Xcel Energy 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

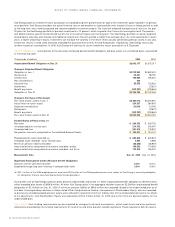

The following discussion briefly describes the use of derivative commodity and financial instruments at Xcel Energy and its subsidiaries, and

discloses the respective fair values at Dec. 31, 2005 and 2004.

Commodity Trading Instruments

At Dec. 31, 2005 and 2004, the fair value of commodity trading contracts was $3.9 million and $0.0 million,

respectively.

Hedging Contracts

The fair value of qualifying cash flow hedges at Dec. 31, 2005 and 2004 was $4.1 million and $(24.6) million, respectively.

Financial Instruments

Xcel Energy and its subsidiaries had interest rate swaps outstanding with a fair value that was a liability of

approximately $44.7 million at Dec. 31, 2005. On Dec. 31, 2004, subsidiaries of Xcel Energy had interest rate swaps outstanding with a fair

value that was a liability of approximately $30 million.

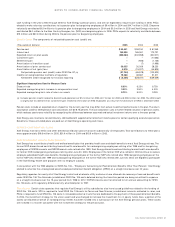

13. FINANCIAL INSTRUMENTS

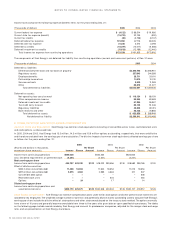

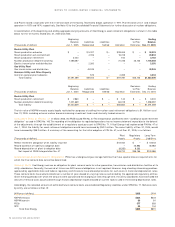

The estimated Dec. 31 fair values of Xcel Energy’s financial instruments, separately identifying amounts that are within continuing operations

and within discontinued operations, are as follows:

2005 2004

Carrying Carrying

(Thousands of dollars) Amount Fair Value Amount Fair Value

Continuing Operations

Nuclear decommissioning fund $1,047,592 $1,047,592 $ 918,442 $ 918,442

Other investments $ 24,286 $ 24,050 $ 43,141 $ 43,031

Long-term debt, including current portion $6,733,284 $7,245,346 $6,716,675 $7,391,616

Discontinued Operations

Long-term debt, including current portion $ – $ – $ 24,800 $ 26,333

The fair value of cash and cash equivalents, notes and accounts receivable and notes and accounts payable are not materially different from

their carrying amounts because of the short-term nature of these instruments or because the stated rates approximate market rates. The fair

values of Xcel Energy’s debt securities in an external nuclear decommissioning fund and other investments are estimated based on quoted

market prices for those or similar investments. The fair values of Xcel Energy’s long-term debt is estimated based on the quoted market

prices for the same or similar issues, or the current rates for debt of the same remaining maturities and credit quality.

The fair value estimates presented are based on information available to management as of Dec. 31, 2005 and 2004. These fair value

estimates have not been comprehensively revalued for purposes of these Consolidated Financial Statements since that date, and current

estimates of fair values may differ significantly.

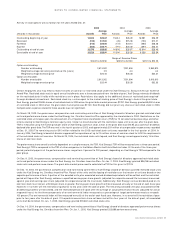

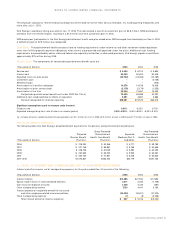

The following tables provide the external decommissioning fund’s approximate gains, losses and proceeds from the sale of securities for the

years ended Dec. 31:

(Thousands of dollars) 2005 2004 2003

Realized gains $ 8,967 $ 16,578 $ 4,999

Realized losses $ 8,990 $ 20,180 $ 6,025

Proceeds from sale of securities $489,697 $223,135 $57,768

(Thousands of dollars) 2005 2004

Unrealized gains $253,991 $240,960

Unrealized losses $ 10,558 $ 2,703

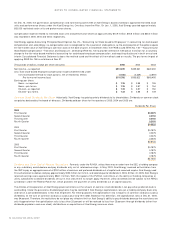

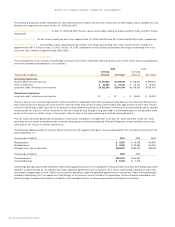

Xcel Energy provides guarantees and bond indemnities supporting certain of its subsidiaries. The guarantees issued by Xcel Energy guarantee

payment or performance by its subsidiaries under specified agreements or transactions. As a result, Xcel Energy’s exposure under the

guarantees is based upon the net liability of the relevant subsidiary under the specified agreements or transactions. Most of the guarantees

issued by Xcel Energy limit the exposure of Xcel Energy to a maximum amount stated in the guarantee. Unless otherwise indicated on the

following page, the guarantees require no liability to be recorded, contain no recourse provisions and require no collateral.

66 XCEL ENERGY 2005 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS