Vodafone 2000 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

54

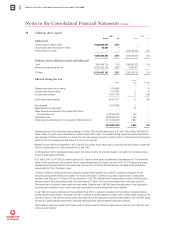

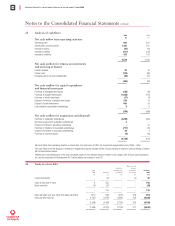

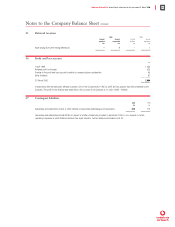

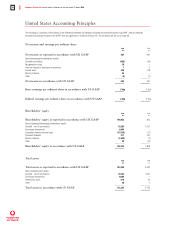

31 Fixed asset investments

Subsidiary Associated Other

undertakings undertakings Investments Total

£m £m £m £m

Cost

1 April 1999 3,199 23 – 3,222

Exchange movements – (1) – (1)

Additions 93,872 – 4,384 98,256

Disposals (43,519) (6) (2,536) (46,061)

–––––––– –––––––– –––––––– ––––––––

31 March 2000 53,552 16 1,848 55,416

–––––––– –––––––– –––––––– ––––––––

The Company’s 98.62% investment in the issued share capital of Mannesmann AG has been recorded based on the nominal value of the

shares issued by the Company, as permitted by section 131 of the Companies Act 1985. Details of the Company’s shares issued in respect

of this investment are set out in note 18. The Company holds 499,970,377 shares in Mannesmann AG, with an aggregate nominal value

of 1,278m.

Loans to associated undertakings included above amounted to £16m at 31 March 2000 (1999 – £17m). The Company’s subsidiary and

associated undertakings and other investments are detailed on pages 56 and 57.

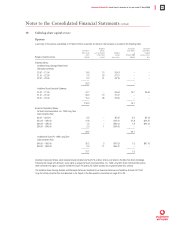

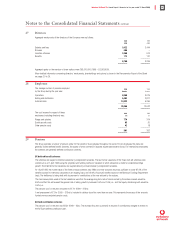

32 Debtors

2000 1999

£m £m

Amounts owed by subsidiary undertakings 7,455 527

Group relief receivable 37 35

Other debtors 62 10

–––––––– ––––––––

7,554 572

–––––––– ––––––––

33 Creditors: amounts falling due within one year 2000 1999

£m £m

Bank loans, other loans and overdrafts 12 62

Commercial paper 703 208

Amounts owed to subsidiary undertakings 10,224 520

Taxation 1–

Other creditors 74

Dividends 417 100

Accruals and deferred income 246 7

–––––––– ––––––––

11,610 901

–––––––– ––––––––

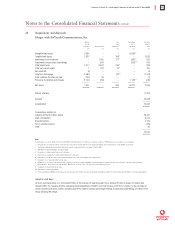

34 Creditors: amounts falling due after more than one year

2000 1999

£m £m

Bank loans –606

Other loans 4,694 515

–––––––– ––––––––

4,694 1,121

–––––––– ––––––––

Other loans are repayable as follows:

Between one and two years 305 –

Between two and five years 1,337 515

After five years 3,052 –

–––––––– ––––––––

Other loans 4,694 515

–––––––– ––––––––

The other loans include £249m (1999 – £248m) and £248m (1999 – £248m) of sterling bonds with coupon rates of 7.875% and 7.5%,

respectively, £893m (1999 – £Nil) of eurobonds with a coupon rate of 5.75%, and £1,089m (1999 – £Nil), £1,702m (1999 – £Nil) and

£459m (1999 – £Nil) of US Dollar bonds with coupon rates of 7.625%, 7.75% and 7.875%, respectively. The bonds are repayable in 2001,

2004, 2006, 2005, 2010 and 2030, respectively.

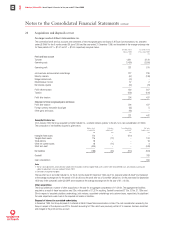

Notes to the Company Balance Sheet