Vodafone 2000 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 3

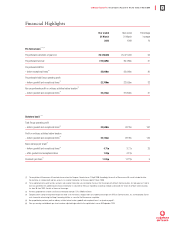

Financial Highlights

(1) The acquisition of Mannesmann AG received clearance from the European Commission on 12 April 2000. Accordingly, the results of Mannesmann AG are not included in either

the pro forma or statutory profit and loss accounts, or customer information, for the year ended 31 March 2000.

(2) The unaudited pro forma profit and loss accounts and customer information are calculated on the basis that the merger with AirTouch Communications, Inc. took place on 1 April in

each year presented. The audited statutory financial information is calculated on the basis required by accounting standards and includes the results of AirTouch Communications,

Inc. from 30 June 1999, the date of closure of the merger.

(3) Pro forma proportionate customer and financial information excludes E-Plus Mobilfunk GmbH.

(4) Exceptional items comprise the profit on disposal of fixed asset investments, reorganisation costs following the merger with AirTouch Communications, Inc. and exceptional finance

costs incurred in restructuring the Group’s borrowing facilities as a result of the Mannesmann acquisition.

(5) Non-proportionate pro forma profit on ordinary activities before taxation, goodwill and exceptional items is analysed on page 61.

(6) Prior year earnings and dividends per share have been adjusted to give effect to the capitalisation issue on 30 September 1999.

Statutory basis(1)(2)

Total Group operating profit

– before goodwill and exceptional items(4) £2,538m £972m 161

Profit on ordinary activities before taxation

– before goodwill and exceptional items(4) £2,154m £878m 145

Basic earnings per share(6)

– before goodwill and exceptional items(4) 4.71p 3.77p 25

– after goodwill and exceptional items 1.80p 4.12p

Dividends per share(6) 1.335p 1.272p 5

Year ended Year ended Percentage

31 March 31 March increase

2000 1999 %

Pro forma basis(1)(2)(3)

Proportionate customers at year end 39,139,000 25,421,000 54

Proportionate turnover £12,569m £9,185m 37

Proportionate EBITDA

– before exceptional items(4) £3,948m £3,046m 30

Proportionate total Group operating profit

– before goodwill and exceptional items(4) £2,708m £2,055m 32

Non-proportionate profit on ordinary activities before taxation(5)

– before goodwill and exceptional items(4) £2,474m £1,800m 37