Xcel Energy 2005 Annual Report Download - page 28

Download and view the complete annual report

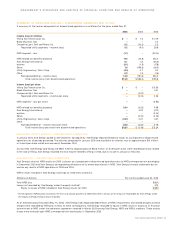

Please find page 28 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Natural Gas Costs

A variety of market factors have contributed to significantly higher natural gas prices. The direct impact of these higher

costs is generally mitigated for Xcel Energy through recovery of such costs from customers through various fuel cost-recovery mechanisms.

However, higher fuel costs could significantly impact the results of operations, if requests for recovery are unsuccessful. In addition, the higher

fuel costs could reduce customer demand or increase bad debt expense, which could also have a material impact on Xcel Energy’s results

of operations. Delays in the timing of the collection of fuel cost recoveries as compared with expenditures for fuel purchases are expected

to have an impact on the cash flows of Xcel Energy. Xcel Energy is unable to predict the future natural gas prices or the ultimate impact of such

prices on its results of operations or cash flows.

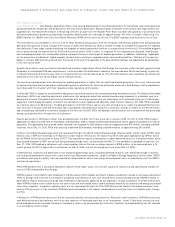

Pension Plan Costs and Assumptions

Xcel Energy’s pension costs are based on an actuarial calculation that includes a number of key assumptions, most notably the annual return

level that pension investment assets will earn in the future and the interest rate used to discount future pension benefit payments to a present

value obligation for financial reporting. In addition, the actuarial calculation uses an asset-smoothing methodology to reduce the volatility of

varying investment performance over time. Note 10 to the Consolidated Financial Statements discusses the rate of return and discount rate

used in the calculation of pension costs and obligations in the accompanying financial statements.

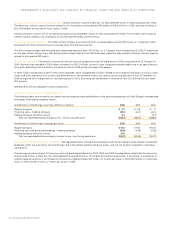

Pension costs have been increasing in recent years, and are expected to increase further over the next several years, due to lower-than-expected

investment returns experienced in prior years and decreases in interest rates used to discount benefit obligations. While investment returns

exceeded the assumed level of 8.75 percent in 2005, 9.0 percent in 2004 and 9.25 percent in 2003, investment returns in 2002 and 2001 were

below the assumed level of 9.5 percent, and discount rates have declined from the 7.25-percent to 8-percent levels used in the 1999 through

2002 cost determinations, to 6.0 percent used in 2005. Xcel Energy continually reviews its pension assumptions and, in 2006, expects to

maintain the investment return assumption at 8.75 percent and to lower the discount rate assumption to 5.75 percent.

The investment gains or losses resulting from the difference between the expected pension returns assumed on asset levels and actual returns

earned are deferred in the year the difference arises and recognized over the subsequent five-year period. This gain or loss recognition occurs

by using a five-year, moving-average value of pension assets to measure expected asset returns in the cost-determination process, and by

amortizing deferred investment gains or losses over the subsequent five-year period. Based on current assumptions and the recognition of

past investment gains and losses over the next five years, Xcel Energy currently projects that the pension costs recognized for financial reporting

purposes in continuing operations will increase from a credit, or negative expense, of $2.4 million in 2005 to an expense of $15.3 million in 2006

and $18.7 million in 2007. Pension costs were a credit in 2005 due to the recognized investment asset returns exceeding the other pension cost

components, such as benefits earned for current service and interest costs for the effects of the passage of time on discounted obligations.

Xcel Energy bases its discount rate assumption on benchmark interest rates from Moody’s Investors Service (Moody’s), and has consistently

benchmarked the interest rate used to derive the discount rate to the movements in the long-term corporate bond indices for bonds rated

Aaa through Baa by Moody’s, which have a period to maturity comparable to our projected benefit obligations. At Dec. 31, 2005, the annualized

Moody’s Baa index rate was 6.21 percent, and the Aaa index rate was 5.26 percent. Accordingly, Xcel Energy lowered the discount rate to

5.75 percent as of Dec. 31, 2005. This rate was used to value the actuarial benefit obligations at that date, and will be used in 2006 pension

cost determinations. At Dec. 31, 2004, the annualized Moody’s Baa index rate was 6.10 percent and the Aaa index rate was 5.43 percent.

The corresponding pension discount rate was 6.00 percent.

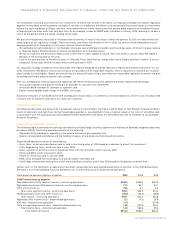

If Xcel Energy were to use alternative assumptions for pension cost determinations, a 1-percent change would result in the following impact

on the estimated pension costs recognized by Xcel Energy:

– A 100 basis point higher rate of return, 9.75 percent, would decrease 2006 recognized pension costs by $17.0 million;

– A 100 basis point lower rate of return, 7.75 percent, would increase 2006 recognized pension costs by $17.0 million;

– A 100 basis point higher discount rate, 6.75 percent, would decrease 2006 recognized pension costs by $5.4 million; and

– A 100 basis point lower discount rate, 4.75 percent, would increase 2006 recognized pension costs by $7.1 million.

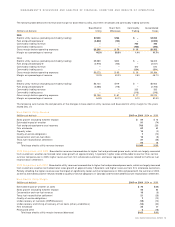

Alternative Employee Retirement Income Security Act of 1974 (ERISA) funding assumptions would also change the expected future cash

funding requirements for the pension plans. Cash funding requirements can be affected by changes to actuarial assumptions, actual asset

levels and other calculations prescribed by the funding requirements of income tax and other pension-related regulations. These regulations

did not require cash funding in recent years for Xcel Energy’s pension plans, and do not require funding in 2006. Assuming that future asset

return levels equal the actuarial assumption of 8.75 percent for the years 2006 and 2007, Xcel Energy projects, under current funding

regulations, that no cash funding would be required for 2006 or 2007. Actual performance can affect these funding requirements significantly.

Current funding regulations are under legislative review in 2006 and, if not retained in their current form, could change these funding

requirements materially.

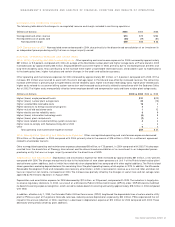

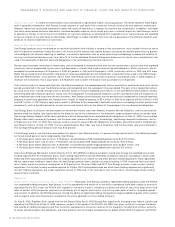

Regulation

Public Utility Holding Company Act of 1935 (PUHCA)

Historically, Xcel Energy has been a registered holding company under the PUHCA.

As a registered holding company, Xcel Energy, its utility subsidiaries and certain of its nonutility subsidiaries have been subject to extensive

regulation by the SEC under the PUHCA with respect to numerous matters, including issuances and sales of securities, acquisitions and

sales of certain utility properties, payments of dividends out of capital and surplus, and intra-system sales of certain nonpower goods

and services. In addition, the PUHCA generally limited the ability of registered holding companies to acquire additional public utility systems

and to acquire and retain businesses unrelated to the utility operations of the holding company.

On Aug. 8, 2005, President Bush signed into law the Energy Policy Act of 2005 (Energy Act), significantly changing many federal statutes and

repealing the PUHCA as of Feb. 8, 2006. However, as part of the repeal of the PUHCA, the FERC was given authority to review the books

and records of holding companies and their nonutility subsidiaries to the extent relevant to the charges of jurisdictional utilities, authority

to review service company cost allocations, and more authority over the merger and acquisition of public utilities. With the repeal of the PUHCA,

26 XCEL ENERGY 2005 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS