Xcel Energy 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

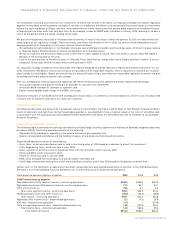

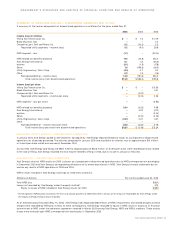

NONREGULATED OPERATING MARGINS

The following table details the changes in nonregulated revenue and margin included in continuing operations:

(Millions of dollars) 2005 2004 2003

Nonregulated and other revenue $74 $75 $134

Nonregulated cost of goods sold (25) (29) (81)

Nonregulated margin $49 $46 $ 53

2004 Comparison to 2003

Nonregulated revenue decreased in 2004, due primarily to the discontinued consolidation of an investment in

an independent power-producing entity that was no longer majority owned.

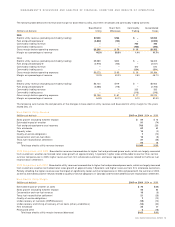

NON-FUEL OPERATING EXPENSES AND OTHER ITEMS

Other Utility Operating and Maintenance Expenses

Other operating and maintenance expenses for 2005 increased by approximately

$87 million, or 5.5 percent, compared with 2004. An outage at the Monticello nuclear plant and higher outage costs at Prairie Island in 2005

increased costs by approximately $26 million. Employee benefit costs were higher in 2005, primarily due to increased pension benefits and

long-term disability costs. Also contributing to the increase were higher uncollectible receivable costs, attributable in part to modifications

to the bankruptcy laws, higher fuel prices and certain changes in the credit and collections process.

Other operating and maintenance expenses for 2004 increased by approximately $21 million, or 1.4 percent, compared with 2003. Of the

increase, $12 million was incurred to assist with the storm damage repair in Florida and was offset by increased revenue. The remaining

increase of $9 million is primarily due to higher electric service reliability costs, higher information technology costs, higher plant-related costs,

higher costs related to a customer billing system conversion and increased costs primarily related to compliance with the Sarbanes-Oxley

Act of 2002. The higher costs were partially offset by lower employee benefit and compensation costs and lower nuclear plant outage costs.

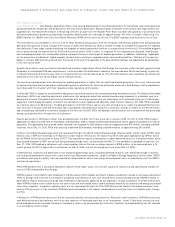

(Millions of dollars) 2005 vs. 2004 2004 vs. 2003

Higher (lower) employee benefit costs $31 $(12)

Higher (lower) nuclear plant outage costs 26 (13)

Higher uncollectible receivable costs 19 2

Higher donations to energy assistance programs 41

Higher mutual aid assistance costs 112

Higher electric service reliability costs 99

Higher (lower) information technology costs (6) 8

Higher (lower) plant-related costs (7) 4

Higher costs related to customer billing system conversion 44

Higher costs to comply with Sarbanes-Oxley Act of 2002 –4

Other 62

Total operating and maintenance expense increase $87 $21

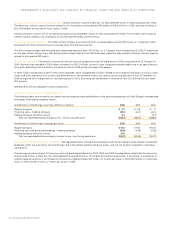

Other Nonregulated Operating and Maintenance Expenses

Other nonregulated operating and maintenance expenses decreased

$16 million, or 35.4 percent, in 2005 compared with 2004, primarily due to the accrual of $18 million in 2004 for a settlement agreement

related to shareholder lawsuits.

Other nonregulated operating and maintenance expenses decreased $9 million, or 17.5 percent, in 2004 compared with 2003. This decrease

resulted from the dissolution of Planergy International and the discontinued consolidation of an investment in an independent power-

producing entity that was no longer majority owned after the divestiture of NRG.

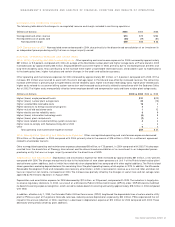

Depreciation and Amortization

Depreciation and amortization expense for 2005 increased by approximately $61 million, or 8.7 percent,

compared with 2004. The changes were primarily due to the installation of new steam generators at Unit 1 of the Prairie Island nuclear plant

and software system additions, both of which have relatively short depreciable lives compared with other capital additions. The Prairie Island

steam generators are being depreciated over the remaining life of the plant operating license, which expires in 2013. In addition, the Minnesota

Renewable Development Fund and renewable cost-recovery amortization, which is recovered in revenue as a non-fuel rider and does not

have an impact on net income, increased over 2004. The increase was partially offset by the changes in useful lives and net salvage rates

approved by Minnesota regulators in August 2005.

Depreciation and amortization expense for 2004 decreased by $21 million, or 2.9 percent, compared with 2003. The reduction is largely due

to several regulatory decisions. In 2004, as a result of a Minnesota Public Utilities Commission (MPUC) order, NSP-Minnesota modified

its decommissioning expense recognition, which served to reduce decommissioning accruals by approximately $18 million in 2004 compared

with 2003.

In addition, effective July 1, 2003, the Colorado Public Utilities Commission (CPUC) lengthened the depreciable lives of certain electric utility

plant at PSCo as a part of the general Colorado rate case, reducing annual depreciation expense by $20 million. PSCo experienced the full

impact of the annual reduction in 2004, resulting in a decrease in depreciation expense of $10 million for 2004 compared with 2003. These

decreases were partially offset by plant additions.

XCEL ENERGY 2005 ANNUAL REPORT 21

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS