Vodafone 2000 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

50

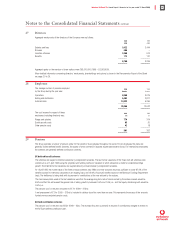

Notes to the Consolidated Financial Statements continued

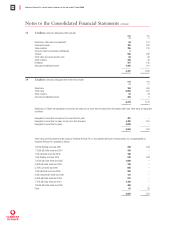

25 Analysis of cash flows 2000 1999

£m £m

Net cash inflow from operating activities

Operating profit 981 847

Depreciation and amortisation 1,432 297

Increase in stocks (65) (15)

Increase in debtors (271) (213)

Increase in creditors 433 129

–––––––– ––––––––

2,510 1,045

–––––––– ––––––––

Net cash outflow for returns on investments

and servicing of finance

Interest received 57 16

Interest paid (370) (85)

Dividends paid to minority shareholders (93) (21)

–––––––– ––––––––

(406) (90)

–––––––– ––––––––

Net cash outflow for capital expenditure

and financial investment

Purchase of intangible fixed assets (185) (18)

Purchase of tangible fixed assets (1,848) (737)

Purchase of trade investments (17) (4)

Disposal of interests in tangible fixed assets 294 14

Disposal of trade investments 991 54

Loans repaid by associated undertakings 93

–––––––– ––––––––

(756) (688)

–––––––– ––––––––

Net cash outflow for acquisitions and disposals

Purchase of subsidiary undertakings (4,062) (255)

Net cash acquired with subsidiary undertakings 4–

Disposal of interest in subsidiary undertaking –19

Purchase of interests in associated undertakings (717) (75)

Disposal of interests in associated undertakings 28 4

Purchase of customer bases (9) (10)

–––––––– ––––––––

(4,756) (317)

–––––––– ––––––––

Net cash inflow from operating activities is stated after cash payments of £30m for exceptional reorganisation costs (1999 – £9m).

The cash inflow from the disposal of interests in tangible fixed assets includes £279m of cash receipts in relation to the sub-letting of certain

US communications towers.

Material non-cash transactions in the year comprised issues of new ordinary shares in relation to the merger with AirTouch Communications,

Inc. and the acquisition of Mannesmann AG. Further details are included in note 18.

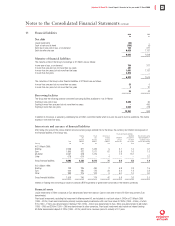

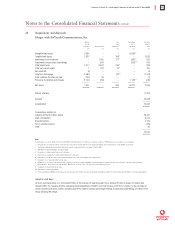

26 Analysis of net debt Other non-cash

Acquisitions changes

1 April (excluding cash & exchange 31 March

1999 Cash flow & overdrafts) movements 2000

£m £m £m £m £m

Liquid investments – 33 – (3) 30

–––––––– –––––––– –––––––– –––––––– ––––––––

Cash at bank and in hand 6 153 – – 159

Bank overdrafts (6) (37) – – (43)

–––––––– –––––––– –––––––– –––––––– ––––––––

– 116 – – 116

–––––––– –––––––– –––––––– –––––––– ––––––––

Debt due within one year (other than bank overdrafts) (371) (149) (449) 218 (751)

Debt due after one year (1,137) (3,319) (1,684) 102 (6,038)

–––––––– –––––––– –––––––– –––––––– ––––––––

(1,508) (3,468) (2,133) 320 (6,789)

–––––––– –––––––– –––––––– –––––––– ––––––––

(1,508) (3,319) (2,133) 317 (6,643)

–––––––– –––––––– –––––––– –––––––– ––––––––