HSBC 2004 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378

|

|

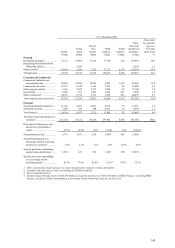

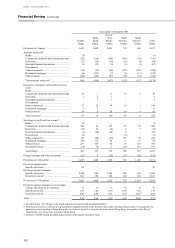

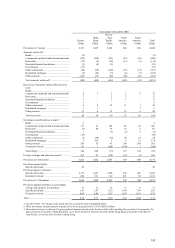

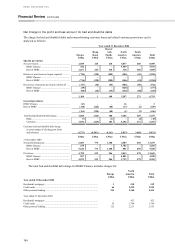

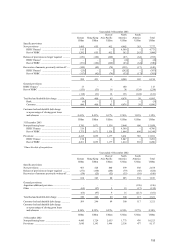

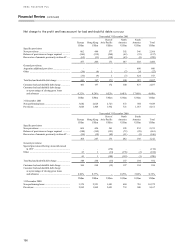

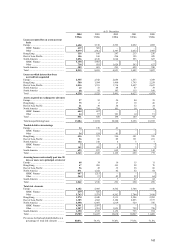

153

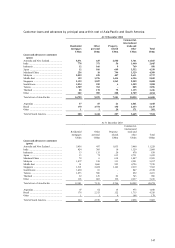

Year ended 31 December 2000

Europe

Hong

Kong

Rest of

Asia-

Pacific

North

America

South

America Total

US$m US$m US$m US$m US$m US$m

Provisions at 1 January ....................................... 2,153 1,887 2,686 864 430 8,020

Amounts written off:

Banks ............................................................... (9) ––––

(9)

Commercial, industrial and international trade (154) (202) (191) (97) (36) (680)

Real estate ....................................................... (27) (9) (58) (13) (3) (110)

Non-bank financial institutions ........................ (2) (8) (3) ––

(13)

Governments ................................................... (37) ––––

(37)

Other commercial ............................................ (68) (68) (149) (97) (15) (397)

Residential mortgages ..................................... (5) (82) (5) (4) (7) (103)

Other personal ................................................. (181) (73) (88) (90) (30) (462)

Total amounts written off ................................ (483) (442) (494) (301) (91) (1,811)

Recoveries of amounts written off in previous

years:

Banks ............................................................... ––––––

Commercial, industrial and international trade 4 3 3 1 2 13

Real estate ....................................................... 7 –23–12

Non-bank financial institutions ........................ 3 –21–6

Governments ................................................... 3 ––––3

Other commercial ............................................ 4 4 23 11 1 43

Residential mortgages ..................................... 1 1 ––13

Other personal ................................................. 32 8 19 15 6 80

Total recoveries ............................................... 54 16 49 31 10 160

Net charge to profit and loss account1:

Banks ............................................................... 2 ––––2

Commercial, industrial and international trade 87 81 107 89 43 407

Real estate ....................................................... (9) 40 19 10 5 65

Non-bank financial institutions ........................ 1 –(3) (2) 2 (2)

Governments ................................................... (19) ––––

(19)

Other commercial ............................................ (3) (30) (18) 80 21 50

Residential mortgages ..................................... 1 101 5 9 12 128

Other personal ................................................. 245 55 63 109 109 581

General provisions ........................................... 43 1 (188) (138) 2 (280)

Total charge ..................................................... 348 248 (15) 157 194 932

Foreign exchange and other movements2 ............ 953 93 (135) (12) (3) 896

Provisions at 31 December................................... 3,025 1,802 2,091 739 540 8,197

Provisions against banks:

Specific provisions .......................................... 30 ––––

30

Provisions against customers:

Specific provisions .......................................... 2,135 1,241 1,929 278 482 6,065

General provisions3 ......................................... 860 561 162 461 58 2,102

Provisions at 31 December .................................. 3,025 1,802 2,091 739 540 8,197

Provisions against customers as a percentage

of loans and advances to customers: %%%%%%

Specific provisions .......................................... 1.61 1.87 6.23 0.44 7.54 2.03

General provisions ........................................... 0.65 0.84 0.53 0.74 0.91 0.70

Total .................................................................... 2.26 2.71 6.76 1.18 8.45 2.73

1See table below ‘Net charge to the profit and loss account for bad and doubtful debts’.

2Other movements include amounts transferred in on the acquisition of CCF of US$882 million.

3General provisions are allocated to geographical segments based on the location of the office booking the provision. Consequently, the

general provision booked in Hong Kong may cover assets booked in branches located outside Hong Kong, principally in the Rest of

Asia-Pacific, as well as those booked in Hong Kong.