Xcel Energy 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

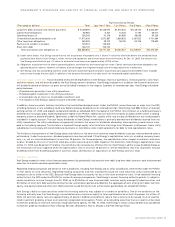

Act, it may be necessary for Xcel Energy and the utility subsidiaries to submit its existing money pool arrangement to the FERC for its

approval. Xcel Energy and the utility subsidiaries are presently evaluating the situation.

Registration Statements

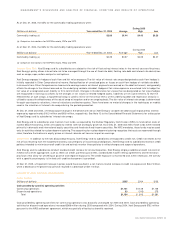

Xcel Energy’s Articles of Incorporation authorize the issuance of 1 billion shares of common stock. As of Dec. 31, 2005,

Xcel Energy had approximately 403 million shares of common stock outstanding. In addition, Xcel Energy’s Articles of Incorporation authorize

the issuance of 7 million shares of $100 par value preferred stock. On Dec. 31, 2005, Xcel Energy had approximately 1 million shares of

preferred stock outstanding. Xcel Energy and its subsidiaries have the following registration statements on file with the SEC, pursuant to

which they may sell, from time to time, securities:

– In February 2002, Xcel Energy filed a $1 billion shelf registration with the SEC. Xcel Energy may issue debt securities, common stock and rights

to purchase common stock under this shelf registration. Xcel Energy has approximately $482.5 million remaining under this registration. Xcel

Energy has approximately $400 million remaining under the $1 billion unsecured debt shelf registration filed with the SEC in 2000.

– On March 22, 2005, NSP-Minnesota filed a shelf registration statement with the SEC to register an additional $1 billion of secured or unsecured

debt securities, which may be issued from time to time in the future. This registration became effective on April 7, 2005, and supplements

the $40 million of debt securities previously registered with the SEC. After issuance of $250 million of first mortgage bonds in July 2005,

as discussed later, $790 million remains available under the currently effective registration statement.

– PSCo has an effective shelf registration statement with the SEC under which $800 million of secured first collateral trust bonds or unsecured

senior debt securities were registered. PSCo has approximately $225 million remaining under this registration.

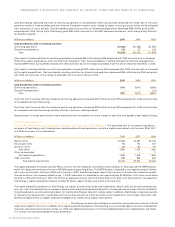

FUTURE FINANCING PLANS

Xcel Energy generally expects to fund its operations and capital investments primarily through internally generated funds. Xcel Energy

plans to refinance existing long-term debt or scheduled long-term debt maturities at each of the regulated operating utilities based on

prevailing market conditions. To facilitate potential long-term debt issuances at the utility subsidiaries, SPS intends to file a long-term

debt shelf registration statement with the SEC for up to $500 million in 2006, and NSP-Wisconsin may file a long-term debt shelf registration

for up to $100 million.

OFF-BALANCE-SHEET ARRANGEMENTS

Xcel Energy does not have any off-balance-sheet arrangements that have or are reasonably likely to have a current or future effect on financial

condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that

is material to investors.

EARNINGS GUIDANCE

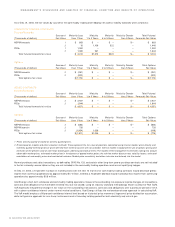

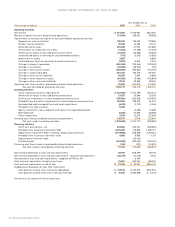

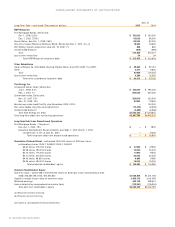

Xcel Energy’s 2006 earnings per share from continuing operations guidance and key assumptions are detailed in the following table.

2006 Diluted Earnings Per Share Range

Utility operations $1.25 – $1.35

COLI tax benefit 0.10

Other nonregulated subsidiaries (0.10)

Xcel Energy Continuing Operations $1.25 – $1.35

Key Assumptions for 2006:

– Normal weather patterns are experienced;

– Reasonable rate recovery is approved in the Minnesota electric rate case;

– Weather-adjusted retail electric utility sales grow by approximately 1.3 percent to 1.7 percent;

– Weather-adjusted retail natural gas utility sales grow by approximately 0.0 percent to 1.0 percent;

– Short-term wholesale and commodity trading margins are projected to be within a range of approximately $30 million to $50 million;

– Other utility operating and maintenance expenses increase between 3 percent and 4 percent from 2005 levels;

– Depreciation expense increases approximately $100 million to $110 million, which includes increases in decommissioning accruals that are

expected to be recovered through rates approved in the Minnesota electric rate case;

– Interest expense increases approximately $10 million to $15 million from 2005 levels;

– Allowance for funds used during construction recorded for equity financing is expected to increase approximately $10 million to $15 million

from 2005 levels;

– Xcel Energy continues to recognize COLI tax benefits;

– The effective tax rate for continuing operations is approximately 27 percent to 29 percent; and

– Average common stock and equivalents total approximately 428 million shares, based on the “ If Converted” method for convertible notes.

XCEL ENERGY 2005 ANNUAL REPORT 37

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS