Xcel Energy 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.state commissions were given similar authority to review the books and records of holding companies and their nonutility subsidiaries.

Despite these increases in the FERC’s authority, Xcel Energy believes that the repeal of the PUHCA will lessen its regulatory burdens and

give it more flexibility in the event it were to choose to expand its utility or nonutility businesses.

Besides repealing the PUHCA, the Energy Act is also expected to have substantial long-term effects on energy markets, energy investment

and regulation of public utilities and holding company systems by the FERC and the U.S. Department of Energy (DOE). The FERC and the DOE

are in various stages of rulemaking in implementing the Energy Policy Act. While the precise impact of these rulemakings cannot be determined

at this time, Xcel Energy generally views the Energy Act as legislation that will enhance the utility industry going forward.

Customer Rate Regulation

The FERC and various state regulatory commissions regulate Xcel Energy’s utility subsidiaries. Decisions by

these regulators can significantly impact Xcel Energy’s results of operations. Xcel Energy expects to periodically file for rate changes based

on changing energy market and general economic conditions.

The electric and natural gas rates charged to customers of Xcel Energy’s utility subsidiaries are approved by the FERC and the regulatory

commissions in the states in which they operate. The rates are generally designed to recover plant investment, operating costs and an

allowed return on investment. Xcel Energy requests changes in rates for utility services through filings with the governing commissions.

Because comprehensive general rate changes are requested infrequently in some states, changes in operating costs can affect Xcel Energy’s

financial results. In addition to changes in operating costs, other factors affecting rate filings are new investments, sales growth, conservation

and demand-side management efforts, and the cost of capital. In addition, the return on equity authorized is set by regulatory commissions in

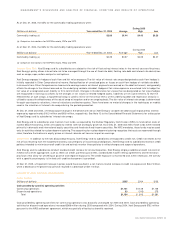

rate proceedings. The most recently authorized electric utility returns are 11.47 percent for NSP-Minnesota; 11.0 percent for NSP-Wisconsin;

10.75 percent for PSCo; and 11.5 percent for SPS. The most recently authorized natural gas utility returns are 10.4 percent for NSP-Minnesota,

11.0 percent for NSP-Wisconsin and 10.5 percent for PSCo.

Wholesale Energy Market Regulation

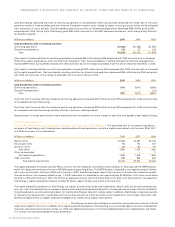

In April 2005, a Day 2 wholesale energy market operated by the Midwest Independent Transmission

System Operator, Inc. (MISO) was implemented to centrally dispatch all regional electric generation and apply a regional transmission

congestion management system. MISO now centrally issues bills and payments for many costs formerly incurred directly by NSP-Minnesota

and NSP-Wisconsin. Both bills and payments from MISO for participation in this centrally dispatched market are received, resulting in a

net cost in serving Xcel Energy’s native load obligation. This net result is recorded as a component of operating and maintenance expenses.

The MPUC issued an interim order in April 2005 allowing MISO Day 2 charges to be recovered through the NSP-Minnesota Fuel Clause

Adjustment (FCA) mechanism. In December 2005, the MPUC issued a second interim order approving the recovery of certain MISO charges

through the FCA mechanism, but requiring that additional charges either be recovered as part of a general rate case or through an annual

review process outside the FCA mechanism, and requiring refunds of non-FCA costs. However, the December 2005 MPUC order also suspended

the refund obligation until such time as it could reconsider the matter. On Feb. 9, 2006, the MPUC voted to reconsider its December 2005 order.

The MPUC on reconsideration determined that parties be directed to determine which charges are appropriately in the FCA and which are

more appropriately established in base rates, and report back to the MPUC in 60 days; to grant deferred accounting treatment for costs ultimately

determined to be included in base rates for a period of 36 months, with recovery of deferred amounts to be reviewed in a general rate case;

and that amounts collected to date through the FCA under the April and December 2005 interim orders are not subject to refund. As a result,

NSP-Minnesota will be allowed to recover its prudently incurred MISO costs either through existing fuel clause mechanisms or in base rates.

In March 2005, the PSCW issued an interim order allowing NSP-Wisconsin deferred accounting treatment of MISO charges. However, the PSCW

staff issued an interpretive memorandum in October 2005 asserting that certain MISO costs may not be recovered through the interim fuel

cost mechanism and may not be deferrable. NSP-Wisconsin and the other Wisconsin utilities contested the PSCW’s interpretation in their

November comments to the PSCW. To date, NSP-Wisconsin has deferred approximately $5.7 million of MISO Day 2 costs as a regulatory asset.

Xcel Energy has notified MISO that NSP-Minnesota and NSP-Wisconsin may seek to withdraw from MISO if rate recovery of Day 2 costs is not

allowed. Withdrawal would require the FERC’s approval and could require Xcel Energy to pay a withdrawal fee.

In addition, pursuant to the FERC’s orders, NSP-Minnesota and NSP-Wisconsin are billed for certain MISO charges associated with the loads

of certain wholesale transmission service customers taking service under pre-MISO grandfathered agreements (GFA). In March 2005, Xcel

Energy filed for the FERC’s approval to pass through these charges to GFA customers. The FERC accepted the filing subject to refund and

hearing procedures. In 2005, NSP-Minnesota and NSP-Wisconsin were billed for $1.1 million of MISO charges, which have not yet been

recovered from GFA customers. The likelihood of full rate recovery is uncertain at this time. In addition, Xcel Energy has filed an appeal of

the FERC orders.

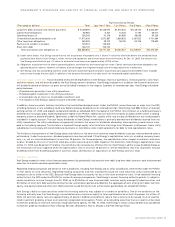

Capital Expenditure Regulation

Xcel Energy’s utility subsidiaries make substantial investments in plant additions to build and upgrade

power plants, and expand and maintain the reliability of the energy distribution system. In addition to filing for increases in base rates charged

to customers to recover the costs associated with such investments, in 2003 the CPUC and MPUC approved proposals to recover, through a

rate surcharge, certain costs to upgrade generation plants and lower emissions in the Denver and Minneapolis-St. Paul metropolitan areas.

These rate-recovery mechanisms are expected to provide significant cash flows to enable recovery of costs incurred on a timely basis.

Future Cost Recovery

Regulated public utilities are allowed to record as regulatory assets certain costs that are expected to be recovered

from customers in future periods, and to record as regulatory liabilities certain income items that are expected to be refunded to customers in

future periods. In contrast, nonregulated enterprises would expense these costs and recognize the income in the current period. If restructuring

or other changes in the regulatory environment occur, Xcel Energy may no longer be eligible to apply this accounting treatment, and may

be required to eliminate such regulatory assets and liabilities from its balance sheet. Such changes could have a material effect on Xcel Energy’s

results of operations in the period the write-off is recorded.

XCEL ENERGY 2005 ANNUAL REPORT 27

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS