notes 2034 ......................................................................... 993 –

£500m 5.375% subordinated notes 2033 ......................................................................... 964 893

€600m 4.25% Callable subordinated notes 20161 ............................................................ 819 756

US$750m Undated floating rate primary capital notes ......................................................... 750 750

£350m 5.375% Callable subordinated step-up notes 20302 ............................................. 677 –

£350m Callable subordinated variable coupon notes 20173 ............................................. 677 625

£350m 5% Callable subordinated notes 20234 ................................................................. 676 625

£300m 6.5% subordinated notes 2023 ............................................................................. 577 532

US$500m Undated floating rate primary capital notes ......................................................... 500 500

US$500m 7.625% subordinated notes 2006 ......................................................................... 500 500

US$400m 8.625% subordinated notes 2004 ......................................................................... –400

£225m 6.25% subordinated notes 2041 ........................................................................... 432 399

US$375m Subordinated step-up coupon floating rate notes 20095 ....................................... –375

£200m 9% subordinated notes 2005 ................................................................................ 385 357

US$300m 10% trust preferred securities 2030 .................................................................... 306 329

US$300m Undated floating rate primary capital notes (Series 3) ......................................... 300 300

US$300m 6.95% subordinated notes 2011 ........................................................................... 300 300

US$300m 7.65% subordinated notes 20258 .......................................................................... 300 299

US$300m 7% subordinated notes 2006 ................................................................................ 300 299

£150m 9.25% step-up undated subordinated notes6 ......................................................... 290 268

£150m 8.625% step-up undated subordinated notes7 ....................................................... 290 268

US$250m 5.875% subordinated notes 2008 ......................................................................... 237 233

JP¥24,800m Fixed rate (5.0% to 5.5%) Subordinated Loans 2004 ........................................... –232

US$250m 7.20% subordinated debentures 2097 .................................................................. 216 216

US$200m 8.25% trust preferred securities 2031 .................................................................. 204 209

US$200m 7.50% trust preferred securities 2031 .................................................................. 203 207

BRL608m Subordinated debentures 2008 ............................................................................ 229 210

US$200m 6.625% subordinated notes 2009 ......................................................................... 200 200

US$200m 7.808% capital securities 2026 ............................................................................ 200 200

US$200m 8.38% capital securities 2027 .............................................................................. 200 200

Other subordinated liabilities less than US$200m ............................................... 2,895 3,345

16,817 15,227

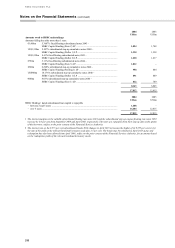

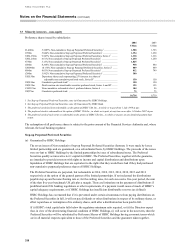

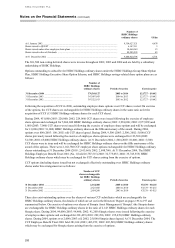

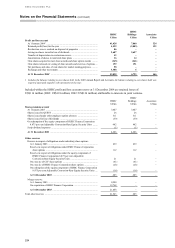

Subordinated loan capital is repayable at par on maturity, but some is repayable prior to maturity at the option of the

borrower, generally with the consent of the Financial Services Authority, in certain cases at a premium over par.

Interest rates on the floating rate loan capital are related to interbank offered rates. On the remaining subordinated

loan capital, interest is payable at fixed rates up to 9.25 per cent.

1The interest rate on the 4.25 per cent Callable subordinated notes changes in March 2011 to three-month EURIBOR plus 1.05 per cent.

2The interest rate on the 5.375 per cent Callable subordinated step-up notes 2030 changes in November 2025 to three month sterling

LIBOR plus 1.50 per cent.

3The interest rate on the Callable subordinated variable coupon notes is fixed at 5.75 per cent until June 2012. Thereafter, the rate per

annum is the sum of the gross redemption yield of the then prevailing five-year UK gilt plus 1.70 per cent.

4The interest on the 5 per cent Callable subordinated notes changes in March 2018 to become the rate per annum which is the sum of the

gross redemption yield of the prevailing five-year UK gilt plus 1.80 per cent.

5The subordinated step-up coupon floating rate notes 2009 were called and repaid by the borrower in August 2004.

6The interest rate on the 9.25 per cent step-up undated subordinated notes changes in December 2006 to become, for each successive five

year period, the rate per annum which is the sum of the yield on the then five year benchmark UK gilt plus 2.15 per cent.

7The interest rate on the 8.625 per cent step-up undated subordinated notes changes in December 2007 to become, for each successive

five year period, the rate per annum which is the sum of the yield on the then five year benchmark UK gilt plus 1.87 per cent.

8The 7.65 per cent Subordinated notes are repayable at the option of each of the holders in May 2007.

Footnotes 1 to 7 all relate to notes that are repayable at the option of the borrower on the date of the change of the

interest rate, and at subsequent interest rate reset dates and interest payment dates in some cases, subject to the prior

consent of the Financial Services Authority.