Vodafone 2000 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

48

Notes to the Consolidated Financial Statements continued

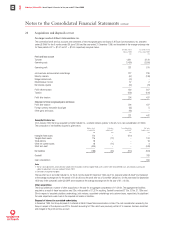

21 Acquisitions and disposals continued

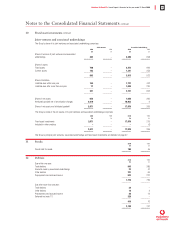

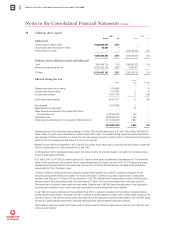

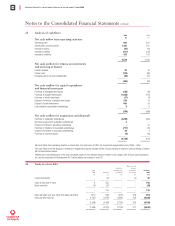

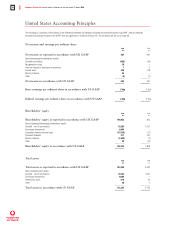

Pre-merger results of AirTouch Communications, Inc.

The summarised profit and loss accounts and statements of total recognised gains and losses of AirTouch Communications, Inc. prepared

under US GAAP for the 6 months ended 30 June 1999 and the year ended 31 December 1998, and translated at the average exchange rate

for these periods of £1 = $1.61 and £1 = $1.66, respectively, are given below.

6 months ended 12 months ended

30 June 1999 31 December 1998

£m £m

Profit and loss account

Turnover 1,811 3,120

Operating costs (1,490) (2,550)

–––––––– ––––––––

Operating profit 321 570

Joint ventures and associated undertakings 227 236

Minority interests (57) (108)

Merger related costs (74) –

Miscellaneous income 57 2

Net interest payable (44) (73)

–––––––– ––––––––

Profit before taxation 430 627

Taxation (136) (190)

–––––––– ––––––––

Profit after taxation 294 437

–––––––– ––––––––

Statement of total recognised gains and losses

Profit after taxation 294 437

Foreign currency translation (loss)/gain (55) 5

Other gains and losses (18) –

–––––––– ––––––––

221 442

–––––––– ––––––––

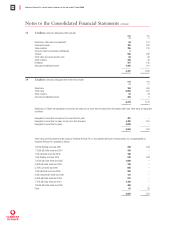

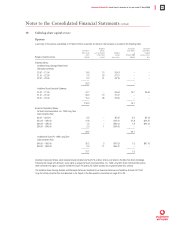

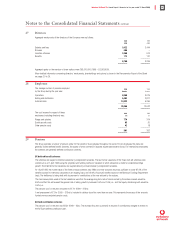

CommNet Cellular Inc.

On 6 January 2000 the Group acquired CommNet Cellular Inc., a cellular network operator in the US, for a cash consideration of £459m.

The composition of net liabilities acquired is given below.

Balance sheet Fair value Accounting policy Fair value

at acquisition adjustments(1) conformity(2) balance sheet

£m £m £m £m

Intangible fixed assets 110 – (110) –

Tangible fixed assets 115 (12) – 103

Trade debtors 18 – – 18

Other net current assets 18 (14) – 4

Short term debt (449) – – (449)

–––––––– –––––––– –––––––– ––––––––

Net liabilities (188) (26) (110) (324)

–––––––– –––––––– ––––––––

Goodwill 783

––––––––

Cash consideration 459

––––––––

Notes

1. The fair value adjustments, which primarily comprise the revaluation of certain tangible fixed assets and the write-off of deferred costs, are provisional and may be

subject to adjustment in the year ending 31 March 2001.

2. Elimination of acquired intangibles.

The loss after tax of CommNet Cellular Inc. for the 3 months ended 31 December 1999 was £1m (prepared under US GAAP and translated

at the average exchange rate for the period of £1=$1.62) and the profit after tax of CommNet Cellular Inc. for the year ended 30 September

1999 was £16m (prepared under US GAAP and translated at the average exchange rate for the year of £1 = $1.63).

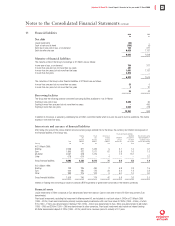

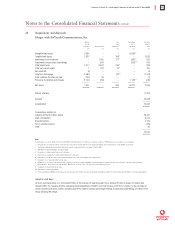

Other acquisitions

The Group undertook a number of other acquisitions in the year for an aggregate consideration of £1,318m. The aggregate net liabilities

acquired as a result of these transactions was £3m, with goodwill of £1,321m resulting. Goodwill comprised £112m, £70m, £1,130m and

£9m in respect of acquired subsidiary undertakings, joint ventures, associated undertakings and customer bases, respectively. No significant

fair value adjustments were made to the acquired net assets or liabilities.

Disposal of interest in associated undertaking

In December 1999, the Group disposed of its interest in Martin Dawes Telecommunications Limited. The cash consideration received by the

Group in respect of the disposal was £27m. Goodwill amounting to £18m, which was previously written off to reserves, has been reinstated

and charged in the profit and loss account.