Xcel Energy 2005 Annual Report Download - page 30

Download and view the complete annual report

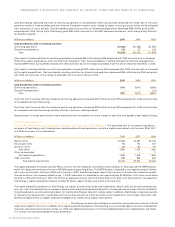

Please find page 30 of the 2005 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At Dec. 31, 2005, Xcel Energy reported on its balance sheet regulatory assets of approximately $963 million and regulatory liabilities of

approximately $1.7 billion that would be recognized in the statement of operations in the absence of regulation. In addition to a potential

write-off of regulatory assets and liabilities, restructuring and competition may require recognition of certain stranded costs not recoverable

under market pricing. See Notes 1 and 16 to the Consolidated Financial Statements for further discussion of regulatory deferrals.

Pending and Recently Concluded Regulatory Proceedings

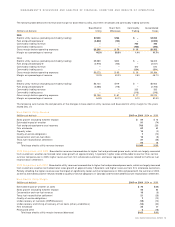

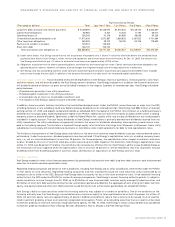

NSP-Minnesota Electric Rate Case

In November 2005, NSP-Minnesota requested an electric rate increase of $168 million, or 8.05 percent.

This increase was based on a requested 11 percent return on common equity, a projected common equity ratio to total capitalization of

51.7 percent and a projected electric rate base of $3.2 billion. On Dec. 15, 2005, the MPUC authorized an interim rate increase of $147 million,

subject to refund, which became effective on Jan. 1, 2006. The anticipated procedural schedule is as follows:

– March 2nd – Intervenor Direct Testimony

– March 30th – Rebuttal Testimony

– April 13th – Surrebuttal Testimony

– April 20th – April 28th – Evidentiary Hearings

– May 24th – Initial Briefs

– June 6th – Reply Briefs

– July 6th – Administrative Law Judge Report

– September 5th – MPUC Order

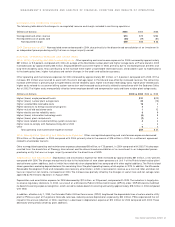

NSP-Wisconsin 2006 General Rate Case

In 2005, NSP-Wisconsin requested an electric revenue increase of $58.3 million and a natural

gas revenue increase of $8.1 million, based on a 2006 test year, an 11.9 percent return on equity and a common equity ratio of 56.32 percent.

On Jan. 5, 2006, the PSCW approved an electric revenue increase of $43.4 million and a natural gas revenue increase of $3.9 million, based on

an 11.0 percent return on equity and a 54 percent common equity ratio target. The new rates were effective Jan. 9, 2006. The order authorized

the deferral of an additional $6.5 million in costs related to nuclear decommissioning and manufactured gas plant site clean up for recovery

in the next rate case. The order also prohibits NSP-Wisconsin from paying dividends above $42.7 million, if its actual calendar year average

common equity ratio is or will fall below 54.03 percent. It also imposes an asymmetrical electric fuel clause bandwidth of positive 2 percent

to negative 0.5 percent outside of which NSP-Wisconsin would be permitted to request or be required to change rates.

PSCo Natural Gas Rate Case

In 2005, PSCo filed for an increase of $34.5 million in natural gas base rates in Colorado, based on a return

on equity of 11.0 percent with a common equity ratio of 55.49 percent.

On Jan. 19, 2006, the CPUC approved a settlement agreement between PSCo and other parties to the case. Final rates became effective

Feb. 6, 2006. The terms of the settlement include:

– Natural gas revenue increase of $22 million;

– Return on common equity of 10.5 percent;

– Earnings over 10.5 percent return on common equity will be refunded back to customers;

– Common equity ratio of 55.49 percent; and

– Customer charges for the residential and commercial sales classes of $10 and $20 per month, respectively.

Tax Matters

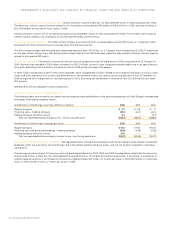

Interest Expense Deductibility

PSCo’s wholly owned subsidiary, PSR Investments, Inc. (PSRI), owns and manages permanent life insurance

policies, known as COLI policies, on some of PSCo’s employees. At various times, borrowings have been made against the cash values of

these COLI policies and deductions taken on the interest expense on these borrowings. The IRS has challenged the deductibility of such interest

expense deductions and has disallowed the deductions taken in tax years 1993 through 1999. Should the IRS ultimately prevail on this issue,

tax and interest payable through Dec. 31, 2005, would reduce earnings by an estimated $361 million. In 2004, Xcel Energy received formal

notification that the IRS will seek penalties. If penalties (plus associated interest) are also included, the total exposure through Dec. 31, 2005,

is approximately $428 million. Xcel Energy estimates its annual earnings for 2006 would be reduced by $44 million, after tax, which represents

10 cents per share, if COLI interest expense deductions were no longer available. See Note 14 to the Consolidated Financial Statements for

further discussion.

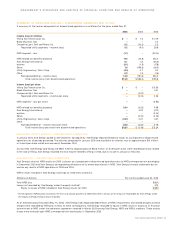

COLI Dow Chemical Court Decision

On Jan. 23, 2006, the 6th Circuit of the U.S. Court of Appeals issued an opinion in a federal income tax

case involving the interest deductions for a COLI program at Dow Chemical Company. The 6th Circuit denied the tax deductions and reversed

the decision of the trial court in the case.

Xcel Energy has analyzed the impact of the Dow decision on its pending COLI litigation and concluded there are significant factual differences

between its case and the Dow case. The court’s opinion in the Dow case outlined three indicators of potential economic benefits to be examined

in a COLI case and noted that the outcome of COLI cases is very fact determinative. These indicators are:

– Positive pre-deduction cash flows;

– Mortality gains; and

– The buildup of cash values.

In a split decision, the 6th Circuit found that the Dow COLI plans possessed none of these indicators of economic substance. However, in

Xcel Energy’s COLI case, the plans were projected to have sizeable pre-deduction cash flows, based upon the relevant assumptions when

purchased. Moreover, the plans presented the opportunity for mortality gains that were not eliminated either retroactively or prospectively.

Xcel Energy’s COLI plans had no provision for giving back any mortality gains that it might realize. In addition, Xcel Energy’s plans had large

cash value increases that were not encumbered by loans during the first seven years of the policies. Consequently, Xcel Energy believes that

the facts and circumstances of its case are stronger than Dow’s case and continues to believe its case has strong merit.

28 XCEL ENERGY 2005 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS