Vodafone 2000 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

52

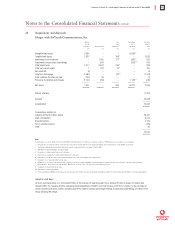

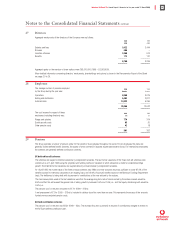

30 Subsequent events

On 3 April 2000, a new US joint venture wireless business with a national footprint, Verizon Wireless, was created by the combination of

Vodafone AirTouch’s and Bell Atlantic’s US cellular, PCS and paging assets. Following the anticipated completion of the merger between

Bell Atlantic Corp. and GTE Corp., the Group will have a 45% shareholding in the new venture.

On 12 April 2000, the acquisition of Mannesmann AG received clearance from the European Commission. The acquisition has resulted in

increased shareholdings in certain mobile operations. In addition, Mannesmann’s interests also include fixed line businesses in Germany, Italy,

France and Austria as well as non-telecommunications businesses, primarily Atecs Mannesmann, its engineering and automotive business.

On 17 April 2000, the Company announced that Mannesmann AG had reached an agreement with Siemens AG and Robert Bosch AG on

the disposal of a 50% plus two shares stake in Atecs Mannesmann, with an option arrangement over Mannesmann AG’s remaining stake.

The transaction values Atecs Mannesmann at approximately 9.6 billion, consisting of a payment of 3.1 billion to be paid on completion

of the sale of the stake of 50% plus two shares, but in any event not later than 30 September 2000, 3.7 billion to 3.8 billion to be paid

upon the exercise of certain options between closing and 31 December 2003, and 2.8 billion of pension and non-trading financial liabilities

to be assumed by Siemens AG and Robert Bosch AG. The proceeds from the sale will be used to reduce Group net debt.

On 27 April 2000, the UK business was successful in acquiring the largest 3G licence available to an existing operator, at a cost of

£5.964 billion.

On 17 May 2000, the Company and VivendiNet (a joint venture between Vivendi and Canal+) announced that an agreement had been signed

for the creation of a new joint venture company, VIZZAVI, to establish a multi-access Internet portal for Europe. The Company and VivendiNet

will both have a 50% shareholding in the new company.

At the end of May, the Company and Mannesmann AG reached agreement for the sale of Orange plc to France Telecom for an enterprise

value of £31 billion, subject to approval by France Telecom’s shareholders and the regulatory authorities. Orange plc will retain its current

debt and commitment to fund its UK 3G licence, giving an equity value of approximately £25 billion. The consideration will comprise

£13.8 billion in cash, payable on completion, approximately £1.3 billion through a loan note redeemable by March 2001, and the balance

in France Telecom paper. France Telecom has underwritten the non-cash consideration to a value of £8.4 billion. Until the transaction is

completed, plans continue to effect a demerger of Orange plc in accordance with an undertaking given to the European Commission.

Notes to the Consolidated Financial Statements continued