HSBC 2004 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378

|

|

161

In view of the high levels of personal

indebtedness in many of the world’ s leading

economies, guidelines for the restructuring of

customer facilities in the event of financial difficulty

have been reinforced.

In the US, the strength of the housing market

continued unabated, driven mainly by affordability.

Low interest rates, lower transaction costs and

increased availability of credit all fuelled the rise in

demand. However, recent rises in interest rates are

likely to affect growth adversely and add pressure to

some borrowers, particularly in certain overpriced

locations. The portfolios, however, remain

geographically diverse and are secured largely by

senior lien positions.

Although increased mortgage borrowing has

contributed to the record level of consumer debt,

levels have largely stabilised and are expected to

decline gradually, as incomes rise sufficiently to pay

down debt, notwithstanding higher interest rates.

Against this background, delinquency rates fell

across the majority of portfolios during 2004 and

trends in lending quality showed an improvement.

Personal lending in the UK also continued to

grow strongly, particularly in the mortgage market.

This secured portfolio, representing 55 per cent of

total lending to personal customers in the UK,

continued to suffer negligible delinquency and

losses. The unsecured portfolio also continued to

expand both through organic growth and with the

acquisition of Marks and Spencer Financial Services,

which added US$5.3 billion to the portfolio in

November 2004. Underwriting criteria were

regularly reviewed to ensure that they remained

appropriate in prevailing market conditions, which

have seen a steady rise in personal bankruptcies and

delinquencies over the course of the year.

With consumer spending rising in Hong Kong

and the levels of bankruptcies and unemployment

both falling, the improvement in the personal

portfolios, which first became evident during the

second half of 2003, continued throughout 2004.

With ongoing property price increases a feature of

2004, the most notable trend was the continued

reduction in the level of negative equity on mortgage

balances, which is now at modest levels.

Across the other geographical regions the

position remained relatively stable, although HSBC

continued to monitor carefully those portfolios that

have the greatest potential for future economic

stress. Delinquency and loss trends differed across

jurisdictions, reflecting these varied conditions.

Risk elements in the loan portfolio

The following disclosure of credit risk elements

reflects US accounting practice and classifications:

• loans accounted for on a non-accrual basis;

• accruing loans contractually past due 90 days or

more as to interest or principal; and

• troubled debt restructurings not included in the

above.

In accordance with UK accounting practice, a

number of operating companies suspend interest

rather than ceasing to accrue. This additional

category is also reported below, as are assets

acquired in exchange for advances.

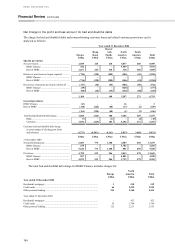

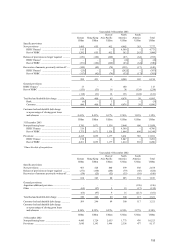

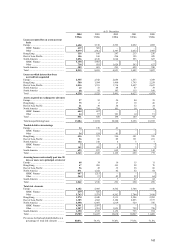

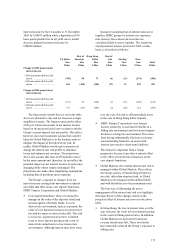

Non-performing loans and advances1

At 31 December

2004

US$m

2003

US$m

Banks ........................................ 25 24

Customers

– HSBC Finance ....................... 4,201 4,706

– Other HSBC............................ 9,058 10,344

13,259 15,050

Total non-performing loans

and advances........................... 13,284 15,074

Total provisions cover as a

percentage of non-performing

loans and advances ................. 95.5% 91.0%

1 Net of suspended interest.

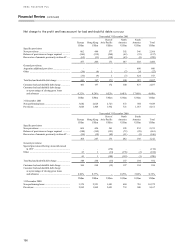

Non-performing customer loans1 and related

specific provisions outstanding by geographical

segment

2004 2003

Non-

performing

loans

Specific

provisions

Non-

performing

loans

Specific

provisions

US$m US$m US$m US$m

Europe ...... 6,065 4,036 5,701 3,554

Hong

Kong ...... 773 331 1,671 629

Rest of

Asia-

Pacific .... 1,180 791 1,538 981

North

America . 4,583 4,420 5,444 5,184

South

America 658 522 696 530

13,259 10,100 15,050 10,878

1 Net of suspended interest.

Total non-performing loans to customers decreased

by US$1,791 million during the year. At

31 December 2004, non-performing loans

represented 1.9 per cent of total lending compared