Vodafone 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 35

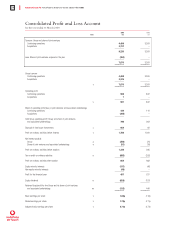

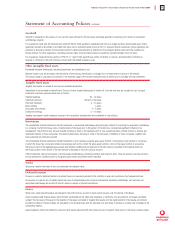

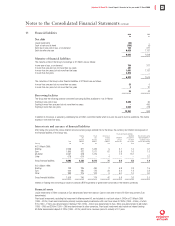

2Operating profit

Continuing

operations Acquisitions 2000 1999

£m £m £m £m

Group turnover 4,498 3,375 7,873 3,360

Cost of sales 2,591 1,768 4,359 1,809

–––––––– –––––––– –––––––– ––––––––

Gross profit 1,907 1,607 3,514 1,551

–––––––– –––––––– –––––––– ––––––––

Selling and distribution costs 305 564 869 243

Administrative expenses 622 1,042 1,664 461

Amortisation of goodwill 16 658 674 8

Other administration costs 606 384 990 453

–––––––– –––––––– –––––––– ––––––––

Total operating expenses 927 1,606 2,533 704

–––––––– –––––––– –––––––– ––––––––

Operating profit 980 1 981 847

–––––––– –––––––– –––––––– ––––––––

Operating profit has been arrived at after charging:

2000 1999

£m £m

Depreciation of tangible fixed assets

Owned assets 698 255

Leased assets 48 27

Amortisation of goodwill 674 8

Amortisation of other intangible fixed assets 12 7

Research and development 46 37

Payments under operating leases

Plant and machinery 76 10

Other assets 278 167

Auditors’ remuneration

Audit work 11

Other fees

United Kingdom 31

Overseas 4–

Exceptional reorganisation costs 30 –

–––––––– ––––––––

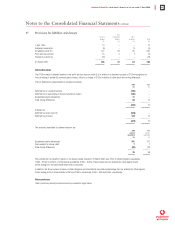

Auditors’ other fees shown above exclude £6m (1999 – £1m) of fees payable for professional services incurred in the period in connection

with mergers and acquisitions. These fees have been accounted for as acquisition costs upon completion of the transaction, or are being

carried forward within investments pending completion. Auditors’ other fees incurred on specific capital projects during the year and totalling

£3m (1999 – £2m) have also been excluded, of which £2m was incurred by overseas operations (1999 – £1m).

The exceptional reorganisation costs relate to the reorganisation of the Group’s US operations following the merger with AirTouch.

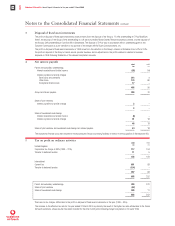

Joint ventures and associated undertakings

Group turnover includes sales to joint ventures and associated undertakings of £303m (1999 – £255m) primarily comprising network airtime

and access charges. Total operating costs include charges from joint ventures and associated undertakings of £82m (1999 – £75m), primarily

comprising roaming charges and service provider incentive payments.

The Group’s share of the operating profit/(loss) of joint ventures and associated undertakings is further analysed as follows:

Continuing

operations Acquisitions 2000 1999

£m £m £m £m

Share of operating profit/(loss):

Joint ventures – (40) (40) –

Associated undertakings 104 (249) (145) 116

–––––––– –––––––– –––––––– ––––––––

104 (289) (185) 116

–––––––– –––––––– –––––––– ––––––––

Included in the Group’s share of operating profit/(loss) above is a charge for the amortisation of goodwill of £52m for joint ventures

(1999 – £Nil) and £986m in respect of associated undertakings (1999 – £1m).

Notes to the Consolidated Financial Statements continued