Vodafone 2000 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 13

The Board has approved ratios consistent with those used by

companies with high credit ratings for net interest cover, market

capitalisation to net debt and net cash flow to net debt, which establish

internal limits for the maximum level of debt that the Group may have

outstanding. Group interest, excluding the Group’s share of interest

payable by joint ventures and associated undertakings, is covered

7.3 times by Group EBITDA (before exceptional reorganisation costs

and excluding dividends received from joint ventures and associated

undertakings). The Group’s main interest exposures are Sterling, Euro

and US dollar interest rates.

The Group’s policy is to borrow centrally, using a mixture of long term

and short term capital market issues and borrowing facilities, to meet

anticipated funding requirements. These borrowings, together with cash

generated from operations, are lent or contributed as equity to

subsidiaries.

The maturity of the undrawn committed facility available to the Group at

31 March 2000 is shown below.

Undrawn committed facility – maturity profile

Analysed by year of expiry: Euro

(million)

Within 1 year 9,500

Between 2-5 years 7,500

–––––––––

17,000

–––––––––

The committed facility comprises a syndicated senior credit facility of

30 billion, which was subsequently reduced to 17 billion on

11 March 2000. The portion of the facility maturing within one year

may be extended, at the option of the Company, for a further period of

between 6 and 12 months.

In addition, Misrfone in Egypt has an EGP2.4 billion committed facility,

which may only be used to fund its operations.

In May 2000, the Company issued US$3.75 billion of Floating Rate

Notes, of which US$0.75 billion is due in June 2001 and US$3 billion

in December 2001.

On 26 May 2000, the Company signed an additional US$5 billion,

364 day bank facility, extendable at the option of the Company by a

further 9 months.

Foreign exchange management

Foreign currency exposures on known future transactions are hedged,

including those resulting from the repatriation of international dividends

and loans. Forward foreign exchange contracts are the derivative

instrument most used for this purpose.

The Group’s policy is not to hedge its international net assets with

respect to foreign currency balance sheet translation exposure, since

net tangible assets represent a small proportion of the market value

of the Group and international operations provide risk diversity.

However, 66% of gross borrowings were denominated in currencies

other than sterling in anticipation of cash flows from profitable

international operations and this provides a partial hedge against

profit and loss account translation exposure.

Interest rate management

Under the Group’s interest rate management policy, interest rates are

fixed when net interest is forecast to have a significant impact on

profits. Therefore, the term structure of interest rates is managed within

limits approved by the Board, using derivative financial instruments

such as interest rate swaps, futures and forward rate agreements.

At the end of the year, 65% of the Group’s gross borrowings were fixed

for a period of at least one year. Based on the Group’s net debt at

31 March 2000, a one percent rise in market interest rates would

reduce profit before taxation by approximately £22m.

Counterparty risk management

Cash deposits and other financial instrument transactions give rise to

credit risk on the amounts due from counterparties. The Group regularly

monitors these risks and the credit rating of its counterparties and,

by policy, limits the aggregate credit and settlement risk it may have

with any one counterparty. Whilst the Group may be exposed to credit

losses in the event of non-performance by these counterparties, the

possibility of material loss is considered to be minimal because of these

control procedures.

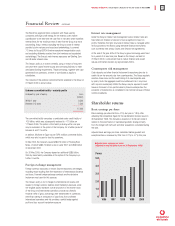

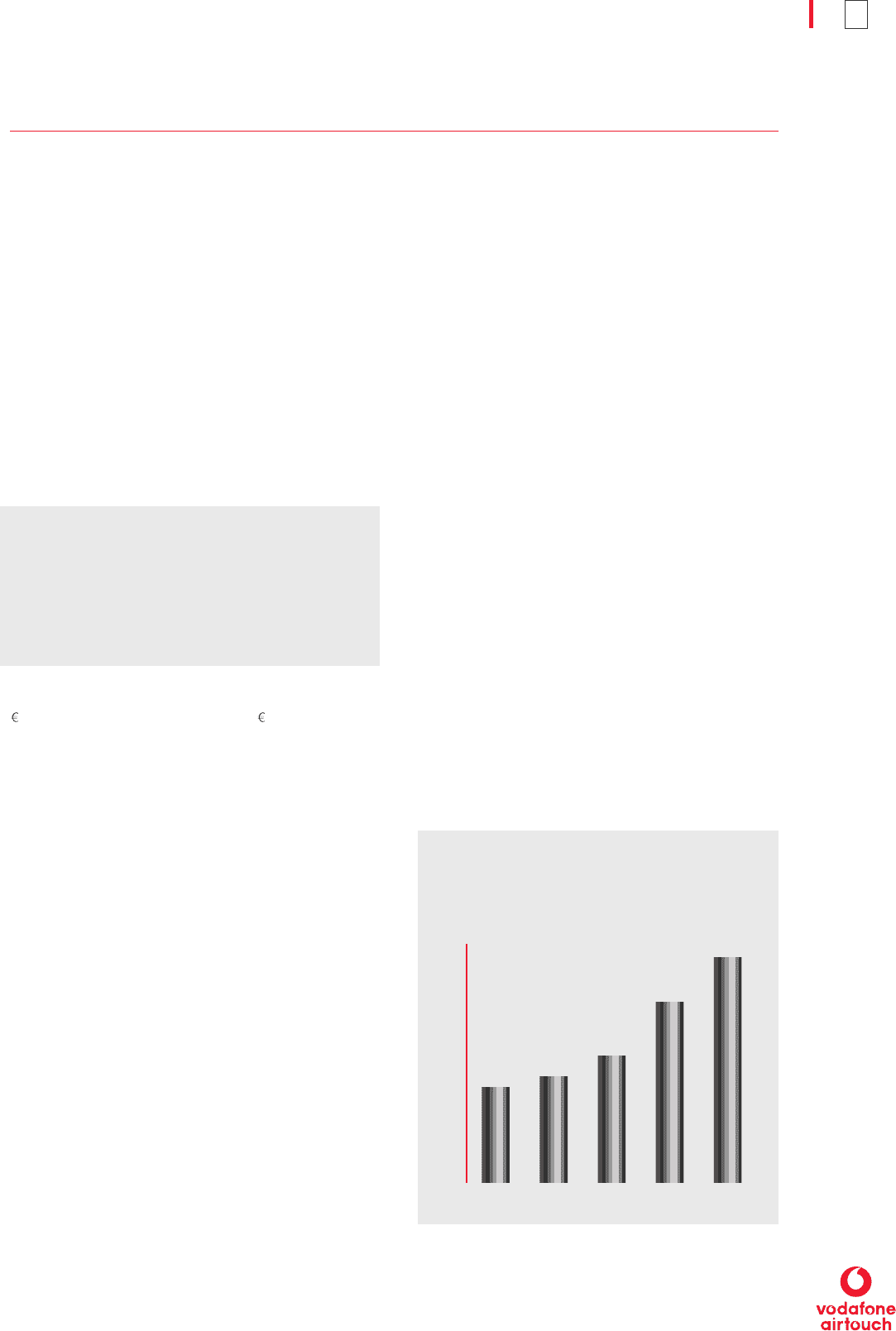

Shareholder returns

Basic earnings per share

Basic earnings per share fell from 4.12p last year to 1.80p, after

adjusting the comparative figure for the capitalisation (bonus) issue on

30 September 1999. This includes a reduction of 6.32p per share in

relation to the amortisation of capitalised goodwill, arising primarily

from the merger with AirTouch and other acquisitions completed during

the year.

Adjusted basic earnings per share, calculated before goodwill and

exceptional items, increased by 25% from 3.77p to 4.71p this year.

Financial Review continued

0

1.0

2.0

3.0

4.0

5.0

Adjusted basic earnings per share

(adjusted for capitalisation issue on 30 September 1999)

1996 1997 1998 1999 2000

Pence