Xcel Energy 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

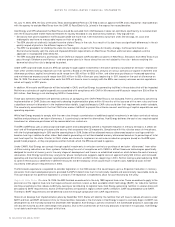

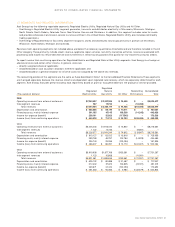

18. SUMMARIZED QUARTERLY FINANCIAL DATA (UNAUDITED)

Summarized quarterly unaudited financial data is as follows:

Quarter ended

March 31, 2005 June 30, 2005 Sept. 30, 2005 Dec. 31, 2005

(Thousands of dollars, except per share amounts)

(a) (a) (a) (a)

Revenue $2,381,038 $2,073,549 $2,288,653 $2,882,237

Operating income 279,341 198,098 364,725 250,555

Income from continuing operations 127,643 74,613 197,817 98,964

Discontinued operations – income (loss) (6,165) 8,793 (1,798) 13,104

Net income 121,478 83,406 196,019 112,068

Earnings available for common shareholders 120,418 82,346 194,959 111,008

Earnings per share from continuing operations – basic $ 0.32 $ 0.18 $ 0.49 $ 0.25

Earnings per share from continuing operations – diluted $ 0.31 $ 0.18 $ 0.47 $ 0.24

Earnings (loss) per share from discontinued operations – basic $ (0.02) $ 0.02 $ (0.01) $ 0.03

Earnings (loss) per share from discontinued operations – diluted $ (0.02) $ 0.02 $ – $ 0.03

Earnings per share total – basic $ 0.30 $ 0.20 $ 0.48 $ 0.28

Earnings per share total – diluted $ 0.29 $ 0.20 $ 0.47 $ 0.27

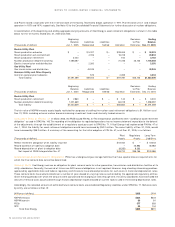

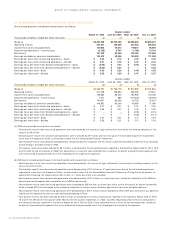

Quarter ended

March 31, 2004 June 30, 2004 Sept. 30, 2004 Dec. 31, 2004

(Thousands of dollars, except per share amounts)

(b) (b) (b) (b)

Revenue $2,248,797 $1,760,175 $1,974,935 $2,231,654

Operating income 321,438 198,694 338,235 217,347

Income from continuing operations 148,684 85,420 165,952 122,208

Discontinued operations – income (loss) 1,227 886 (119,232) (49,184)

Net income 149,911 86,306 46,720 73,024

Earnings available for common shareholders 148,851 85,246 45,660 71,964

Earnings per share from continuing operations – basic $ 0.37 $ 0.21 $ 0.41 $ 0.30

Earnings per share from continuing operations – diluted $ 0.36 $ 0.21 $ 0.40 $ 0.30

Earnings (loss) per share from discontinued operations – basic $ – $ – $ (0.30) $ (0.12)

Earnings (loss) per share from discontinued operations – diluted $ – $ – $ (0.28) $ (0.12)

Earnings per share total – basic $ 0.37 $ 0.21 $ 0.11 $ 0.18

Earnings per share total – diluted $ 0.36 $ 0.21 $ 0.12 $ 0.18

(a) 2005 results include unusual items as follows:

– Third-quarter results from continuing operations were decreased by the accrual of legal settlements incurred by the holding company in the

amount of $5 million.

– Second-quarter results from discontinued operations were increased by $7.7 million due to a true-up on the estimated impairment expected to

result from the disposal of Seren, as discussed in Note 2 to the Consolidated Financial Statements.

– Fourth-quarter results from discontinued operations include the positive impact of a $17.2 million tax benefit recorded to reflect the final resolution

of Xcel Energy’s divested interest in NRG.

– First-quarter revenue has been reduced by $6.1 million as compared to the amount previously reported in the Quarterly Report filed on Form 10-Q

with the SEC for the first quarter of 2005. This adjustment is a result of fees collected from customers on behalf of governmental agencies that

were reclassified to be presented net of the related payments made to the agencies.

(b) 2004 results include special charges in the fourth quarter and unusual items as follows:

– Fourth-quarter results from continuing operations were decreased by the accrual of legal settlements incurred by the holding company in the

amount of $17.6 million.

– Third-quarter results from discontinued operations were decreased by $112 million, or 27 cents per share, due to the estimated impairment

expected to result from the disposal of Seren, as discussed in Note 2 to the Consolidated Financial Statements. During the fourth quarter, an

adjustment increasing the impairment by $31 million, or 7 cents per share, was recorded.

– Fourth-quarter results from discontinued operations were decreased by $15.7 million, or 4 cents per share, related to a reduction of the NRG tax

benefits previously booked, after completion of an NRG tax basis study.

– Fourth-quarter results from continuing operations were increased by $33.8 million, or 8 cents per share, due to the accrual of income tax benefits

which included $22.3 million related to the successful resolution of various issues and other adjustments to current and deferred taxes.

– Fourth-quarter results from continuing operations were decreased by a $19.7 million accrual recorded to reflect SPS’ best estimate of any potential

liability for the impact of its retail fuel cost-recovery proceeding in Texas.

– First-quarter revenue has been reduced by $10.4 million as compared to the amount previously reported in the Quarterly Report filed on Form

10-Q with the SEC for the first quarter 2005. Revenue for the quarter ended Dec. 31, 2004, has been reduced by $10.3 million as compared to

the amount previously reported in the Annual Report on Form 10-K for 2004. These adjustments are a result of fees collected from customers

on behalf of governmental agencies that were reclassified to be presented net of the related payments made to the agencies.

82 XCEL ENERGY 2005 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS