Vodafone 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

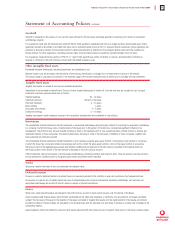

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 27

Company law requires the directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the

Company and the Group as at the end of the financial year and of the profit of the Group for that period. In preparing those financial statements, the

directors are required to:

• select suitable accounting policies and apply them consistently;

• make judgements and estimates that are reasonable and prudent;

• state whether applicable accounting standards have been followed; and

• prepare the financial statements on a going concern basis unless it is inappropriate to presume that the Company and the Group will continue

in business.

The directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the financial position of the

Company and the Group and to enable them to ensure that the financial statements comply with the Companies Act 1985. They are also responsible for

the systems of internal financial controls and for safeguarding the assets of the Company and the Group and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

Statement of Directors’ Responsibilities

Report of the Auditors

Auditors’ report to the members of Vodafone AirTouch Plc

We have audited the financial statements on pages 28 to 57, which have been prepared under the accounting policies set out on pages 32 and 33, and

the detailed information disclosed in respect of directors’ remuneration and share options set out in the Remuneration Report of the Board on pages 20

to 26. We have also audited the financial information prepared in accordance with accounting principles generally accepted in the United States set out

on pages 58 and 59.

We have reviewed the pro forma financial information on pages 60 to 62 which has been prepared in accordance with the bases set out on pages 60

and 62.

Respective responsibilities of directors and auditors

The directors are responsible for preparing the Annual Report & Accounts, including as described above preparation of the financial statements, which

are required to be prepared in accordance with applicable United Kingdom law and accounting standards. The directors are also responsible for the

preparation of the financial information prepared in accordance with accounting principles generally accepted in the United States and the pro forma

financial information prepared in accordance with the bases referred to above. Our responsibilities, as independent auditors, are established by statute,

the Auditing Practices Board, the UK Listing Authority, and by our profession’s ethical guidance.

We report to you our opinion as to whether the financial statements give a true and fair view and are properly prepared in accordance with the

Companies Act 1985. We also report to you if, in our opinion, the directors’ report is not consistent with the financial statements, if the Company has not

kept proper accounting records, if we have not received all the information and explanations we require for our audit, or if information specified by law or

the Listing Rules regarding directors’ remuneration and transactions with the Company and other members of the Group is not disclosed.

We review whether the Corporate Governance statement on pages 18 and 19 reflects the Company’s compliance with the seven provisions of the

Combined Code specified for our review by the UK Listing Authority, and we report if it does not. We are not required to consider whether the Board’s

statements on internal control cover all risks and controls, or form an opinion on the effectiveness of the Group’s Corporate Governance procedures or its

risk and control procedures.

We read the other information contained in the Annual Report & Accounts, including the directors’ report on Corporate Governance, and consider whether

it is consistent with the audited financial statements. We consider the implications for our report if we become aware of any apparent misstatements or

material inconsistencies with the financial statements.

Bases of opinions

We conducted our audit in accordance with United Kingdom auditing standards issued by the Auditing Practices Board which are similar to auditing

standards in the United States. An audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial

statements. It also includes an assessment of the significant estimates and judgements made by the directors in the preparation of the financial

statements, and of whether the accounting policies are appropriate to the circumstances of the Company and the Group, consistently applied and

adequately disclosed.

We planned and performed our audit so as to obtain all the information and explanations which we considered necessary in order to provide us with

sufficient evidence to give reasonable assurance that the financial statements are free from material misstatement, whether caused by fraud or other

irregularity or error. In forming our opinion we also evaluated the overall adequacy of the presentation of information in the financial statements.

Our review of the pro forma financial information, which was substantially less in scope than an audit performed in accordance with Auditing Standards,

consisted primarily of considering the nature of the adjustments made and discussing the resulting pro forma financial information with management.

Opinions

In our opinion:

• the financial statements give a true and fair view of the state of affairs of the Company and the Group as at 31 March 2000 and of the profit of the

Group for the year then ended and have been properly prepared in accordance with the Companies Act 1985;

• the financial information set out on page 58 has been properly prepared in accordance with accounting principles generally accepted in the United

States; and

• the pro forma financial information has been properly prepared in accordance with the bases set out on pages 60 and 62, which are consistent with

the accounting policies of the Group.

Deloitte & Touche

Chartered Accountants and Registered Auditors

Hill House

1 Little New Street

London EC4A 3TR

29 May 2000