Xcel Energy 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and Prairie Island, originates with the in-service date of the facility. Monticello began operation in 1971. Prairie Island units 1 and 2 began

operation in 1973 and 1974, respectively. See Note 15 to the Consolidated Financial Statements for further discussion of nuclear obligations.

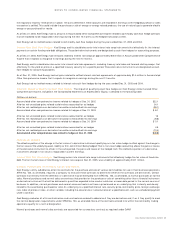

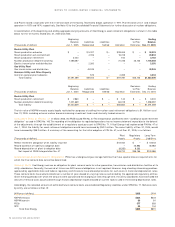

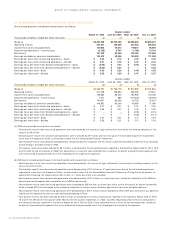

A reconciliation of the beginning and ending aggregate carrying amounts of Xcel Energy’s asset retirement obligations is shown in the table

below for the 12 months ended Dec. 31, 2005 and 2004:

Beginning Revisions Ending

Balance Liabilities Liabilities to Prior Balance

(Thousands of dollars) Jan. 1, 2005 Recognized Settled Accretion Estimates Dec. 31, 2005

Electric Utility Plant

Steam production asbestos $ – $ 5,917 $ – $ 28,406 $ – $ 34,323

Steam production ash containment – 4,916 – 16,018 – 20,934

Steam production retirement 3,002 – – 150 – 3,152

Nuclear production decommissioning 1,088,087 – – 70,736 26,145 1,184,968

Electric transmission and distribution – 2,350–––2,350

Gas Utility Plant

Gas transmission and distribution – 43,245–––43,245

Common Utility and Other Property

Common general plant asbestos – 575 – 2,459 – 3,034

Total liability $1,091,089 $57,003 $ – $117,769 $26,145 $1,292,006

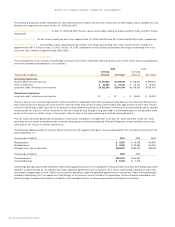

Beginning Revisions Ending

Balance Liabilities Liabilities to Prior Balance

(Thousands of dollars) Jan. 1, 2004 Recognized Settled Accretion Estimates Dec. 31, 2004

Electric Utility Plant

Steam production retirement $ 2,860 $ – $ – $ 142 $ – $ 3,002

Nuclear production decommissioning 1,021,669 – – 66,418 – 1,088,087

Total liability $1,024,529 $ – $ – $ 66,560 $ – $1,091,089

The fair value of NSP-Minnesota assets legally restricted for purposes of settling the nuclear asset retirement obligations is $1.1 billion as of

Dec. 31, 2005, including external nuclear decommissioning investment funds and internally funded amounts.

Cumulative Effect of FIN No. 47

In March 2005, the FASB issued FIN No. 47. The interpretation clarified the term “ conditional asset retirement

obligation” as used in SFAS No. 143. The recording of the obligation for regulated operations has no income statement impact due to the deferral

of the adjustments through the establishment of a regulatory asset pursuant to SFAS No. 71. If Xcel Energy had implemented FIN No. 47 at

Jan. 1, 2004, the liability for asset retirement obligations would have increased by $52.2 million. The same liability at Dec. 31, 2004, would

have increased by $55.2 million. A summary of the accounting for the initial adoption of FIN No. 47, as of Dec. 31, 2005, is as follows:

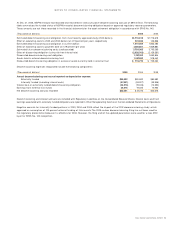

Plant Regulatory Long-Term

(Thousands of dollars) Assets Assets Liabilities

Reflect retirement obligation when liability incurred $ 57,003 $ – $ 57,003

Record accretion of liability to adoption date – 46,883 46,883

Record depreciation of plant to adoption date (8,283) 8,283 –

Net impact of FASB Interpretation No. 47 $48,720 $55,166 $103,886

Indeterminate Asset Retirement Obligations

PSCo has underground gas storage facilities that have special closure requirements for

which the final removal date cannot be determined.

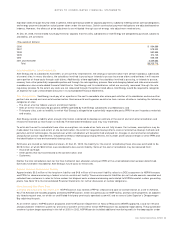

Removal Costs

Xcel Energy accrues an obligation for plant removal costs for other generation, transmission and distribution facilities of its

utility subsidiaries. Generally, the accrual of future non-ARO removal obligations is not required. However, long-standing ratemaking practices

approved by applicable state and federal regulatory commissions have allowed provisions for such costs in historical depreciation rates.

These removal costs have accumulated over a number of years based on varying rates as authorized by the appropriate regulatory entities.

Given the long periods over which the amounts were accrued and the changing of rates through time, the utility subsidiaries have estimated the

amount of removal costs accumulated through historic depreciation expense based on current factors used in the existing depreciation rates.

Accordingly, the recorded amounts of estimated future removal costs are considered Regulatory Liabilities under SFAS No. 71. Removal costs

by entity are as follows at Dec. 31:

(Millions of dollars) 2005 2004

NSP-Minnesota $334 $323

NSP-Wisconsin 86 81

PSCo 377 383

SPS 98 104

Total Xcel Energy $895 $891

74 XCEL ENERGY 2005 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS