Xcel Energy 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

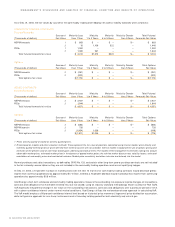

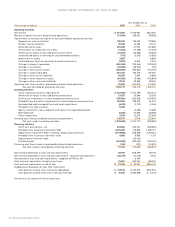

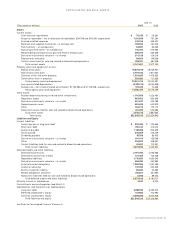

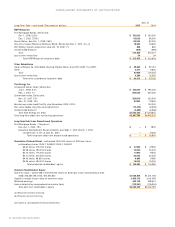

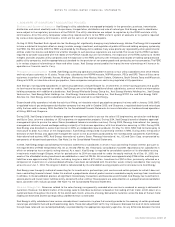

Year ended Dec. 31

(Thousands of dollars) 2005 2004 2003

Operating activities

Net income $ 512,972 $ 355,961 $622,392

Remove (income) loss from discontinued operations (13,934) 166,303 (99,568)

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization 782,074 739,025 757,838

Nuclear fuel amortization 45,330 43,296 43,401

Deferred income taxes 205,058 57,273 100,869

Amortization of investment tax credits (11,620) (12,189) (12,439)

Allowance for equity funds used during construction (21,627) (33,648) (25,338)

Undistributed equity in earnings of unconsolidated affiliates (712) (3,342) (4,833)

Impairment of assets 2,887 – 8,856

Unrealized gain (loss) on derivative financial instruments (3,923) 6,206 2,404

Change in accounts receivable (250,305) (123,044) (129,408)

Change in inventories (94,605) (46,220) (911)

Change in other current assets (289,250) (190,827) (174,793)

Change in accounts payable 281,430 133,278 106,087

Change in other current liabilities 30,923 2,494 (4,855)

Change in other noncurrent assets (81,506) (6,485) (142,849)

Change in other noncurrent liabilities 37,242 39,669 59,306

Operating cash flows (used in) provided by discontinued operations 53,283 (314,575) 274,582

Net cash provided by operating activities 1,183,717 813,175 1,380,741

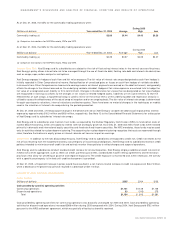

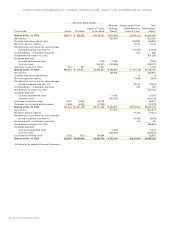

Investing activities

Utility capital/construction expenditures (1,304,468) (1,274,290) (944,421)

Allowance for equity funds used during construction 21,627 33,648 25,338

Purchase of investments in external decommissioning fund (576,001) (305,328) (144,367)

Proceeds from the sale of investments in external decommissioning fund 494,529 228,676 61,031

Nonregulated capital expenditures and asset acquisitions (6,976) (2,122) (2,055)

Proceeds from sale of assets 11,228 ––

Equity investments, loans, deposits and sales of nonregulated projects –(4,082) 10,588

Restricted cash (6,226) 42,628 (38,488)

Other investments 5,075 12,474 (22,380)

Investing cash flows provided by discontinued operations 135,577 37,119 125,904

Net cash used in investing activities (1,225,635) (1,231,277) (928,850)

Financing activities

Short-term borrowings – net 433,820 253,737 (428,580)

Proceeds from issuance of long-term debt 2,529,408 419,848 1,689,317

Repayment of long-term debt, including reacquisition premiums (2,517,698) (438,595) (1,307,012)

Proceeds from issuance of common stock 9,085 6,985 3,219

Repurchase of common stock –(32,023) –

Dividends paid (343,092) (320,444) (303,316)

Financing cash flows (used in) provided by discontinued operations (200) (200) (20,500)

Net cash (used in) provided by financing activities 111,323 (110,692) (366,872)

Net increase (decrease) in cash and cash equivalents 69,405 (528,794) 85,019

Net increase (decrease) in cash and cash equivalents – discontinued operations (20,570) (12,018) 6,510

Net increase in cash and cash equivalents – adoption of FIN No. 46 –3,439 –

Cash and cash equivalents at beginning of year 23,361 560,734 469,205

Cash and cash equivalents at end of year $ 72,196 $ 23,361 $560,734

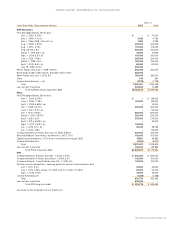

Supplemental disclosure of cash flow information

Cash paid for interest (net of amounts capitalized) $417,016 $ 423,673 $402,506

Cash paid for income taxes (net of refunds received) $ 10,625 $(355,639) $ (6,379)

See Notes to Consolidated Financial Statements.

42 XCEL ENERGY 2005 ANNUAL REPORT

CONSOLIDATED STATEM ENTS OF CASH FLOWS