Vodafone 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

60

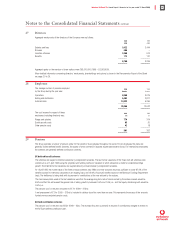

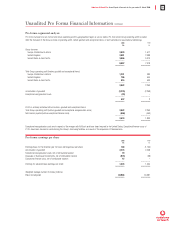

Unaudited Pro Forma Financial Information

Basis of pro forma financial information

The merger with AirTouch has been accounted for as an acquisition in accordance with Financial Reporting Standard 6, “Acquisitions and Mergers”.

The unaudited pro forma consolidated profit and loss accounts are also prepared on this basis.

The unaudited pro forma consolidated profit and loss account and accompanying notes for the year ended 31 March 2000 have been derived from

the audited consolidated financial results for that year, and the unaudited financial results of AirTouch for the three month period ended 30 June 1999.

The unaudited pro forma consolidated profit and loss account and accompanying notes for the year ended 31 March 1999 are derived from the audited

consolidated financial statements of Vodafone Group, and the unaudited consolidated financial statements of AirTouch, prepared for the corresponding

period. The financial statements of AirTouch, which were previously prepared under US GAAP, have been adjusted to conform materially to Vodafone

AirTouch’s accounting policies under UK GAAP following the merger.

The pro forma results for the year ended 31 March 2000 and the year ended 31 March 1999 have been determined as if the merger took place on

1 April 1999 and 1 April 1998, respectively, the first day of the financial accounting period presented in the unaudited pro forma consolidated profit and

loss accounts for those periods.

The pro forma merger adjustments reflected in the unaudited pro forma consolidated profit and loss accounts include assumptions that the Group’s

management believe to be reasonable. The unaudited pro forma consolidated profit and loss accounts do not take into account any synergies, including

cost savings, or any severance and restructuring costs, which may or are expected to occur as a result of the merger, except insofar as such costs and

savings have been included in the financial statements of Vodafone AirTouch for the year ended 31 March 2000.

Pro forma financial information does not include any adjustments arising from the creation, on 3 April 2000, of Verizon Wireless under a joint venture

arrangement with Bell Atlantic or the acquisition of Mannesmann AG, for which European Commission approval was received on 12 April 2000.

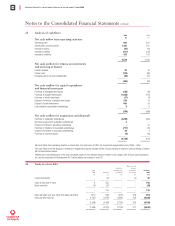

Unaudited pro forma profit and loss accounts for the years ended 31 March 2000 and 31 March 1999

2000 1999

£m £m

Group turnover 8,887 7,018

–––––––– ––––––––

Operating profit 1,013 762

Share of operating loss in joint ventures and associated undertakings (376) (760)

–––––––– ––––––––

Total Group operating profit 637 2

Total Group operating profit before goodwill and exceptional items:

– Subsidiary undertakings 1,886 1,624

– Joint ventures and associated undertakings 1,056 636

–––––––– ––––––––

2,942 2,260

Amortisation of goodwill (2,275) (2,258)

Exceptional reorganisation costs (30) –

–––––––– ––––––––

Total Group operating profit 637 2

–––––––– ––––––––

Disposal of fixed asset investments 975 116

–––––––– ––––––––

Profit on ordinary activities before interest 1,612 118

Net interest payable (485) (460)

–––––––– ––––––––

Profit/(loss) on ordinary activities before taxation 1,127 (342)

Tax on profit/(loss) on ordinary activities (810) (584)

–––––––– ––––––––

Profit/(loss) on ordinary activities after taxation 317 (926)

Equity minority interest (162) (129)

Non-equity minority interests (51) (51)

–––––––– ––––––––

Profit/(loss) for the financial year 104 (1,106)

–––––––– ––––––––

Basic earnings/(loss) per share 0.34p (3.64)p

Adjusted basic earnings per share 4.64p 3.47p