Vodafone 2000 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 49

Notes to the Consolidated Financial Statements continued

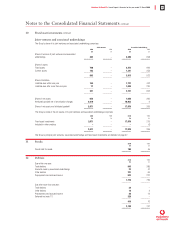

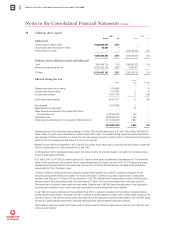

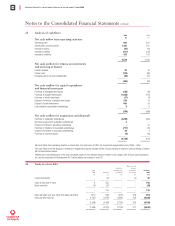

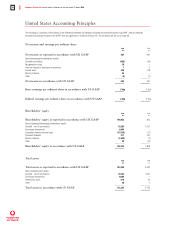

22 Leased assets

Operating leases

Commitments to non-cancellable operating lease payments within one year are as follows:

2000 1999

Land and Other Land and Other

buildings assets buildings assets

In respect of leases expiring: £m £m £m £m

Within one year 29 145 7 16

Between two and five years 71 60 19 121

After five years 118 35 40 39

–––––––– –––––––– –––––––– ––––––––

218 240 66 176

–––––––– –––––––– –––––––– ––––––––

Finance leases

Tangible fixed assets at 31 March 2000 include the following amounts in respect of finance leases:

Network

Plant and Fixtures infra-

machinery and fittings structure Total

£m £m £m £m

Cost 19 4 250 273

Accumulated depreciation (16) (4) (106) (126)

–––––––– –––––––– –––––––– ––––––––

Net book value 3 – 144 147

–––––––– –––––––– –––––––– ––––––––

31 March 1999

Net book value 2 3 171 176

–––––––– –––––––– –––––––– ––––––––

Liabilities under leases for network infrastructure assets have been unconditionally satisfied by call deposits and other assets, trust deed

and set-off arrangements. Accordingly, neither these lease liabilities nor the corresponding financial assets are included in the Group’s

balance sheet.

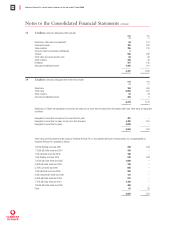

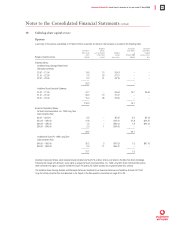

23 Capital commitments

2000 1999

£m £m

Contracted for but not provided 442 161

–––––––– ––––––––

24 Contingent liabilities

2000 1999

£m £m

Guarantees and indemnities of bank or other facilities including those in respect

of the Group’s joint ventures, associated undertakings and investments 1,155 175

–––––––– ––––––––

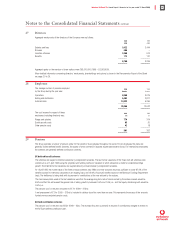

Guarantees and indemnities include £978m in respect of a letter of indemnity provided, in September 1999, to a co-investor in certain

operating companies in which Vodafone AirTouch has equity interests. The co-investor has provided the lending institutions to the operating

companies with certain credit support documents, which are not legally binding obligations on the co-investor. Prior to Vodafone AirTouch

indemnifying the co-investor from any loss it may suffer as a result of the credit support documents, the co-investor has agreed to request

other shareholders in the operating companies to make equity contributions in order that the operating companies may discharge their

liabilities and, in the event that the co-investor discharges, under the credit support documents, more than 40 per cent of the operating

companies’ indebtedness, the co-investor will use its efforts to cause the operating companies to refinance (if practicable) the remaining debt.