Vodafone 2000 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

20

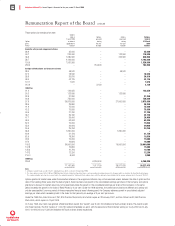

Remuneration Report of the Board

Composition of the Remuneration Committee

The Remuneration Committee of the Board consists only of non-executive directors of the Company and after the completion of the merger with

AirTouch Communications, Inc. comprised Michael Boskin, Don Fisher, Sam Ginn and Sir David Scholey, with Ian MacLaurin as Chairman. Upon the

retirement of Sam Ginn in May 2000 and Ian MacLaurin’s election as Chairman of the Company, Sir David Scholey became Chairman of the Committee.

When appropriate, the Committee invites the views of the Chief Executive and the Group Director of Human Resources and commissions reports from

expert remuneration consultants. The results of market surveys and other analyses from external sources are also made available to the Committee,

which has resolved to review its policy with the Board on a regular basis to ensure it continues to meet the Company’s requirements and to comply

with best practice.

Remuneration policy

The Company requires to employ people of a calibre consistent with those at the leading edge of the telecommunications industry. The executive talent

needed to maximise returns for shareholders in the international business of telecommunications is very scarce and the future performance of the

Company will depend upon its ability to incentivise its employees and to offer remuneration packages which are competitive in value terms when

measured against the best in the industry.

In determining the Company’s broad policy for executive remuneration, and in particular the remuneration package for each of the executive directors,

the Committee aims to provide remuneration which is competitive and appropriate and which ensures the right rewards are given to motivate, incentivise

and retain the senior executives of the Group.

As a result of the merger with AirTouch and the acquisition of Mannesmann, the Company has the highest capitalisation on the London Stock Exchange

and is one of the ten largest companies by capitalisation in the world. It has operations in 25 countries on five continents and, in recognition of the scale

and scope of the business and the responsibilities falling on its senior executives, the Remuneration Committee has undertaken a review of executive

remuneration and has decided to construct packages reflective of the global market in which the Company operates in order to ensure that it can attract

and retain the world class executive talent necessary to continue to deliver the levels of shareholder value which have been achieved in recent years.

Key principles of the Committee’s decision are that for executives with global responsibilities, remuneration levels and practices will be referenced to a

global peer group, that a high and increasing proportion of total remuneration will be contingent upon the achievement of high and demanding levels of

corporate performance and that executives comply with minimum share ownership criteria. The Committee intends that, in future, base salary and short

term incentive plans (at the 100% of base salary target level) will represent approximately 25% of total target remuneration. The remaining 75% of target

pay will be delivered by share option based incentive plans which will incorporate very stretching performance targets. All options under this policy will be

granted at market value and award levels for options will be determined using the Black Scholes formula, an internationally accepted methodology for

valuing share options. Amendments to the Company’s incentive plans to permit the adoption of the Committee’s policy are being proposed at the

Company’s Annual General Meeting.

Salaries and benefits

The remuneration package of the UK based executive directors is made up of a number of elements. Each is paid an annual salary, on which pension

benefits are calculated, and is provided with a car and other benefits. The executive directors participate in the Company’s executive share option

schemes and are entitled to participate in its all-employee share schemes, the Sharesave scheme and the Profit Sharing Scheme, further details of which

are provided on page 23.

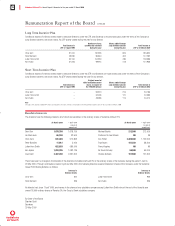

In 1998, following approval by shareholders at the Annual General Meeting, two new incentive schemes, a Short Term Incentive Plan (“STIP”) and a

Long Term Incentive Plan (“LTIP”), were introduced. Under the terms of the STIP participants may, subject to the achievement of performance criteria for

the year as set by the Remuneration Committee (for the year to 31 March 2000 the target was the achievement of Group budgeted adjusted earnings

per share, before goodwill amortisation and exceptional items), receive a provisional award of ordinary shares in Vodafone AirTouch Plc. The provisional

award of shares is in two parts: an original award of “Initial Shares” worth up to 25% of salary and an additional award of “Enhancement Shares”, worth

50% of the value of the original award. The Initial Shares will normally be released, subject to the participant remaining with the Group, two years after

the provisional allocation is made. The Enhancement Shares may also be released at this time, although this is conditional upon the achievement of

additional performance criteria. In relation to awards for the year ended 31 March 2000, the condition is that the growth in adjusted basic earnings

per share must exceed the growth in the UK retail price index by an average of 3 per cent per year for the two financial years ending 31 March 2002.

If an executive chooses not to accept the provisional award of shares, the Company may pay, at its discretion, a cash bonus of up to 25% of salary.

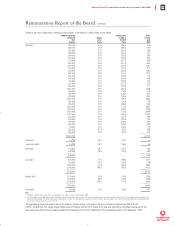

For the LTIP, the independent trustee of the Vodafone Group Employee Trust, a discretionary trust, purchases ordinary shares in Vodafone AirTouch Plc

in the market. Shares are then awarded conditionally to eligible executive directors and senior executives at the beginning of a three year period, the

ultimate vesting of the award being conditional upon the achievement of performance criteria set by the Remuneration Committee for that three year

period. If the performance criteria are met, the shares will be transferred from the Trust to the executive directors and senior executives at nil

consideration. Details of the benefits provided to the executive directors under the STIP and the LTIP are in the tables on page 26.