Vodafone 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

40

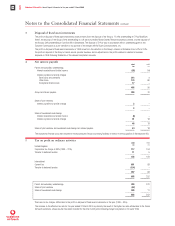

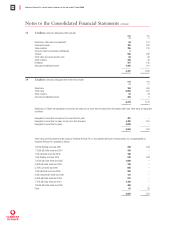

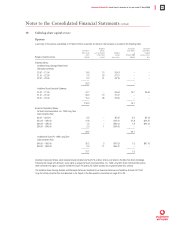

13 Creditors: amounts falling due within one year

2000 1999

£m £m

Bank loans, other loans and overdrafts 94 174

Commercial paper 700 203

Trade creditors 706 216

Amounts owed to associated undertakings 2–

Taxation 535 252

Other taxes and social security costs 54 28

Other creditors 436 46

Dividends 417 100

Accruals and deferred income 1,497 511

–––––––– ––––––––

4,441 1,530

–––––––– ––––––––

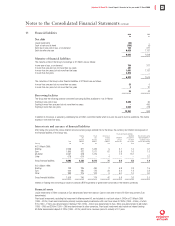

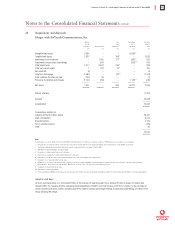

14 Creditors: amounts falling due after more than one year 2000 1999

£m £m

Bank loans 184 606

Other loans 5,854 531

Other creditors 33 33

Accruals and deferred income 303 9

–––––––– ––––––––

6,374 1,179

–––––––– ––––––––

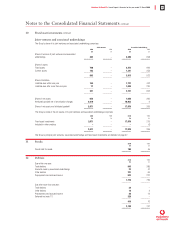

Bank loans of £184m are repayable in more than two years but not more than five years from the balance sheet date. Other loans are repayable

as follows:

Repayable in more than one year but not more than two years 481 –

Repayable in more than two years but not more than five years 1,497 531

Repayable in more than five years 3,876 –

–––––––– ––––––––

5,854 531

–––––––– ––––––––

Other loans primarily comprise bond issues by Vodafone AirTouch Plc, or its subsidiary AirTouch Communications, Inc. and guaranteed by

Vodafone AirTouch Plc, analysed as follows:

7.875% Sterling bond due 2001 249 248

7.125% US Dollar bond due 2001 156 –

7.0% US Dollar bond due 2003 156 –

7.5% Sterling bond due 2004 248 248

7.625% US Dollar bond due 2005 1,089 –

6.35% US Dollar bond due 2005 125 –

5.75% Euro bond due 2006 893 –

7.5% US Dollar bond due 2006 250 –

5.5% Deutschmark bond due 2008 123 –

6.65% US Dollar bond due 2008 313 –

7.75% US Dollar bond due 2010 1,702 –

7.875% US Dollar bond due 2030 459 –

Other 91 35

–––––––– ––––––––

5,854 531

–––––––– ––––––––

Notes to the Consolidated Financial Statements continued