Vodafone 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 41

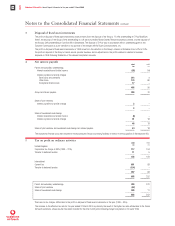

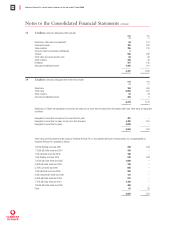

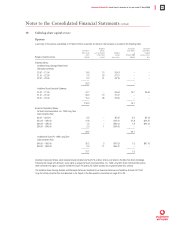

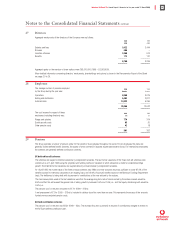

15 Financial liabilities 2000 1999

£m £m

Net debt

Liquid investments (30) –

Cash at bank and in hand (159) (6)

Debt due in one year or less, or on demand 794 377

Debt due after one year 6,038 1,137

–––––––– ––––––––

6,643 1,508

–––––––– ––––––––

Maturity of financial liabilities

The maturity profile of the Group’s borrowings at 31 March was as follows:

In one year or less, or on demand 794 377

In more than one year but not more than two years 481 –

In more than two years but not more than five years 1,681 1,137

In more than five years 3,876 –

–––––––– ––––––––

6,832 1,514

–––––––– ––––––––

The maturities of the Group’s other financial liabilities at 31 March was as follows:

In more than one year but not more than two years 33 5

In more than two years but not more than five years 337

–––––––– ––––––––

36 42

–––––––– ––––––––

Borrowing facilities

The Group had the following undrawn committed borrowing facilities available to it on 31 March:

Expiring in one year or less 5,689 50

Expiring in more than one year but not more than two years –495

Expiring in more than two years 4,562 418

–––––––– ––––––––

10,251 963

–––––––– ––––––––

In addition to the above, a subsidiary undertaking has a £439m committed facility which may only be used to fund its operations. This facility

expires in more than five years.

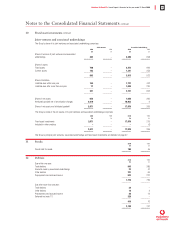

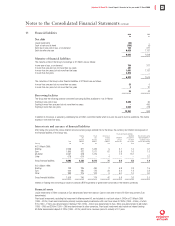

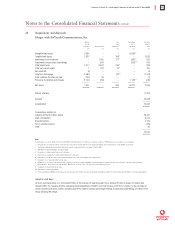

Interest rate and currency of financial liabilities

After taking into account the various interest rate and currency swaps entered into by the Group, the currency and interest rate exposure of

the financial liabilities of the Group was: Fixed rate financial liabilities

Floating Fixed Non-interest Weighted Non-interest bearing

rate rate bearing Weighted average time financial liabilities –

financial financial financial average for which weighted average

Total liabilities liabilities liabilities interest rate rate is fixed period until maturity

Currency £m £m £m £m % Years Years

At 31 March 2000:

Sterling 2,298 871 1,422 5 6.7 1.6 0.7

Euro 1,895 322 1,511 62 3.8 1.6 1.3

US Dollar 2,057 578 1,479 – 7.3 13.1 –

Other 618 614 – 4 – – 3.2

–––––––– –––––––– –––––––– –––––––– –––––––– –––––––– ––––––––

Gross financial liabilities 6,868 2,385 4,412 71 5.9 5.5 1.4

–––––––– –––––––– –––––––– –––––––– –––––––– –––––––– ––––––––

At 31 March 1999:

Sterling 733 235 496 2 6.8 3.3 1.5

Euro 440 230 176 34 3.4 1.3 2.3

Other 383 275 102 6 5.0 1.0 3.0

–––––––– –––––––– –––––––– –––––––– –––––––– –––––––– ––––––––

Gross financial liabilities 1,556 740 774 42 5.8 2.6 2.5

–––––––– –––––––– –––––––– –––––––– –––––––– –––––––– ––––––––

Interest on floating rate borrowings is based on national LIBOR equivalents or government bond rates in the relevant currencies.

Financial assets

Liquid investments of £30m comprises a Euro denominated short term deposit. Cash at bank and in hand of £159m was primarily Euro

denominated.

Fixed asset investments, excluding the investment in Mannesmann AG, are included at a net book value of £442m at 31 March 2000

(1999 – £97m). Fixed asset investments primarily comprise equity investments with a net book value of £392m (1999 – £60m), of which

£7m (1999 – £16m) was denominated in Sterling, £79m (1999 – £44m) was denominated in Euro, £66m was denominated in US Dollars

(1999 – £Nil) and £240m (1999 – £Nil) was denominated in other currencies. Fixed asset investments also include an interest bearing

US Dollar denominated deposit of £32m (1999 – £37m) which had a maximum period to maturity of 3.7 years.

Notes to the Consolidated Financial Statements continued