Vodafone 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

46

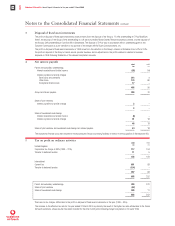

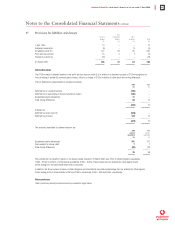

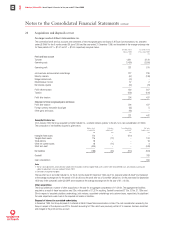

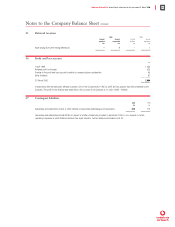

19 Reserves

Share Profit

premium Merger Other and loss

account reserve reserve account

£m £m £m £m

1 April 1999 96 – – 564

Shares issued in respect of the merger with

AirTouch Communications, Inc. 38,274 – – –

Redenomination of share capital (41) – – –

Capitalisation issue (1,508) – – –

Shares issued in respect of the acquisition of

Mannesmann AG 2,431 96,914 – –

Other allotments of shares 306 – – –

Loss for the financial year – – – (133)

Goodwill transferred to the profit and loss

account in respect of business disposals – – – 18

Currency translation – – – (1,130)

Transfer in respect of issue of shares

to employee trusts (note 18) 20 – – (20)

Unvested option consideration – – 1,165 –

Transfer to profit and loss account – – (45) 45

Scrip dividends (1) – – 81

–––––––– –––––––– –––––––– ––––––––

31 March 2000 39,577 96,914 1,120 (575)

–––––––– –––––––– –––––––– ––––––––

The currency translation movement includes a gain of £316m (1999 – loss of £19m) in respect of foreign currency net borrowings.

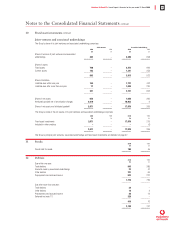

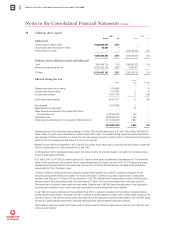

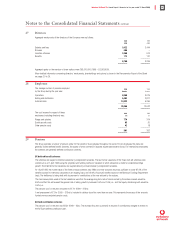

20 Non-equity minority interests

Non-equity minority interests of £1,004m comprise £1,000m of Class D & E Preferred Shares issued by AirTouch Communications, Inc.

and £4m non-cumulative redeemable preference shares issued by Vodafone Pacific Pty Limited, formerly Vodafone Holdings Australia Pty

Limited (1999 – £4m non-cumulative redeemable preference shares issued by Vodafone Pacific Pty Limited).

The aggregate redemption value of the Class D & E Preferred Shares, on which annual dividends of $51.43 per share are payable quarterly

in arrears, is $1.65 billion. The holders of the Preferred Shares are not entitled to vote unless their dividends are in arrears and unpaid for six

quarterly dividend periods, in which case holders can vote for the election of two directors. The maturity date of the 825,000 AirTouch Class

D Preferred Shares is 6 April 2020, although they may be redeemed at the option of the company, in whole or in part, after 7 April 2018.

The 825,000 AirTouch Class E Preferred Shares have a maturity date of 7 April 2018 with no early redemption. The Preferred Shares have

a redemption price of $1,000 per share plus all accrued and unpaid dividends.

The holders of the shares issued by Vodafone Pacific Pty Limited have the right to vote and receive such dividend as the directors declare,

subject to a pre-defined limit on the amount of that dividend. These shares are redeemable by either the company or the holder of the share

under certain circumstances and are generally not entitled to any participation in the profits or assets of the company other than as prescribed.

These securities rank in priority to all other classes of share issued by the company as regards return of capital.

Notes to the Consolidated Financial Statements continued