Vodafone 2000 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

36

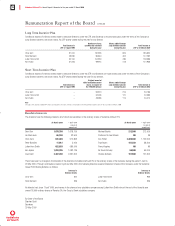

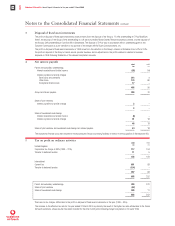

3 Disposal of fixed asset investments

The profit on disposal of fixed asset investments arose primarily from the disposal of the Group’s 17.24% shareholding in E-Plus Mobilfunk

GmbH, the disposal of the Group’s 20% shareholding in a UK service provider, Martin Dawes Telecommunications Limited, and the disposal of

the Group’s 50% shareholding in Comfone AG in Switzerland. The disposal of E-Plus was in accordance with an undertaking given to the

European Commission as a pre-condition to its approval of the merger with AirTouch Communications, Inc.

The profit on disposal of fixed asset investments in 1999 arose from the reduction in the Group’s interest in Globalstar from 5.2% to 3.0%,

the profit on disposal of the Group’s French service provider business and an adjustment to the profits realised in relation to business

disposals in 1998 following finalisation of the relevant completion accounts.

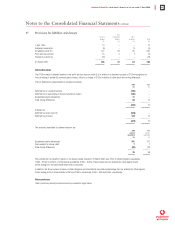

4Net interest payable

2000 1999

£m £m

Parent and subsidiary undertakings

Interest receivable and similar income (55) (14)

–––––––– ––––––––

Interest payable and similar charges

Bank loans and overdrafts 214 4

Other loans 174 86

Exceptional finance costs 17 –

–––––––– ––––––––

405 90

–––––––– ––––––––

Group net interest payable 350 76

–––––––– ––––––––

Share of joint ventures

Interest payable and similar charges 3–

–––––––– ––––––––

3–

–––––––– ––––––––

Share of associated undertakings

Interest receivable and similar income (3) –

Interest payable and similar charges 51 18

–––––––– ––––––––

48 18

–––––––– ––––––––

Share of joint ventures and associated undertakings net interest payable 51 18

–––––––– ––––––––

The exceptional finance costs were incurred in restructuring the Group’s borrowing facilities in relation to the acquisition of Mannesmann AG.

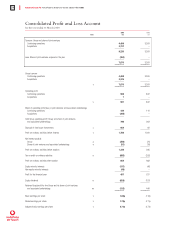

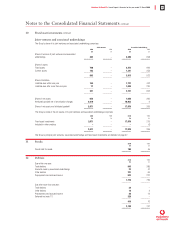

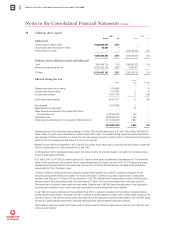

5 Tax on profit on ordinary activities

2000 1999

£m £m

United Kingdom

Corporation tax charge at 30% (1999 – 31%) 117 164

Transfer to deferred taxation 11 5

–––––––– ––––––––

128 169

–––––––– ––––––––

International

Current tax 691 83

Transfer to deferred taxation (134) –

–––––––– ––––––––

557 83

–––––––– ––––––––

685 252

–––––––– ––––––––

Parent and subsidiary undertakings 494 241

Share of joint ventures (57) -

Share of associated undertakings 248 11

–––––––– ––––––––

685 252

–––––––– –––––––

There are no tax charges attributable to the profit on disposal of fixed asset investments in the year (1999 – £2m).

The increase in the effective tax rate for the year ended 31 March 2000 is primarily the result of the higher tax rates attributable to the former

AirTouch operations, whose results have been included for the nine month period following merger completion on 30 June 1999.

Notes to the Consolidated Financial Statements continued