Xcel Energy 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

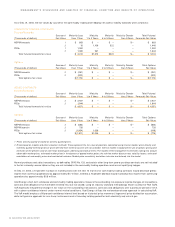

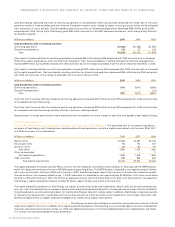

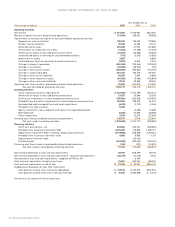

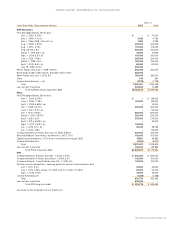

Payments Due by Period

(Thousands of dollars) Total Less than 1 Year 1 to 3 Years 4 to 5 Years After 5 Years

Long-term debt, principal and interest payments $ 10,387,694 $1,236,074 $1,672,323 $2,148,700 $ 5,330,597

Capital lease obligations 98,684 6,447 12,426 11,794 68,017

Operating leases

(a)

208,249 41,376 64,589 48,055 54,229

Unconditional purchase obligations

(b)

11,972,606 2,573,587 2,639,833 2,057,622 4,701,564

Other long-term obligations 265,925 38,213 55,376 52,706 119,630

Payments to vendors in process 129,315 129,315 – – –

Short-term debt 746,120 746,120 – – –

Total contractual cash obligations

(c)

$23,808,593 $4,771,132 $4,444,547 $4,318,877 $10,274,037

(a) Under some leases, Xcel Energy would have to sell or purchase the property that it leases if it chose to terminate before the scheduled lease

expiration date. Most of Xcel Energy’s railcar, vehicle and equipment and aircraft leases have these terms. At Dec. 31, 2005, the amount that

Xcel Energy would have to pay if it chose to terminate these leases was approximately $110.8 million.

(b) Obligations to purchase fuel for electric generating plants, and electricity and natural gas for resale. Certain contractual purchase obligations are

adjusted based on indexes. However, the effects of price changes are mitigated through cost-of-energy adjustment mechanisms.

(c) Xcel Energy also has outstanding authority under contracts and blanket purchase orders to purchase up to approximately $600 million of goods

and services through the year 2020, in addition to the amounts disclosed in this table and in the forecasted capital expenditures.

Common Stock Dividends

Future dividend levels will be dependent on Xcel Energy’s results of operations, financial position, cash flows

and other factors, and will be evaluated by the Xcel Energy board of directors. Xcel Energy’s objective is to deliver the financial results that

will enable the board of directors to grant annual dividend increases in the range of 2 percent to 4 percent per year. Xcel Energy’s dividend

policy balances:

– Projected cash generation from utility operations;

– Projected capital investment in the utility businesses;

– A reasonable rate of return on shareholder investment; and

– The impact on Xcel Energy’s capital structure and credit ratings.

In addition, there are certain statutory limitations that could affect dividend levels. Under the PUHCA, unless there was an order from the SEC,

a holding company or any subsidiary could only declare and pay dividends out of retained earnings. Xcel Energy had $562 million of retained

earnings at Dec. 31, 2005, and expects to declare dividends as scheduled. With the repeal of the PUHCA, this limitation on a holding company’s

dividends will no longer apply. Notwithstanding the repeal of the PUHCA, federal law will still limit the ability of public utilities within a holding

company system to declare dividends. Specifically, under the Federal Power Act, a public utility may not pay dividends from any funds properly

included in a capital account. The cash to pay dividends to Xcel Energy shareholders is primarily derived from dividends received from the

utility subsidiaries. The utility subsidiaries are generally limited in the amount of dividends allowed by state regulatory commissions to be

paid to the holding company. The limitation is imposed through equity ratio limitations that range from 30 percent to 60 percent. Some utility

subsidiaries must comply with bond indenture covenants or restrictions under credit agreements for debt to total capitalization ratios.

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay when preferred stock is

outstanding. Under the provisions, dividend payments may be restricted if Xcel Energy’s capitalization ratio (on a holding company basis

only, i.e., not on a consolidated basis) is less than 25 percent. For these purposes, the capitalization ratio is equal to common stock plus

surplus, divided by the sum of common stock plus surplus plus long-term debt. Based on this definition, Xcel Energy’s capitalization ratio

at Dec. 31, 2005, was 84 percent. Therefore, the restrictions do not place any effective limit on Xcel Energy’s ability to pay dividends because

the restrictions are only triggered when the capitalization ratio is less than 25 percent or will be reduced to less than 25 percent through

dividends (other than dividends payable in common stock), distributions or acquisitions of Xcel Energy common stock.

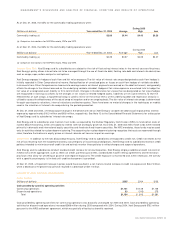

CAPITAL SOURCES

Xcel Energy expects to meet future financing requirements by periodically issuing short-term debt, long-term debt, common stock and preferred

securities to maintain desired capitalization ratios.

Registered holding companies and certain of their subsidiaries, including Xcel Energy and its utility subsidiaries, were limited under the PUHCA

in their ability to issue securities. Registered holding companies and their subsidiaries could not issue securities unless authorized by an

exemptive rule or order of the SEC. Because Xcel Energy does not qualify for any of the main exemptive rules, it had received financing

authority from the SEC under the PUHCA for various financing arrangements. Xcel Energy’s current financing authority permits it, subject to

certain conditions, to issue through June 30, 2008, up to $1.8 billion of new long-term debt, common equity and equity-linked securities, and

$1.0 billion of short-term debt securities during the new authorization period, provided that the aggregate amount of long-term debt, common

equity, and equity-linked and short-term debt securities issued during the new authorization period does not exceed $2.0 billion.

Xcel Energy’s ability to issue securities under the financing authority was subject to a number of conditions. One of the conditions of the

financing authority was that Xcel Energy’s consolidated ratio of common equity to total capitalization be at least 30 percent. As of Dec. 31,

2005, the common equity ratio was approximately 42 percent. Additional conditions require that a security to be issued, must at least be

rated investment grade by at least one nationally recognized rating agency. Finally, all outstanding securities that are rated must be rated

investment grade by at least one nationally recognized rating agency. On Feb. 10, 2006, Xcel Energy’s senior unsecured debt was considered

investment grade by Standard & Poor’s Ratings Services (Standard & Poor’s), Moody’s and Fitch Ratings (Fitch).

XCEL ENERGY 2005 ANNUAL REPORT 35

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS