Vodafone 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

38

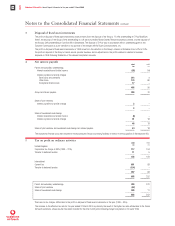

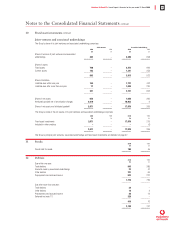

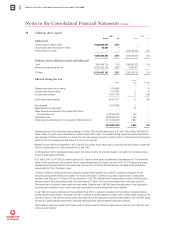

9 Tangible fixed assets Land Network

and Plant and Fixtures and infra-

buildings machinery fittings structure Total

£m £m £m £m £m

Cost

1 April 1999 94 455 132 2,516 3,197

Exchange movements (50) (24) (5) (123) (202)

Acquisitions (note 21) 222 33 53 2,624 2,932

Reclassifications from associated undertakings – – – 85 85

Additions 34 342 76 1,610 2,062

Disposals (7) (14) (4) (32) (57)

Reclassifications 2 (30) (8) 36 –

–––––––– –––––––– –––––––– –––––––– ––––––––

31 March 2000 295 762 244 6,716 8,017

–––––––– –––––––– –––––––– –––––––– ––––––––

Accumulated depreciation

1 April 1999 26 207 50 764 1,047

Exchange movements (5) (9) (1) (24) (39)

Charge for the year 17 116 22 591 746

Disposals (1) (12) (2) (29) (44)

Reclassifications (2) (11) (4) 17 –

–––––––– –––––––– –––––––– –––––––– ––––––––

31 March 2000 35 291 65 1,319 1,710

–––––––– –––––––– –––––––– –––––––– ––––––––

Net book value

31 March 2000 260 471 179 5,397 6,307

–––––––– –––––––– –––––––– –––––––– ––––––––

31 March 1999 68 248 82 1,752 2,150

–––––––– –––––––– –––––––– –––––––– ––––––––

The net book value of land and buildings comprises freeholds of £195m (1999 – £16m), long leaseholds of £10m (1999 – £5m) and short

leaseholds of £55m (1999 – £47m).

Network infrastructure at 31 March 2000 comprises: Short term

Freehold leasehold Plant and

premises premises machinery Total

£m £m £m £m

Cost 41 519 6,156 6,716

Accumulated depreciation 5 114 1,200 1,319

–––––––– –––––––– –––––––– ––––––––

Net book value 36 405 4,956 5,397

–––––––– –––––––– –––––––– ––––––––

31 March 1999

Net book value 10 167 1,575 1,752

–––––––– –––––––– –––––––– ––––––––

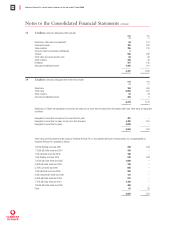

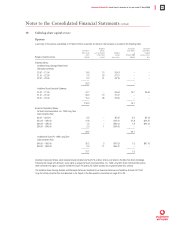

10 Fixed asset investments Joint Associated Other

ventures undertakings investments Total

£m £m £m £m

1 April 1999 – 275 97 372

Exchange movements (35) (740) (13) (788)

Additions and loan advances 768 640 101,652 103,060

Goodwill 2,101 18,524 – 20,625

Disposals and loan repayments (67) (7) (48) (122)

Share of retained results, excluding goodwill amortisation (44) 358 – 314

Goodwill amortisation (52) (986) – (1,038)

Reclassifications to subsidiary undertakings – (85) – (85)

–––––––– –––––––– –––––––– ––––––––

31 March 2000 2,671 17,979 101,688 122,338

–––––––– –––––––– –––––––– ––––––––

The Group’s share of its joint ventures’ and associated undertakings’ post acquisition accumulated (losses)/profits at 31 March 2000 amounted

to £(44)m (1999 – £Nil) and £402m (1999 – £136m) respectively. There were no loans outstanding with joint ventures during the year. Loans to

associated undertakings at 31 March 2000 were £33m (1999 – £Nil). The maximum aggregate loans to associated undertakings and former

associated undertakings during the year which are not included within the period end balance were £13m (1999 – £3m).

Included in additions and loan advances within “Other investments” is an amount of £101,246m in respect of the acquisition of Mannesmann AG.

This represents the fair value of the consideration for the acquisition of approximately 98.62% of the issued share capital of Mannesmann AG and

99.72% of its convertible bond, together with related costs incurred. European Commission approval of the acquisition was received on 12 April

2000. Accordingly, the Group’s consolidated financial statements do not include Mannesmann AG as a consolidated subsidiary. The results and

net assets of Mannesmann AG will be consolidated in the Group’s financial statements for the year ending 31 March 2001.

The Group’s joint ventures, associated undertakings and fixed asset investments are detailed on page 57.

Fixed asset investments include 12,532,364 ordinary shares in Vodafone AirTouch Plc, held by a Qualifying Employee Share Ownership Trust

(‘QUEST’). These shares had a Nil cost to the Group. Further detail is provided within note 18 to the accounts.

Fixed asset investments also include 2,673,833 ordinary shares in Vodafone AirTouch Plc, held by the Vodafone Group Employee Trust to satisfy

the potential award of shares under the Group’s Long Term Incentive Plan and Short Term Incentive Plan. The cost to the Group of these shares

was £5m and their market value at 31 March 2000 was £9m.

Notes to the Consolidated Financial Statements continued