Whirlpool 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

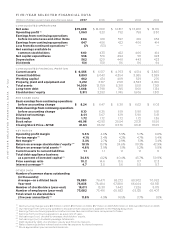

FINANCIAL SUMMARY P.112

FORWARD-LOOKING PERSPECTIVE

We expect modest global appliance industry growth during 2008 primarily due to continued weak-

nesses in the U.S. housing market and weaker economic conditions and consumer confidence in

Western Europe. We continue to expect strong emerging market appliance industry growth. Within

North America we expect industry demand to decline 3-5% for the year. Industry appliance demand

in Europe is expected to be flat versus 2007 levels; Latin America and Asia are expected to grow 5-8%

and 5-10% for the year, respectively.

Prices for materials and oil-related costs are expected to increase by approximately $350 million in

2008, largely driven by increases in component parts, base metals, such as copper, aluminum, zinc

and nickel, as well as steel. We expect to offset these higher costs with productivity improvements,

new product introductions, including the revitalization of Maytag branded products, previously

implemented cost-based price adjustments and improved product mix.

Our innovation product pipeline continues to grow and drive higher average sales values, consumer

and trade response to our new product offerings has been positive, and we continue to accelerate our

global branded consumer products strategy of delivering relevant innovation to markets worldwide.

FINANCIAL CONDITION AND LIQUIDITY

Our objective is to finance our business through the appropriate mix of long-term and short-term debt.

By diversifying the maturity structure, we avoid concentrations of debt, reducing liquidity risk. We

have varying needs for short-term working capital financing as a result of the nature of our business.

The volume and timing of refrigeration and air conditioning production impacts our cash flows and

consists of increased production in the first half of the year to meet increased demand in the summer

months. We finance working capital fluctuations primarily through the commercial paper markets in

the U.S. and Europe, which are supported by committed bank lines, and we anticipate that access to

these markets will continue to remain available. In addition, outside the U.S., short-term funding is

also provided by bank borrowings on uncommitted lines. We have access to long-term funding in the

U.S., Europe and other public bond markets. We are in compliance with the financial covenants for all

periods presented.

On June 15, 2004, the Board of Directors authorized a share repurchase program under which we

may repurchase up to $500 million of outstanding common stock. We repurchased $368 million of

outstanding common stock for the year ended December 31, 2007. Approximately $97 million of the

authorization remains outstanding.

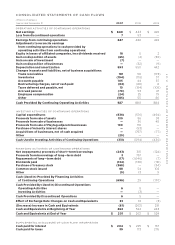

SOURCES AND USES OF CASH

We expect to meet our cash needs for 2008 from cash flows from continuing operations, cash and

equivalents and financing arrangements. Our cash and equivalents were $201 million at December 31,

2007 as compared to $262 million at December 31, 2006.

Cash Flows from Operating Activities of Continuing Operations Cash provided by continuing

operating activities in 2007 was $927 million, an increase of $47 million compared to the year ended

December 31, 2006. Cash provided by continuing operations for 2007 reflects higher earnings

primarily from our Latin America and Europe segments as compared to 2006. Cash provided by

continuing operations also reflects cash consumed from increased inventories as a result of lower

than anticipated demand in North America during the fourth quarter of 2007 as well as support for

higher sales volumes in Latin America and product transitions in the U.S. The increased inventory

balances were more than offset by improved trade receivable collections, improved accounts payable

terms as well as lower global taxes. Cash provided by continuing operations was negatively impacted

by increased spending associated with a Maytag dishwasher recall. Cash provided by continuing oper-

ating activities in 2006 was $880 million, a decrease of $4 million compared to the year ended

December 31, 2005. Cash provided by operating activities benefited from higher earnings, primarily

within our European and Latin American business segments. Increased inventories, which include

higher laundry inventory to support plant closures and transition of the Maytag laundry product to

Whirlpool facilities, consumed additional cash during 2006 but was largely offset by improvements

in accounts receivable collections and increases in accounts payable.