Vodafone 2000 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 43

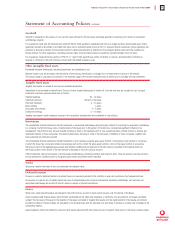

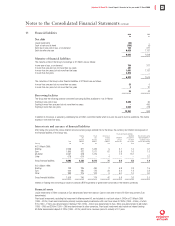

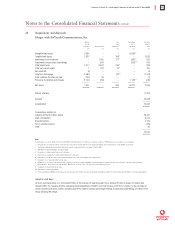

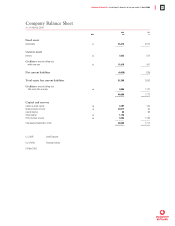

17 Provisions for liabilities and charges Post

Deferred employment Other

taxation benefits provisions Total

£m £m £m £m

1 April 1999 10 – – 10

Exchange movements (5) – (1) (6)

Acquisitions (note 21) 157 23 60 240

Profit and loss account 13 4 2 19

Transfer to current tax (70) – – (70)

–––––––– –––––––– –––––––– ––––––––

31 March 2000 105 27 61 193

–––––––– –––––––– –––––––– ––––––––

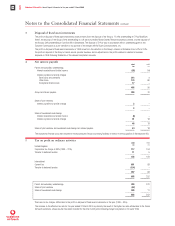

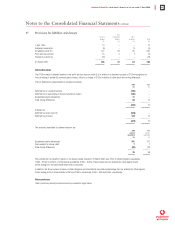

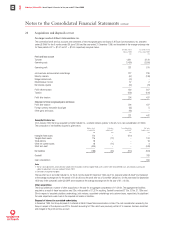

Deferred taxation

The £123m credit to deferred taxation in the profit and loss account (note 5) is in relation to a deferred tax asset of £136m recognised on

the sub-letting of certain US communications towers, offset by a charge of £13m in relation to other short term timing differences.

The net deferred tax (asset)/liability is analysed as follows:

2000 1999

£m £m

Deferred tax on unvested options (193) –

Deferred tax on sub-letting of US communications towers (136) –

Accelerated capital allowances 11 –

Other timing differences 94 10

–––––––– ––––––––

(224) 10

–––––––– ––––––––

Analysed as:

Deferred tax asset (note 12) (329) –

Deferred tax provision 105 10

–––––––– ––––––––

(224) 10

–––––––– ––––––––

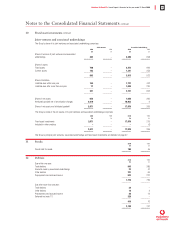

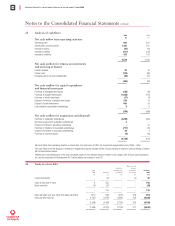

The amounts unprovided for deferred taxation are:

2000 1999

Amount Amount

unprovided unprovided

£m £m

Accelerated capital allowances 161 101

Gains subject to rollover relief 77

Other timing differences (92) (10)

–––––– ––––––

76 98

–––––– ––––––

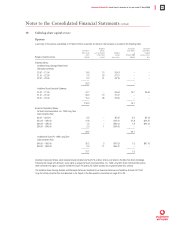

The potential net tax benefit in respect of tax losses carried forward at 31 March 2000 was £16m in United Kingdom subsidiaries

(1999 – £18m) and £51m in international subsidiaries (1999 – £52m). These losses are only available for offset against future

profits arising from the same trade within these companies.

In addition, the Group’s share of losses of United Kingdom and international associated undertakings that are available for offset against

future trading profits in these entities is £Nil and £105m, respectively (1999 – £Nil and £55m, respectively).

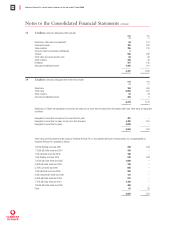

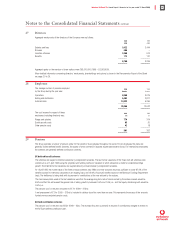

Other provisions

Other provisions primarily comprise amounts provided for legal claims.

Notes to the Consolidated Financial Statements continued