Vodafone 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 47

Notes to the Consolidated Financial Statements continued

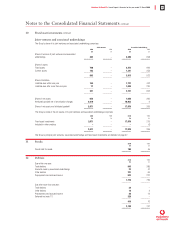

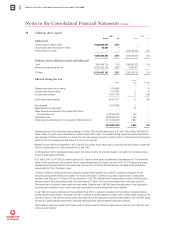

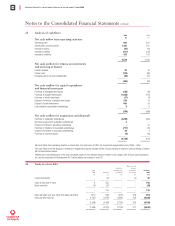

21 Acquisitions and disposals

Merger with AirTouch Communications, Inc.

Balance Fair(1 Accounting Fair value

sheet at value(1 policy)balance

acquisition Reclassification(1) adjustments(2) conformity sheet

£m £m(2) £m(1) £m £m

Intangible fixed assets 5,284 – – (5,284)(3) –

Tangible fixed assets 2,637 – 188(4) – 2,825

Investments in joint ventures – 1,495 127(5) (963)(3) 659

Investments in associated undertakings – 809 – (203)(3)(6) 606

Other investments 2,477 (2,357) 245(7) – 365

Other net current assets 1 223 76(8) – 300

Net overdrafts (5) – – – (5)

Long term borrowings (1,483) – (30)(9) – (1,513)

Other creditors due after one year (100) 98 – – (2)

Provisions for liabilities and charges (1,150) (268) – 1,178(10) (240)

–––––– –––––– –––––– –––––– ––––––

Net assets 7,661 – 606 (5,272) 2,995

–––––– –––––– –––––– ––––––

Minority interests (1,267)

Goodwill(11) 40,968

––––––

Consideration 42,696

––––––

Consideration satisfied by:

Vodafone AirTouch ordinary shares 38,467

Cash consideration 3,477

Unvested options 1,165

Tax on unvested options (449)

Other 36

––––––

42,696

––––––

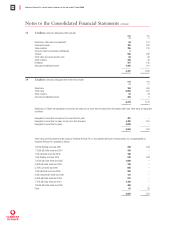

Notes

The table above sets out the details of the merger with AirTouch Communications, Inc. which was completed on 30 June 1999 and has been accounted for as an acquisition.

1. Reclassification of certain investments to investments in joint ventures and investments in associated undertakings, and reclassification of certain liabilities to provisions.

2. The fair value adjustments are provisional and may be subject to adjustment in the year ending 31 March 2001.

3. Elimination of acquired intangibles, including goodwill.

4. Revaluation of certain tangible fixed assets to fair value.

5. Equity share of revaluations of certain tangible fixed assets to fair value.

6. Restatement of the Group’s share of associated undertakings’ net assets in line with Group accounting policies.

7. Revaluation of cost based investments to fair value.

8. Adjustments to other net current assets primarily comprise provisions for potential tax liabilities and an adjustment in relation to the discount to fair value of an option held by AirTouch

Communications, Inc. to increase its shareholding in Omnitel from 17.8% to 21.6%. This option was exercised during the year.

9. Revaluation of long term debt to fair value.

10. Restatement of deferred tax liabilities.

11. The total goodwill of £40,968m derived above has been allocated as £21,543m in respect of subsidiary undertakings, £2,031m for joint ventures and £17,394m for associated undertakings.

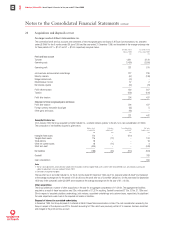

Impact on cash flows

AirTouch Communications, Inc. contributed £945m to the Group’s net operating cash flows, received £104m in respect of taxation and

utilised £487m for investing activities (including capital expenditure of £686m, and cash receipts of £279m in relation to the sub-lease of

certain US communications towers), excluding payments made to increase percentage holdings in associated undertakings on behalf of the

Group following the merger.