Whirlpool 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL SUMMARY P.114

We use foreign currency forward contracts, currency options and currency swaps to hedge the

price risk associated with firmly committed and forecasted cross-border payments and receipts

related to ongoing business and operational financing activities. Foreign currency contracts are

sensitive to changes in foreign currency exchange rates. At December 31, 2007, a 10% unfavorable

exchange rate movement in each currency in our portfolio of foreign currency contracts would have

resulted in an incremental unrealized loss of approximately $80 million, while a 10% favorable shift

would have resulted in an incremental unrealized gain of approximately $85 million. Consistent with

the use of these contracts to neutralize the effect of exchange rate fluctuations, such unrealized losses

or gains would be offset by corresponding gains or losses, respectively, in the re-measurement of the

underlying exposures.

We enter into commodity swap contracts to hedge the price risk associated with firmly committed

and forecasted commodities purchases that are not fixed directly through supply contracts. As of

December 31, 2007, a 10% favorable or unfavorable shift in commodity prices would have resulted in

an incremental $29 million gain or a $25 million loss related to these contracts.

We utilize interest rate swaps to hedge our interest rate risk. As of December 31, 2007, a 10% shift in

interest rates would have resulted in an incremental $1.0million gain or loss related to these contracts.

PERFORMANCE GRAPH

The graph below depicts the yearly dollar (and percentage) change in the cumulative total stockhold-

er return on our common stock with the cumulative total return of Standard & Poor’s (S&P)

Composite 500 Stock Index and the cumulative total return of the S&P Household Appliance Group

Index for the years 2003 through 2007.* The graph assumes $100 was invested on December 31, 2002,

in Whirlpool common stock, the S&P 500 and the S&P Household Appliance Group.

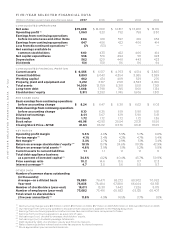

INDEXED RETURNS

Company / Index Base Period Years Ending

Dec02 Dec03 Dec04 Dec05 Dec06 Dec07

Whirlpool Corporation 100 142.31 139.14 172.45 174.35 174.62

S&P Composite 500 Stock Index 100 128.68 142.69 149.70 173.34 182.86

S&P Household Appliance

Group Index 100 120.09 148.39 157.98 163.61 158.87

2002 2003 2004 2005 2006 2007

$0

$100

$200

Whirlpool Corporation S&P 500 Index S&P 500 Household Appliances

* Cumulative total return is measured by dividing: (1) the sum of (a) the cumulative amount of the dividends for the measurement

period, assuming dividend reinvestment, and (b) the difference between share price at the end and the beginning of the

measurement period by (2) the share price at the beginning of the measurement period.