Whirlpool 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S LETTER P.2

FISCAL 2007 RESULTS

During 2007, we successfully managed a difficult operating

environment. We experienced the most challenging U.S.

industry conditions in more than two decades, and we

absorbed nearly $600 million in material and oil-related

cost increases. Yet, we saw record performance in our

international businesses, led by Latin America and Europe.

And we continued to grow and deliver value-creating

results. Our 2007 highlights were as follows:

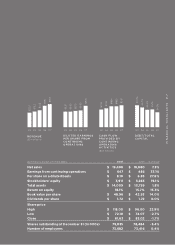

Net sales increased 7 percent to a record $19.4 billion.

Diluted earnings from continuing operations per share

increased 28 percent to $8.10.

Cash flow from operations reached $927 million, and

we were able to reduce total debt levels from $2.3 billion

to $2.1 billion.

The Maytag integration was completed, and we realized

more than $400 million in efficiencies.

$502 million was returned to shareholders in the form of

dividends and share repurchases.

STRATEGY EXECUTION

We remain committed to our brand value creation

strategy — focusing on innovation, cost productivity,

product quality and margin expansion. We continue to

improve our global operating platform to ensure we are

the best-cost and best-quality appliance manufacturer

worldwide. Our supply chain has been transformed to better

deliver products to trade customers and consumers. And

we are seeing the benefits of these actions today through

consolidated facilities, a stronger network, increased

efficiencies and timely deliveries.

BRAND PLATFORM

Best Consumer Position

TRADE PLATFORM

Best Trade Position

GLOBAL OPERATING PLATFORM

Best Cost, Quality and Delivery Position