Xcel Energy 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

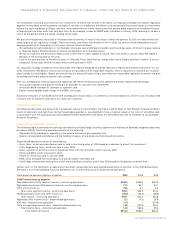

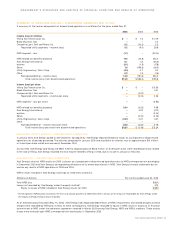

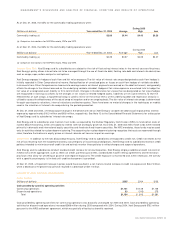

STATEMENT OF OPERATIONS ANALYSIS –DISCONTINUED OPERATIONS (NET OF TAX)

A summary of the various components of discontinued operations is as follows for the years ended Dec. 31:

2005 2004 2003

Income (loss) in millions

Viking Gas Transmission Co. $– $1.3 $21.9

Black Mountain Gas –– 2.4

Cheyenne Light, Fuel and Power Co. 0.2 (10.3) 2.5

Regulated utility segments – income (loss) 0.2 (9.0) 26.8

NRG segment – loss (1.1) – (251.4)

NRG-related tax benefits (expense) 17.2 (12.8) 404.4

Xcel Energy International 0.1 7.3 (45.5)

e prime (0.1) (1.8) (17.8)

Seren 1.8 (156.6) (18.3)

Utility Engineering / Quixx Corp. (4.4) 4.7 3.0

Other 0.2 1.9 (1.6)

Nonregulated/other – income (loss) 14.8 (157.3) 324.2

Total income (loss) from discontinued operations $13.9 $(166.3) $ 99.6

Income (loss) per share

Viking Gas Transmission Co. $– $ – $ 0.05

Black Mountain Gas –– 0.01

Cheyenne Light, Fuel and Power Co. –(0.02) –

Regulated utility segments – income per share –(0.02) 0.06

NRG segment – loss per share –– (0.60)

NRG-related tax benefits (expense) 0.04 (0.03) 0.96

Xcel Energy International –0.02 (0.11)

e prime –– (0.04)

Seren –(0.37) (0.04)

Utility Engineering / Quixx Corp. (0.01) 0.01 0.01

Other –––

Nonregulated/other – income (loss) per share 0.03 (0.37) 0.78

Total income (loss) per share from discontinued operations $0.03 $ (0.39) $ 0.24

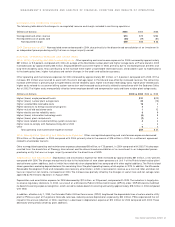

REGULATED UTILITY RESULTS –DISCONTINUED OPERATIONS

In January 2004, Xcel Energy agreed to sell Cheyenne. Consequently, Xcel Energy reported Cheyenne results as a component of discontinued

operations for all periods presented. The sale was completed in January 2005 and resulted in an after-tax loss of approximately $13 million,

or 3 cents per share, which was accrued in December 2004.

During 2003, Xcel Energy sold Viking and BMG. After-tax disposal gains of $23.3 million, or 6 cents per share, were recorded primarily related

to the sale of Viking. Xcel Energy recorded minimal income related to Viking in 2003, due to its sale in January of that year.

NRG RESULTS –DISCONTINUED OPERATIONS

Xcel Energy’s share of NRG results for 2003 is shown as a component of discontinued operations due to NRG’s emergence from bankruptcy

in December 2003 and Xcel Energy’s corresponding divestiture of its ownership interest in NRG. Xcel Energy financial statements do not

contain any results of NRG operations in 2005 and 2004.

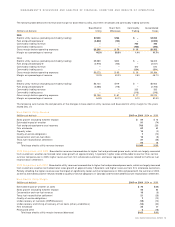

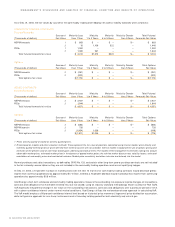

NRG’s results included in Xcel Energy’s earnings for 2003 were as follows:

(Millions of dollars) Six months ended June 30, 2003

Total NRG loss $(621)

Losses not recorded by Xcel Energy under the equity method

*

370

Equity in losses of NRG included in Xcel Energy results for 2003 $(251)

* These represent NRG losses incurred in the first and second quarters of 2003 that were in excess of the amounts recordable by Xcel Energy under

the equity method of accounting limitations.

As of the bankruptcy filing date (May 14, 2003), Xcel Energy had recognized $263 million of NRG’s impairments and related charges as these

charges were recorded by NRG prior to May 14, 2003. Consequently, Xcel Energy recorded its equity in NRG results in excess of its financial

commitment to NRG under the settlement agreement reached in March 2003 among Xcel Energy, NRG and NRG’s creditors. These excess

losses were reversed upon NRG’s emergence from bankruptcy in December 2003.

XCEL ENERGY 2005 ANNUAL REPORT 23

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS