Vodafone 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

14

Dividends

The proposed final dividend of 0.680p per ordinary share produces a

total for the year of 1.335p, an increase of 5% over last year. Dividend

cover, before goodwill amortisation, increased to 3.5 times compared

with 3.3 times for the year ended 31 March 1999.

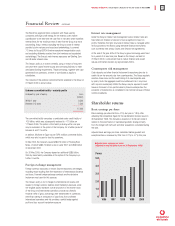

Share price

The share price has shown healthy growth since the Company floated

in 1988 at an issue price of 170p, which is now equivalent to 11.33p

following the capitalisation issues in July 1994 and September 1999.

Annual compound growth in the share price over the five year period to

31 March 2000 was 54%.

This increase in the share price, which continued through the year

ended 31 March 2000, reflected the general rise in equity prices,

the market’s rating of the mobile telecommunications sector and

confidence in the Group’s prospects.

Year 2000

The Company, through its comprehensive Millennium Programme,

continues to give high priority to the potential impact of all year

2000 date related issues. At the date of this report, the principal

transition dates, including 31 December 1999, 1 January 2000 and

29 February 2000, have passed without revealing any serious problems

in the Group’s systems and the directors are not aware of any

significant factors relating to any year 2000 date related issue which

have arisen, or that may arise, and which will significantly affect the

activities of the business. Nevertheless, the situation is still being

monitored.

The Group incurred costs in relation to Year 2000 compliance of

approximately £22m in the financial year, and £18m in previous

financial years, although many costs are not separately identifiable as

Millennium modifications are often embodied in software purchased

and developed in the normal course of business.

Introduction of the single

European currency

The Group has interests in eight of the eleven countries where the Euro

was introduced on 1 January 1999 for business-to-business use.

Following a three year transition period, the Euro will be adopted in

those countries for all purposes. Working groups have been established

by local management in these ‘first wave’ markets to assess the impact

on business operations of trading in the Euro and to manage the

implementation of appropriate change programmes.

The Executive Committee of the Vodafone Group has set up a steering

group to assess the impact of the single currency on the Group and to

monitor progress in the adoption of Euro-compliant business systems.

Current status, together with strategic and operational issues arising,

are tracked regularly on a country-by-country basis and reports made

to the Executive Committee.

Progress in all markets to date is on target, with no significant issues

outstanding. In EU markets not yet committed to the introduction

of the Euro, preliminary assessments have been carried out.

The financial cost of preparation for the adoption of the Euro is

not material to the Group.

Basis of preparation of the

financial statements

During the year the following Financial Reporting Standards (“FRS”)

issued by the Accounting Standards Board became effective and have

been adopted in these financial statements:

FRS 15 – Tangible Fixed Assets; and

FRS 16 – Current Tax.

Implementation of these new Standards has not resulted in any

changes to prior year comparatives.

The Group’s accounting policies are conservative and appropriate to

the business.

Going concern

After reviewing the Group’s and Company’s budget for the next financial

year, and other longer term plans, the directors are satisfied that, at the

time of approving the financial statements, it is appropriate to adopt the

going concern basis in preparing the financial statements.

Financial Review continued

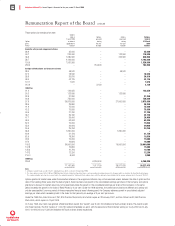

0

50

100

150

200

250

300

350

1996 1997 1998 1999 2000

Share price at 31 March

(adjusted for capitalisation issue on 30 September 1999)

Pence