Xcel Energy 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

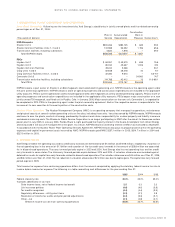

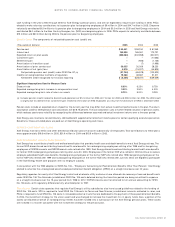

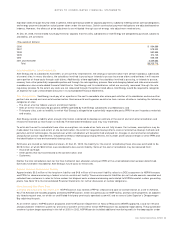

cash funding in the years 2003 through 2005 for Xcel Energy’s pension plans, and are not expected to require cash funding in 2006. PSCo

elected to make voluntary contributions to its pension plan for bargaining employees of $9 million in 2004 and $14.7 million in 2005, Cheyenne

voluntarily contributed $0.9 million to its pension plan for bargaining employees in 2004 and $0.3 million in 2005 and Xcel Energy voluntarily

contributed $5.0 million to the New Century Energies, Inc. (NCE) non-bargaining plans in 2005. PSCo expects to voluntarily contribute between

$15 million and $30 million during 2006 to the pension plan for bargaining employees.

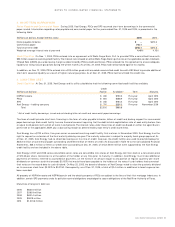

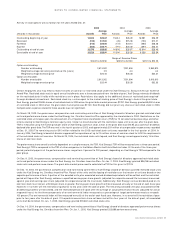

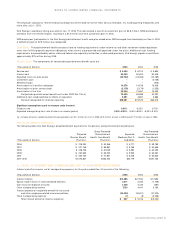

Benefit Costs

The components of net periodic pension cost (credit) are:

(Thousands of dollars) 2005 2004 2003

Service cost $ 60,461 $ 58,150 $ 67,449

Interest cost 160,985 165,361 170,731

Expected return on plan assets (280,064) (302,958) (322,011)

Curtailment gain –– (17,363)

Settlement gain –(926) (1,135)

Amortization of transition asset –(7) (1,996)

Amortization of prior service cost 30,035 30,009 28,230

Amortization of net (gain) loss 6,819 (15,207) (44,825)

Net periodic pension cost (credit) under SFAS No. 87

(a)

(21,764) (65,578) (120,920)

Credits not recognized due to effects of regulation 19,368 38,967 51,311

Net benefit credit recognized for financial reporting $ (2,396) $(26,611) $(69,609)

Significant Assumptions Used to Measure Costs

Discount rate 6.00% 6.25% 6.75%

Expected average long-term increase in compensation level 3.50% 3.50% 4.00%

Expected average long-term rate of return on assets 8.75% 9.00% 9.25%

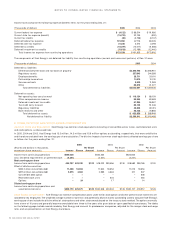

(a) Includes pension credits related to discontinued operations of $1.3 million for 2005, $4.7 million for 2004 and $19.0 million for 2003. The 2003 credit

is largely due to a $20.0 million curtailment gain related to termination of NRG employees as a result of the divestiture of NRG in December 2003.

Pension costs include an expected return impact for the current year that may differ from actual investment performance in the plan. Th e r etu rn

assumption used for 2006 pension cost calculations will be 8.75 percent. The cost calculation uses a market-related valuation of pension assets,

which reduces year-to-year volatility by recognizing the differences between assumed and actual investment returns over a five-year period.

Xcel Energy also maintains noncontributory, defined benefit supplemental retirement income plans for certain qualifying executive personnel.

Benefits for these unfunded plans are paid out of Xcel Energy’s operating cash flows.

DEFINED CONTRIBUTION PLANS

Xcel Energy maintains 401(k) and other defined contribution plans that cover substantially all employees. Total contributions to these plans

were approximately $19.6 million in 2005, $21.9 million in 2004 and $15.9 million in 2003.

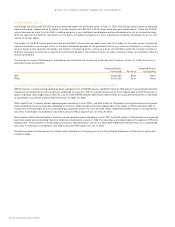

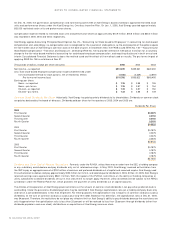

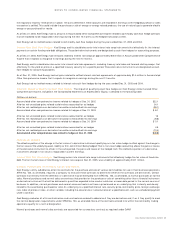

POSTRETIREMENT HEALTH CARE BENEFITS

Xcel Energy has a contributory health and welfare benefit plan that provides health care and death benefits to most Xcel Energy reti rees. The

former NSP discontinued contributing toward health care benefits for nonbargaining employees retiring after 1998 and for bargaining

employees of NSP-Minnesota and NSP-Wisconsin who retired after 1999. Xcel Energy discontinued contributing toward health care benefits

for former NCE nonbargaining employees retiring after June 30, 2003. Employees of the former NCE who retired in 2002 continue to receive

employer-subsidized health care benefits. Nonbargaining employees of the former NSP who retired after 1998, bargaining employees of the

former NSP who retired after 1999 and nonbargaining employees of the former NCE who retired after June 30, 2003, are eligible to participate

in the Xcel Energy health care program with no employer subsidy.

In conjunction with the 1993 adoption of SFAS No. 106 – “ Employers’ Accounting for Postretirement Benefits Other Than Pension,” Xcel Energy

elected to amortize the unrecognized accumulated postretirement benefit obligation (APBO) on a straight-line basis over 20 years.

Regulatory agencies for nearly all of Xcel Energy’s retail and wholesale utility customers have allowed rate recovery of accrued benefit costs

under SFAS No. 106. The Colorado jurisdictional SFAS No. 106 costs deferred during the transition period are being amortized to expense

on a straight-line basis over the 15-year period from 1998 to 2012. NSP-Minnesota also transitioned to full accrual accounting for SFAS

No. 106 costs, with regulatory differences fully amortized prior to 1997.

Plan Assets

Certain state agencies that regulate Xcel Energy’s utility subsidiaries also have issued guidelines related to the funding of

SFAS No. 106 costs. SPS is required to fund SFAS No. 106 costs for Texas and New Mexico jurisdictional amounts collected in rates, and

PSCo is required to fund SFAS No. 106 costs in irrevocable external trusts that are dedicated to the payment of these postretirement benefits.

In 2004, the investment strategy for the union asset fund was changed to increase the investment mix in equity funds. Also, a portion of the

assets contributed on behalf of nonbargaining retirees has been funded into a sub-account of the Xcel Energy pension plans. These assets

are invested in a manner consistent with the investment strategy for the pension plan.

XCEL ENERGY 2005 ANNUAL REPORT 61

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS