Xcel Energy 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

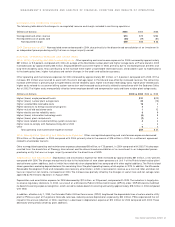

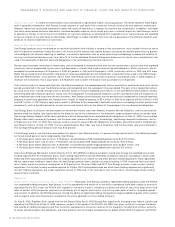

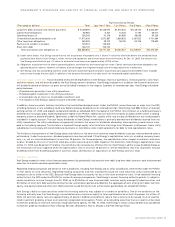

Accounting Policy Judgments/Uncertainties Affecting Application See Additional Discussion At

Regulatory Mechanisms and – External regulatory decisions, requirements Management’s Discussion and Analysis:

Cost Recovery and regulatory environment Factors Affecting Results of Continuing Operations

– Anticipated future regulatory Regulation

decisions and their impact Notes to Consolidated Financial Statements

– Impact of deregulation and competition on Notes 1, 14 and 16

ratemaking process and ability to recover costs

Nuclear Plant Decommissioning – Costs of future decommissioning Notes to Consolidated Financial Statements

and Cost Recovery – Availability of facilities for waste disposal Notes 1, 14 and 15

– Approved methods for waste disposal

– Useful lives of nuclear power plants

– Future recovery of plant investment and

decommissioning costs

Income Tax Accruals – Application of tax statutes and Management’s Discussion and Analysis:

regulations to transactions Factors Affecting Results of Continuing Operations

– Anticipated future decisions of tax authorities Tax Matters

– Ability of tax authority decisions/positions Notes to Consolidated Financial Statements

to withstand legal challenges and appeals Notes 1, 8 and 14

– Ability to realize tax benefits through carry

backs to prior periods or carry overs to

future periods

Benefit Plan Accounting – Future rate of return on pension and other Management’s Discussion and Analysis:

plan assets, including impact of any changes Factors Affecting Results of Continuing Operations

to investment portfolio composition Pension Plan Costs and Assumptions

– Discount rates used in valuing benefit obligation Notes to Consolidated Financial Statements

– Actuarial period selected to recognize deferred Notes 1 and 10

investment gains and losses

Asset Valuation – Regional economic conditions affecting asset Management’s Discussion and Analysis:

operation, market prices and related cash flows Results of Operations

– Regulatory and political environments Statement of Operations Analysis

and requirements Discontinued Operations

– Levels of future market penetration and Factors Affecting Results of Continuing Operations

customer growth Impact of Nonregulated Investments

Notes to Consolidated Financial Statements

Note 2

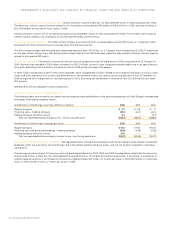

Xcel Energy continually makes informed judgments and estimates related to these critical accounting policy areas, based on an evaluation

of the varying assumptions and uncertainties for each area. For example:

– Probable outcomes of regulatory proceedings are assessed in cases of requested cost recovery or other approvals from regulators.

– The ability to operate plant facilities and recover the related costs over their useful operating lives, or such other period designated by

Xcel Energy’s regulators, is assumed.

– Probable outcomes of reviews and challenges raised by tax authorities, including appeals and litigation where necessary, are assessed.

– Projections are made regarding earnings on pension investments, and the salary increases provided to employees over their periods of

service.

– Future cash inflows of operations are projected in order to assess whether they will be sufficient to recover future cash outflows, including

the impact of product price changes and market penetration to customer groups.

The information and assumptions underlying many of these judgments and estimates will be affected by events beyond the control of Xcel

Energy, or otherwise change over time. This may require adjustments to recorded results to better reflect the events and updated information

that becomes available. The accompanying financial statements reflect management’s best estimates and judgments of the impact of these

factors as of Dec. 31, 2005.

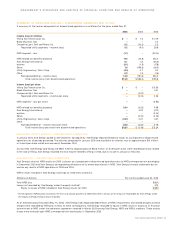

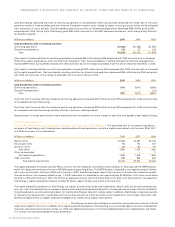

RECENTLY IMPLEMENTED ACCOUNTING CHANGES

For a discussion of significant accounting policies, see Note 1 to the Consolidated Financial Statements.

PENDING ACCOUNTING CHANGES

Statement of Financial Accounting Standards (SFAS) No. 123 (Revised 2004) – “ Share Based Payment” (SFAS No. 123R)

In December 2004, the FASB issued SFAS No. 123R related to equity-based compensation. This statement replaces the original SFAS No. 123 –

“Accounting for Stock-Based Compensation.” Under SFAS No. 123R, companies are no longer allowed to account for their share-based payment

awards using the intrinsic value allowed by previous accounting requirements, which did not require any expense to be recorded on stock

options granted with an equal to or greater than fair market value exercise price. Instead, equity-based compensation arrangements will be

30 XCEL ENERGY 2005 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS