Vodafone 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 33

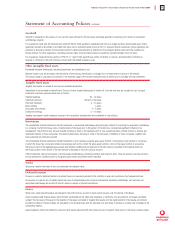

Statement of Accounting Policies continued

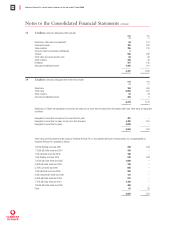

Goodwill

Goodwill is calculated as the surplus of cost over fair value attributed to the net assets (excluding goodwill) of subsidiary, joint venture or associated

undertakings acquired.

For acquisitions made after the financial year ended 31 March 1998, goodwill is capitalised and held as a foreign currency denominated asset, where

applicable. Goodwill is amortised on a straight line basis over its estimated useful economic life. For acquired network businesses, whose operations are

governed by fixed term licences, the amortisation period is determined primarily by reference to the unexpired licence period and the conditions for

licence renewal. For other acquisitions, including customer bases, the amortisation period for goodwill is typically between 5 and 10 years.

For acquisitions made before the adoption of FRS 10 on 1 April 1998, goodwill was written off directly to reserves. Goodwill written off directly to

reserves is reinstated in the profit and loss account when the related business is sold.

Other intangible fixed assets

Purchased intangible fixed assets, including licence fees, are capitalised at cost.

Network licence costs are amortised over the periods of the licences. Amortisation is charged from commencement of service of the network.

The annual charge is calculated in proportion to the expected usage of the network during the start up period and on a straight line basis thereafter.

Tangible fixed assets

Tangible fixed assets are stated at cost less accumulated depreciation.

Depreciation is not provided on freehold land. The cost of other tangible fixed assets is written off, from the time they are brought into use, by equal

instalments over their expected useful lives as follows:

Freehold buildings 25 – 50 years

Leasehold premises the term of the lease

Plant and machinery 5 – 10 years

Motor vehicles 4 years

Computers and software 3 – 5 years

Furniture and fittings 5 – 10 years

Tangible fixed assets include overheads incurred in the acquisition, establishment and installation of base stations.

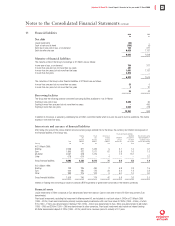

Investments

The consolidated financial statements include investments in associated undertakings using the equity method of accounting. An associated undertaking

is a company in which the Group owns a material share of the equity and, in the opinion of the directors, can exercise significant influence in its

management. The profit and loss account includes the Group’s share of the operating profit or loss, exceptional items, interest income or expense and

attributable taxation of those companies. The balance sheet shows the Group’s share of the net assets or liabilities of those companies, together with

loans advanced and attributed goodwill.

The consolidated financial statements include investments in joint ventures using the gross equity method of accounting. A joint venture is a company

in which the Group has a long term interest and exercises joint control. Under the gross equity method, a form of the equity method of accounting,

the Group’s share of the aggregate gross assets and liabilities underlying the investment in the joint venture is included in the balance sheet and

the Group’s share of the turnover of the joint venture is disclosed in the profit and loss account.

Other investments, held as fixed assets, comprise equity shareholdings, partnership interests and long term loans. They are stated at cost less provision

for any impairment. Dividend income is recognised upon receipt and interest when receivable.

Stocks

Stocks are valued at the lower of cost and estimated net realisable value.

Deferred taxation

Provision is made for deferred taxation only where there is a reasonable probability that a liability or asset will crystallise in the foreseeable future.

No provision is made for any tax liability which may arise if undistributed profits of certain international subsidiary undertakings, joint ventures and

associated undertakings are remitted to the UK, except in respect of planned remittances.

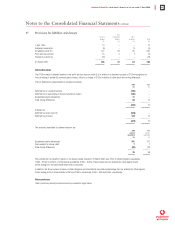

Leases

Rental costs under operating leases are charged to the profit and loss account in equal annual amounts over the periods of the leases.

Assets acquired under finance leases, which transfer substantially all the rights and obligations of ownership, are accounted for as though purchased

outright. The fair value of the asset at the inception of the lease is included in tangible fixed assets and the capital element of the leasing commitment

included in creditors. Finance charges are calculated on an actuarial basis and are allocated over each lease to produce a constant rate of charge on the

outstanding balance.

Lease obligations which are satisfied by cash and other assets deposited with third parties are set-off against those assets in the Group’s balance sheet.