Xcel Energy 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

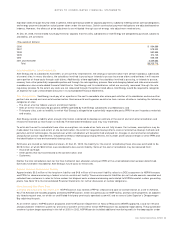

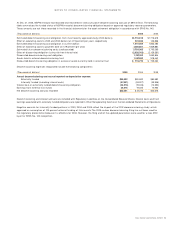

At Dec. 31, 2005, NSP-Minnesota had recorded and recovered in rates cumulative decommissioning accruals of $816 million. The following

table summarizes the funded status of NSP-Minnesota’s decommissioning obligation based on approved regulatory recovery parameters.

These amounts are not those recorded in the financial statements for the asset retirement obligation in accordance with SFAS No. 143.

(Thousands of dollars) 2005 2004

Estimated decommissioning cost obligation from most recently approved study (2002 dollars) $1,716,618 $1,716,618

Effect of escalating costs to 2005 and 2004 dollars (at 4.19 percent per year), respectively 224,946 146,866

Estimated decommissioning cost obligation in current dollars 1,941,564 1,863,484

Effect of escalating costs to payment date (at 4.19 percent per year) 1,851,801 1,929,881

Estimated future decommissioning costs (undiscounted) 3,793,365 3,793,365

Effect of discounting obligation (using risk-free interest rate) (2,026,003) (2,139,561)

Discounted decommissioning cost obligation 1,767,362 1,653,804

Assets held in external decommissioning trust 1,047,592 918,442

Discounted decommissioning obligation in excess of assets currently held in external trust $ 719,770 $ 735,362

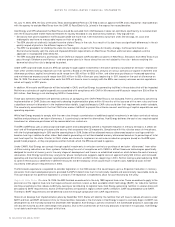

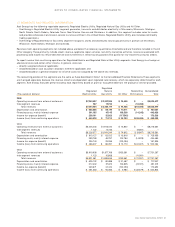

Decommissioning expenses recognized include the following components:

(Thousands of dollars) 2005 2004 2003

Annual decommissioning cost accrual reported as depreciation expense:

Externally funded $80,582 $80,582 $80,582

Internally funded (including interest costs) (57,561) (53,307) (35,906)

Interest cost on externally funded decommissioning obligation (24,516) (19,026) (14,952)

Earnings from external trust funds 24,516 19,026 14,952

Net decommissioning accruals recorded $23,021 $ 27,275 $44,676

Decommissioning and interest accruals are included with Regulatory Liabilities on the Consolidated Balance Sheets. Interest costs and trust

earnings associated with externally funded obligations are reported in Other Nonoperating Income on the Consolidated Statements of Operations.

Negative accruals for internally funded portions in 2003, 2004 and 2005 reflect the impact of the 2002 decommissioning study, which

approved an assumption of 100-percent external funding of future costs. The 2005 nuclear decommissioning filing has not been used for

the regulatory presentation because it is effective for 2006. However, the filing and all the updated parameters were used for a new ARO

layer for SFAS No. 143 recognition.

XCEL ENERGY 2005 ANNUAL REPORT 79

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS