Xcel Energy 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

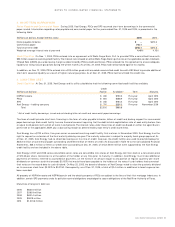

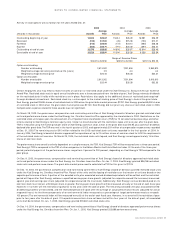

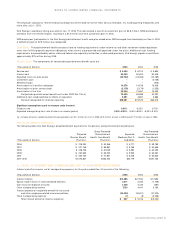

The actual composition of postretirement benefit plan assets at Dec. 31 was: 2005 2004

Equity and equity mutual fund securities 61% 54%

Fixed income/debt securities 17 21

Cash equivalents 21 25

Nontraditional Investments 1–

100% 100%

Xcel Energy bases its investment-return assumption for the postretirement health care fund assets on expected long-term performance for

each of the investment types included in its postretirement health care asset portfolio. Investment-return volatility is not considered to be a

material factor in postretirement health care costs.

Benefit Obligations

A comparison of the actuarially computed benefit obligation and plan assets for Xcel Energy postretirement health

care plans that benefit employees of its utility subsidiaries is presented in the following table:

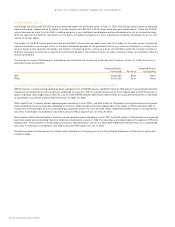

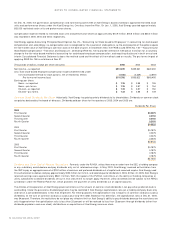

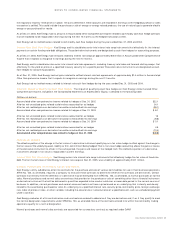

(Thousands of dollars) 2005 2004

Change in Benefit Obligation

Obligation at Jan. 1 $929,125 $775,230

Service cost 6,684 6,100

Interest cost 55,060 52,604

Plan amendments –(1,600)

Plan participants’ contributions 12,008 9,532

Actuarial gain (loss) (3,175) 148,341

Benefit payments (61,530) (61,082)

Obligation at Dec. 31 $938,172 $929,125

Change in Fair Value of Plan Assets

Fair value of plan assets at Jan. 1 $318,667 $285,861

Actual return on plan assets 14,507 21,950

Plan participants’ contributions 12,008 9,532

Employer contributions 68,211 62,406

Benefit payments (61,530) (61,082)

Fair value of plan assets at Dec. 31 $351,863 $318,667

Funded Status at Dec. 31

Net obligation $586,309 $610,458

Unrecognized transition obligation (103,022) (117,600)

Unrecognized prior service cost 15,736 17,914

Unrecognized loss (364,745) (383,026)

Accrued benefit liability recorded

(a)

$134,278 $ 127,746

Measurement Date Dec. 31, 2005 Dec. 31, 2004

Significant Assumptions Used to Measure Benefit Obligations

Discount rate for year-end valuation 5.75% 6.00%

(a) $3.1 million of the 2005 accrued benefit liability and $1.7 million of the 2004 accrued benefit liability relate to Xcel Energy’s remaining obligation for

companies that are now classified as discontinued operations.

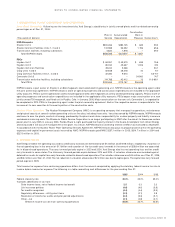

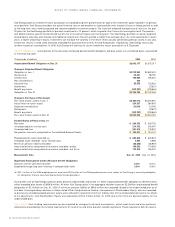

Effective Dec. 31, 2004, Xcel Energy raised its initial medical trend assumption from 6.5 percent to 9.0 percent and lowered the ultimate trend

assumption from 5.5 percent to 5.0 percent. The period until the ultimate rate is reached also was increased from two years to six years. Xcel

Energy bases its medical trend assumption on the long-term cost inflation expected in the health care market, considering the levels projected

and recommended by industry experts, as well as recent actual medical cost increases experienced by Xcel Energy’s retiree medical plan.

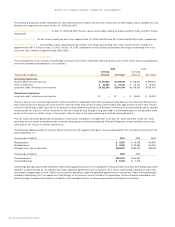

A 1-percent change in the assumed health care cost trend rate would have the following effects:

(Thousands of dollars)

1-percent increase in APBO components at Dec. 31, 2005 $104,967

1-percent decrease in APBO components at Dec. 31, 2005 $ (87,450)

1-percent increase in service and interest components of the net periodic cost $ 8,177

1-percent decrease in service and interest components of the net periodic cost $ (6,696)

62 XCEL ENERGY 2005 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS