Xcel Energy 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

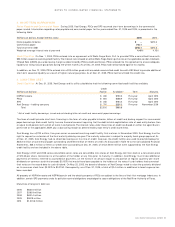

7. GENERATING PLANT OWNERSHIP AND OPERATION

Joint Plant Ownership

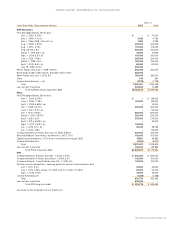

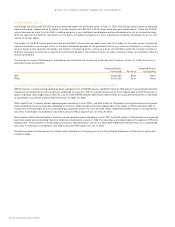

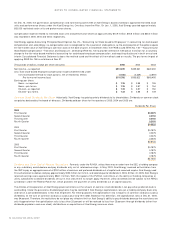

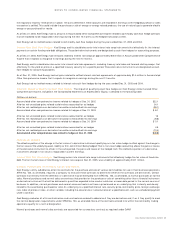

Following are the investments by Xcel Energy’s subsidiaries in jointly owned plants and the related ownership

percentages as of Dec. 31, 2005: Construction

Plant in Accumulated Work in

(Thousands of dollars) Service Depreciation Progress Ownership %

NSP-Minnesota

Sherco Unit 3 $500,266 $282,145 $ 665 59.0

Sherco Common Facilities Units 1, 2 and 3 102,988 53,552 1,196 65.6

Transmission facilities, including substations 4,832 1,878 – 59.0

Total NSP-Minnesota $608,086 $ 337,575 $ 1,861

PSCo

Hayden Unit 1 $ 84,357 $ 43,579 $ 635 75.5

Hayden Unit 2 80,034 45,637 1,006 37.4

Hayden Common Facilities 28,244 5,538 – 53.1

Craig Units 1 and 2 52,848 26,318 24 9.7

Craig Common Facilities Units 1, 2 and 3 32,384 9,673 – 6.5–9.7

Comanche Unit 3 – – 54,960 74.7

Transmission and other facilities, including substations 114,788 42,412 13 11.6–68.1

Total PSCo $392,655 $173,157 $56,638

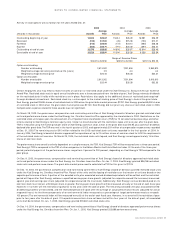

NSP-Minnesota is part owner of Sherco 3, an 860-megawatt, coal-fueled electric generating unit. NSP-Minnesota is the operating agent under

the joint ownership agreement. NSP-Minnesota’s share of operating expenses and construction expenditures are included in the applicable

utility accounts. PSCo’s current operational assets include approximately 320 megawatts of jointly owned generating capacity. PSCo’s share of

operating expenses and construction expenditures are included in the applicable utility accounts. PSCo began major construction on a new

jointly owned 750-megawatt, coal-fired unit in Pueblo, Colo. in January 2006. Major construction on the new unit, Comanche 3, is expected to

be completed in 2010. PSCo is the operating agent under the joint ownership agreement. Each of the respective owners is responsible for the

issuance of its own securities to finance its portion of the construction costs.

Nuclear Plant Operation

The Nuclear Management Company (NMC) is an operating company that manages the operations, maintenance

and physical security of several nuclear generating units on five sites, including three units / two sites owned by NSP-Minnesota. NSP-Minnesota

continues to own the plants, controls all energy produced by the plants and retains responsibility for nuclear property and liability insurance

and decommissioning costs. The Wisconsin Public Service Corporation is no longer participating in NMC after the sale of its Kewaunee nuclear

power plant in July 2005. In January 2006, Florida Power & Light purchased the majority interest in the Duane Arnold plant from Alliant Energy

and announced it will assume management of the plant. As a result, NSP-Minnesota’s ownership interest in NMC has increased to 25 percent.

In accordance with the Nuclear Power Plant Operating Services Agreement, NSP-Minnesota also pays its proportionate share of the operating

expenses and capital improvement costs incurred by NMC. NSP-Minnesota paid NMC $257.1 million in 2005, $314.7 million in 2004 and

$227.0 million in 2003.

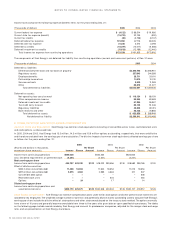

8. INCOME TAXES

Xcel Energy’s federal net operating loss and tax credit carry forwards are estimated to be $1.4 billion and $107.6 million, respectively. A portion of

the net operating loss in the amount of $1.1 billion and a portion of the tax credit carry forwards in the amount of $28.8 million are accounted

for in discontinued operations. The carry forward periods expire in 2023 and 2024. Xcel Energy also has net operating loss and tax credit

carry forwards in some states. The state carry forward periods expire between 2014 and 2024. A valuation allowance was recorded against

deferred tax assets for capital loss carry forwards related to discontinued operations. The valuation allowance was $44 million as of Dec. 31, 2005,

and $46 million as of Dec. 31, 2004. The net reduction in valuation allowance of $2 million was due to capital gains. The capital loss carry forward

period expires in 2009.

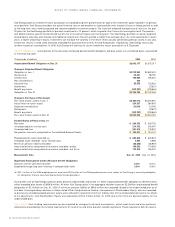

Total income tax expense from continuing operations differs from the amount computed by applying the statutory federal income tax rate to

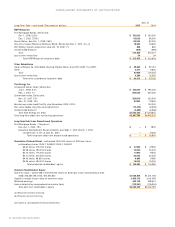

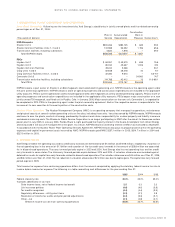

income before income tax expense. The following is a table reconciling such differences for the years ending Dec. 31:

2005 2004 2003

Federal statutory rate 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

State income taxes, net of federal income tax benefit 2.5 3.3 2.3

Life insurance policies (4.6) (4.0) (3.8)

Tax credits recognized (4.4) (4.4) (3.9)

Regulatory differences – utility plant items (0.3) (0.1) 0.8

Resolution of income tax audits and prior-period adjustments (0.3) (5.3) (5.1)

Other – net (2.1) (0.8) (0.7)

Effective income tax rate from continuing operations 25.8% 23.7% 24.6%

XCEL ENERGY 2005 ANNUAL REPORT 55

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS