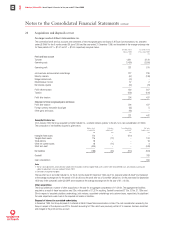

Vodafone 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 39

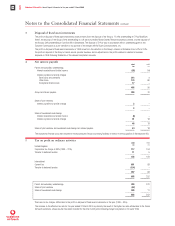

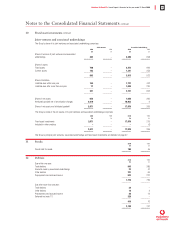

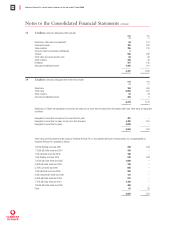

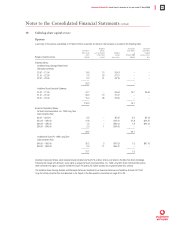

10 Fixed asset investments continued

Joint ventures and associated undertakings

The Group’s share of its joint ventures and associated undertakings comprises:

Joint ventures Associated undertakings

2000 1999 2000 1999

£m £m £m £m

Share of turnover of joint ventures and associated

undertakings 362 –3,286 698

–––––––– –––––––– –––––––– ––––––––

Share of assets

Fixed assets 790 –2,472 669

Current assets 103 –1,341 253

–––––––– –––––––– –––––––– ––––––––

893 –3,813 922

–––––––– –––––––– –––––––– ––––––––

Share of liabilities

Liabilities due within one year 164 –1,737 442

Liabilities due after more than one year 77 –1,020 220

–––––––– –––––––– –––––––– ––––––––

241 –2,757 662

–––––––– –––––––– –––––––– ––––––––

Share of net assets 652 –1,056 260

Attributed goodwill net of amortisation charges 2,019 –16,923 9

–––––––– –––––––– –––––––– ––––––––

Share of net assets and attributed goodwill 2,671 –17,979 269

–––––––– –––––––– –––––––– ––––––––

The Group’s share of the net assets of its joint ventures and associated undertakings comprises:

2000 1999 2000 1999

£m £m £m £m

Fixed asset investments 2,671 –17,979 275

Included in other creditors –––(6)

–––––––– –––––––– –––––––– ––––––––

2,671 –17,979 269

–––––––– –––––––– –––––––– ––––––––

The Group’s principal joint ventures, associated undertakings and fixed asset investments are detailed on page 57.

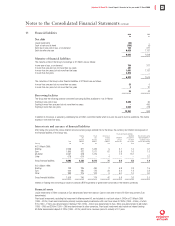

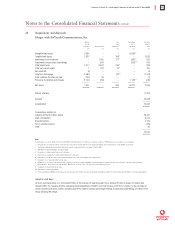

11 Stocks 2000 1999

£m £m

Goods held for resale 190 45

–––––––– ––––––––

12 Debtors 2000 1999

£m £m

Due within one year:

Trade debtors 943 385

Amounts owed by associated undertakings 23 47

Other debtors 221 66

Prepayments and accrued income 532 227

–––––––– ––––––––

1,719 725

–––––––– ––––––––

Due after more than one year:

Trade debtors 34 –

Other debtors 10 2

Prepayments and accrued income 46 14

Deferred tax (note 17) 329 –

–––––––– ––––––––

419 16

–––––––– ––––––––

2,138 741

–––––––– ––––––––

Notes to the Consolidated Financial Statements continued