Xcel Energy 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

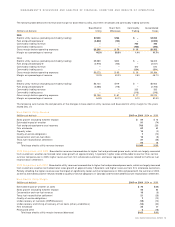

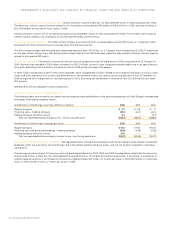

The following table details the revenue and margin for base electric utility, short-term wholesale and commodity trading activities:

Base Electric Short-Term Commodity Consolidated

(Millions of dollars) Utility Wholesale Trading Totals

2005

Electric utility revenue (excluding commodity trading) $7,038 $196 $ – $7,234

Fuel and purchased power (3,802) (120) – (3,922)

Commodity trading revenue – – 730 730

Commodity trading costs – – (720) (720)

Gross margin before operating expenses $3,236 $ 76 $ 10 $3,322

Margin as a percentage of revenue 46.0% 38.8% 1.4% 41.7%

2004

Electric utility revenue (excluding commodity trading) $5,989 $220 $ – $6,209

Fuel and purchased power (2,916) (125) – (3,041)

Commodity trading revenue – – 610 610

Commodity trading costs – – (594) (594)

Gross margin before operating expenses $3,073 $ 95 $ 16 $3,184

Margin as a percentage of revenue 51.3% 43.2% 2.6% 46.7%

2003

Electric utility revenue (excluding commodity trading) $5,724 $179 $ – $5,903

Fuel and purchased power (2,588) (118) – (2,706)

Commodity trading revenue – – 333 333

Commodity trading costs – – (316) (316)

Gross margin before operating expenses $3,136 $ 61 $ 17 $3,214

Margin as a percentage of revenue 54.8% 34.1% 5.1% 51.5%

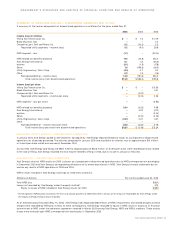

The following summarizes the components of the changes in base electric utility revenue and base electric utility margin for the years

ended Dec. 31:

Base Electric Utility Revenue

(Millions of dollars) 2005 vs. 2004 2004 vs. 2003

Sales growth (excluding weather impact) $57 $73

Estimated impact of weather 91 (74)

Fuel and purchased power cost recovery 706 230

Firm wholesale 67 62

Capacity sales 15 (2)

Quality-of-service obligations 7(12)

Conservation and non-fuel riders 16 (5)

Texas fuel reconciliation settlement 21 (25)

Other 69 18

Total base electric utility revenue increase $1,049 $265

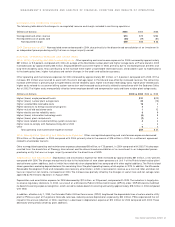

2005 Comparison with 2004

Base electric revenues increased due to higher fuel and purchased power costs, which are largely recovered

from customers; weather-normalized retail sales growth of approximately 1.4 percent; higher sales attributable to warmer than normal

summer temperatures in 2005; higher revenues from firm wholesale customers; and lower regulatory accruals related to the Texas fuel

reconciliation settlement.

2004 Comparison with 2003

Base electric utility revenues increased due to higher fuel and purchased power costs, which are largely recovered

from customers; weather-normalized retail sales growth of approximately 1.8 percent; and higher revenues from firm wholesale customers.

Partially offsetting the higher revenues was the impact of significantly cooler summer temperatures in 2004, compared with the summer of 2003,

as well as estimated customer refunds related to quality-of-service obligations in Colorado and the estimated Texas fuel reconciliation settlement.

Base Electric Utility Margin

(Millions of dollars) 2005 vs. 2004 2004 vs. 2003

Estimated impact of weather on sales $75 $(56)

Sales growth (excluding weather impact) 42 55

Conservation and non-fuel revenue 16 (6)

Texas fuel reconciliation settlement 21 (25)

Quality-of-service obligations 7(12)

Under-recovery of fuel costs (NSP-Wisconsin) (15) (10)

Under-recovery and timing of recovery of fuel costs (other jurisdictions) (14) (20)

Firm wholesale 23 27

Pricing and other 8(16)

Total base electric utility margin increase (decrease) $163 $(63)

XCEL ENERGY 2005 ANNUAL REPORT 19

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS