Xcel Energy 2005 Annual Report Download - page 27

Download and view the complete annual report

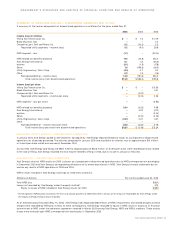

Please find page 27 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fuel Supply and Costs

Coal Deliverability

Xcel Energy’s operating utilities have varying dependence on coal-fired generation. At the utilities, coal-fired generation

comprises between 60 percent and 85 percent of the total annual generation. Approximately 70 percent of the annual coal requirements are

supplied from the Powder River Basin in Wyoming. Delivery of coal from the Powder River Basin has been disrupted by train derailments

and other operational problems purportedly caused by deteriorated rail track beds of approximately 140 miles in length in Wyoming. The

BNSF Railway Co. (BNSF) and the Union Pacific Railroad (UPRR) jointly own the rail line. The BNSF operates and maintains the rail line.

The coal delivery issues began in the first half of 2005. Based on discussions with the railroads, Xcel Energy expects that disrupted coal

deliveries will continue at least through the first part of 2006. Xcel Energy has taken a number of steps to mitigate the impact of the reduced

coal deliveries. These steps include modifying the dispatch of certain generation facilities to conserve coal inventories. This modified dispatch

was in place during the second half of 2005 and has continued in 2006, to date. In response to this reduced coal dispatch, Xcel Energy

has increased purchases from third parties and has increased the use of natural gas for electric generation. In addition, Xcel Energy negotiated

for the acquisition of additional, higher capacity rail cars and is working to upgrade certain coal-handling facilities. Delivery of the new cars

began in January 2006 and will continue over the course of the year. The upgrades to the coal-handling facilities are expected to be completed

in the first half of 2006.

Despite these efforts, coal inventories have declined to below target levels. While Xcel Energy has secured, under contract, approximately

99 percent of anticipated 2006 coal requirements, it cannot predict the likelihood of receiving the required coal. While Xcel Energy is planning

to rebuild inventories during the year, there is no guarantee that it will be able to do so. The ultimate impact of coal availability cannot be fully

assessed at this time, but could impact future financial results.

The cost of purchased power and natural gas for electric generation is higher than for coal-fired electric generation. The use of these sources

to replace coal-fired electric generation increased the price of electricity for retail and wholesale customers. Xcel Energy’s utility subsidiaries

have discussed this situation with their respective state regulatory commissions.

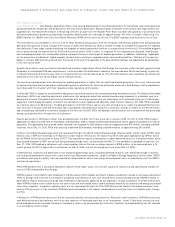

In Colorado, PSCo is subject to a retail electric adjustment clause that recovers fuel, purchased energy and resource costs. The Electric Commodity

Adjustment (ECA) is an incentive adjustment mechanism that compares actual fuel and purchased energy expenses in a calendar year to a

benchmark formula. The benchmark formula increases with natural gas prices, but not necessarily with increased volumes of natural gas

usage due to coal supply disruption. Therefore, any disruption in coal supply could adversely affect fuel cost recovery. For 2005, PSCo recorded

an incentive accrual of $8.5 million. The ECA provides for an $11.25 million cap on any cost sharing over or under the allowed ECA formula

rate. Any cost in excess of the $11.25 million cap is completely recovered from customers, while any savings in excess of the $11.25 million

cap is completely refunded to customers. Subject to the terms of the ECA, PSCo anticipates it would recover any increased fuel and purchased

energy costs greater than the cap from its customers.

Natural gas prices in 2005 were higher than projected when the ECA tariff rates were set in January 2005. On Oct. 5, 2005, PSCo filed an

application to adjust the ECA rate for November and December 2005 to reduce the ECA deferred balance and to update its projection of natural

gas prices. This application was granted, which resulted in an increase to 2005 electric revenue of approximately $70 million, including unbilled

revenues. As of Dec. 31, 2005, PSCo was carrying a deferred ECA balance, including unbilled revenue, of approximately $15 million.

In Texas, fuel and purchased energy costs are recovered through a fixed fuel and purchased energy recovery factor, which is part of SPS’ retail

electric rates. If SPS will materially over-recover or under-recover these costs, the factor may be revised upon application by SPS or action

by the Public Utility Commission of Texas (PUCT). The regulations require surcharging of under-recovered amounts, including interest, when

they exceed 4 percent of SPS’ annual fuel and purchased energy costs, as allowed by the PUCT, if the condition is expected to continue. On

Dec. 21, 2005, SPS reached a settlement with various parties that set the fuel surcharge request at $76.9 million, to be recovered over a 15-

month period. The PUCT approved this settlement on Feb. 9, 2006, and the surcharge went into effect Feb. 13, 2006.

In New Mexico, increases and decreases in fuel and purchased energy costs, including deferred amounts, are recovered through a monthly

fuel and purchased power clause with a two-month lag. Wholesale customers, under the Federal Energy Regulatory Commission (FERC)

jurisdiction also pay a monthly fuel cost adjustment calculated on actual fuel and purchased power costs in accordance with the FERC’s

fuel clause regulations.

While SPS believes that it should be allowed to recover these higher costs, the ultimate success of recovery could significantly impact the

future of SPS and possibly Xcel Energy.

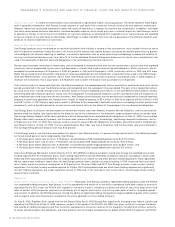

NSP-Minnesota’s retail electric rate schedules in the Minnesota, North Dakota and South Dakota jurisdictions include a fuel clause adjustment

(FCA) to billings and revenues for changes in prudently incurred cost of fuel, fuel-related items and purchased energy. NSP-Minnesota is

permitted to recover these costs through FCA mechanisms individually approved by the regulators in each jurisdiction. The FCA mechanisms

allow NSP-Minnesota to bill customers for the cost of fuel and fuel-related items used to generate electricity at its plants and energy purchased

from other suppliers. In general, capacity costs are not recovered through the FCA. NSP-Minnesota’s electric wholesale customers also

have an FCA provision in their contracts. NSP-Minnesota anticipates it will recover increased costs resulting from its mitigation plan through

the FCA.

In Wisconsin, NSP-Wisconsin does not have an automatic electric fuel clause adjustment for Wisconsin retail customers. NSP-Wisconsin may

seek deferred accounting treatment and future rate recovery of increased costs due to an “emergency” event, if that event causes fuel and

purchased power costs to exceed the amount included in rates on an annual basis by more than 2 percent. Coal deliverability has not resulted

in an emergency event to date.

XCEL ENERGY 2005 ANNUAL REPORT 25

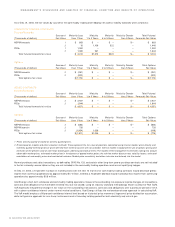

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS