Vodafone 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone AirTouch Plc

Annual Report & Accounts

For the year ended 31 March 2000

Picture of

Jeffrey Dietel

to be supplied

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000

Table of contents

-

Page 1

Vodafone AirTouch Plc Annual Report & Accounts For the year ended 31 March 2000 Picture of Jeffrey Dietel to be supplied -

Page 2

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 our vision -

Page 3

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 1 Our vision is to be the world's leading wireless telecommunications and information provider, bringing more services and more value to more customers than any other. -

Page 4

...Statement 2000 comprise the full Annual Report and Accounts of Vodafone AirTouch Plc for the year ended 31 March 2000, prepared in accordance with the Companies Act 1985. Statements in this document relating to future status or circumstances, including statements regarding future performance, costs... -

Page 5

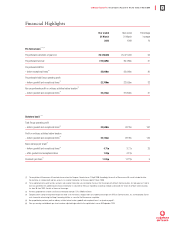

... Dividends per share (6) (4) 4.71p 1.80p 1.335p 3.77p 4.12p 1.272p 25 5 (1) (2) The acquisition of Mannesmann AG received clearance from the European Commission on 12 April 2000. Accordingly, the results of Mannesmann AG are not included in either the pro forma or statutory profit and loss... -

Page 6

... the Mannesmann acquisition. • In May 2000, creation of new multi-access Internet portal company for Europe, operating under the VIZZAVI global brand name. Europolitan Libertel Panafon Telecel Listed in Market capitalisation 31 March 2000 Following the AirTouch merger on 30 June 1999, the Group... -

Page 7

...value added services, with 141 million messages being sent in March 2000 using the Short Message Service (SMS). • Successful launch of wireless portal in December 1999. • Largest available UK 3G licence acquired in April 2000. The year saw continued rapid expansion in the UK mobile phone market... -

Page 8

...AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Business Review continued Vodafone Retail has shown continued success and grew to 272 shops, with average connections per shop up by 57%. Vodafone Corporate increased its market share in the overall corporate market. An option... -

Page 9

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 7 Business Review continued services in the US market. During the year, the total number of retail outlets increased by 222 stores to 316 at 31 March 2000. Customers connected through wholly owned retail operations ... -

Page 10

... is building an employment and human rights code that will apply to all of the Group's subsidiaries. Similarly, the Group's health and safety practice has been designed to provide the best working conditions for all its employees throughout the world. New Group headquarters building Environmental... -

Page 11

... through partnership with suppliers, by re-using waste, wherever possible, and by recycling waste, wherever practical. A good illustration of this policy in action is Vodafone UK's participation in the Take Back scheme for mobile telephones, a joint industry initiative. Launched in May 1999, its... -

Page 12

...June 1999, the date the merger completed. The consolidated profit and loss account does not include any adjustments arising from the creation, on 3 April 2000, of Verizon Wireless under a joint venture arrangement with Bell Atlantic, or the acquisition of Mannesmann AG, for which European Commission... -

Page 13

... for growth of mobile telecommunications markets, the Group's market share, revenue per customer, the costs of providing and selling existing services, and start up costs of new businesses and products including those dependent on the build and roll-out of 3G networks. The global market for mobile... -

Page 14

... below. Net cash outflow - investments AirTouch Communications, Inc. CommNet Cellular Inc. J-Phone Group Omnitel Other £m 3,534 459 342 112 354 --------- 4,801 --------- Future investment The Group intends to acquire spectrum to operate 3G services. In April 2000, the largest UK licence available... -

Page 15

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 13 Financial Review continued The Board has approved ratios consistent with those used by companies with high credit ratings for net interest cover, market capitalisation to net debt and net cash flow to net debt, ... -

Page 16

...Share price at 31 March (adjusted for capitalisation issue on 30 September 1999) Pence 350 300 250 200 150 100 50 0 1996 1997 1998 1999 2000 Basis of preparation of the financial statements During the year the following Financial Reporting Standards ("FRS") issued by the Accounting Standards Board... -

Page 17

...27 July 2000. Results and dividends The consolidated proï¬t and loss account is set out on page 28 of the ï¬nancial statements. The directors have proposed a ï¬nal dividend for the year of 0.680p per ordinary share, payable on 11 August 2000 to shareholders on the register of members at close of... -

Page 18

...The Board places a high priority on employee communications and this is achieved through an increasing number of different channels including management presentations, team brieï¬ng, e-mail and conferences. The Company has, during the year, established an International Employee Communications Forum... -

Page 19

..., as part of its review of the adequacy and objectivity of the audit process. Substantial shareholdings The directors are not aware of any holding in the ordinary share capital of Vodafone AirTouch Plc which, at 29 May 2000, exceeded 3% except that Hutchison Whampoa Limited had a holding of 3.47%. -

Page 20

... are set out brieï¬,y on page 28 of the Annual Review. The merger with AirTouch Communications, Inc. in June 1999, the acquisition of Mannesmann AG in April 2000 and the creation of the Company's joint venture with Bell Atlantic Corp., which was completed in April 2000, have resulted in a year of... -

Page 21

... proposed at the 1999 Annual General Meeting and the proxy voting at the Company's Extraordinary General Meetings held on 24 May 1999 and 24 January 2000 were disclosed to those in attendance at the meetings and the Company will follow this policy at future general meetings. Financial and other... -

Page 22

... for valuing share options. Amendments to the Company's incentive plans to permit the adoption of the Committee's policy are being proposed at the Company's Annual General Meeting. Salaries and beneï¬ts The remuneration package of the UK based executive directors is made up of a number of... -

Page 23

...director on 15 May 2000, is an employee of Mannesmann AG and has a remuneration package comprising salary, annual cash bonus, pension, a car and other beneï¬ts normally provided to executives of his status in Germany. He will also participate in the Company's executive share option scheme. Bonuses... -

Page 24

22 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Remuneration Report of the Board Remuneration for the year to 31 March 2000 Salary/fees 2000 1999 £000 £000 2000 £000 Bonus 1999 £000 continued Incentive schemes 2000 1999 £000 £000 (6) Beneï¬ts 2000 1999... -

Page 25

... Vodafone AirTouch Plc 1999 Long Term Stock Incentive Plan ('1999 Plan'). No other directors have options under any of these schemes. Only under the sharesave scheme may shares be offered at a discount in future grants of options. Options held at 1 April 1999 or date of appointment Number Weighted... -

Page 26

24 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Remuneration Report of the Board These options by exercise price were: Options held at 1 April 1999 or date of appointment Number continued Option price Pence Executive scheme and unapproved scheme Options ... -

Page 27

... at the average exchange rate for the year of $1.61:£1. The aggregate gross pre-tax gains made on the exercise of share options in the year by the above Company's directors was £93,910,000 (1999 - £6,963,000). The closing middle market price of Vodafone AirTouch Plc's shares at the year... -

Page 28

... made in April and May 2000, the following directors acquired interests in shares of the Company under the Vodafone Group Proï¬t Sharing Scheme, as follows: Interests in Ordinary Shares Interests in Ordinary Shares Chris Gent Peter Bamford 844 936 Julian Horn-Smith Ken Hydon 936 936 No... -

Page 29

... AirTouch Plc We have audited the ï¬nancial statements on pages 28 to 57, which have been prepared under the accounting policies set out on pages 32 and 33, and the detailed information disclosed in respect of directors' remuneration and share options set out in the Remuneration Report of the Board... -

Page 30

28 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Consolidated Proï¬t and Loss Account for the year ended 31 March 2000 Note 2000 £m 1999 £m Turnover: Group and share of joint ventures Continuing operations Acquisitions 4,498 3,737 -------- 8,235 (362) ... -

Page 31

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 29 Consolidated Balance Sheet at 31 March 2000 Note 2000 £m 1999 £m Fixed assets Intangible assets Tangible assets Investments Investments in joint ventures: Share of gross assets Share of gross liabilities 8 9 10 ... -

Page 32

30 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Consolidated Cash Flow for the year ended 31 March 2000 Note 2000 £m 1999 £m Net cash inï¬,ow from operating activities Dividends received from joint ventures and associated undertakings Net cash outï¬,ow for ... -

Page 33

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 31 Consolidated Statement of Total Recognised Gains and Losses for the year ended 31 March 2000 2000 £m 1999 £m Proï¬t for the ï¬nancial year Currency translation Total recognised gains and losses relating to the ... -

Page 34

... with Financial Reporting Standard 6, "Acquisitions and Mergers". The particular accounting policies adopted are stated below. Accounting convention The ï¬nancial statements are prepared under the historical cost convention. Basis of consolidation The Group ï¬nancial statements consolidate the... -

Page 35

... The balance sheet shows the Group's share of the net assets or liabilities of those companies, together with loans advanced and attributed goodwill. The consolidated ï¬nancial statements include investments in joint ventures using the gross equity method of accounting. A joint venture is a company... -

Page 36

34 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Notes to the Consolidated Financial Statements 1 Segmental analysis The Group operates substantially in one class of business, the supply of mobile telecommunications services and products. Analyses of turnover, pro... -

Page 37

... Plc Annual Report & Accounts for the year ended 31 March 2000 35 Notes to the Consolidated Financial Statements continued 2 Operating proï¬t Continuing operations £m Acquisitions £m 2000 £m 1999 £m Group turnover Cost of sales Gross proï¬t Selling and distribution costs Administrative... -

Page 38

... charges Share of joint ventures and associated undertakings net interest payable The exceptional ï¬nance costs were incurred in restructuring the Group's borrowing facilities in relation to the acquisition of Mannesmann AG. 5 Tax on proï¬t on ordinary activities United Kingdom Corporation... -

Page 39

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 37 Notes to the Consolidated Financial Statements continued 6 Equity dividends Interim dividend paid of 0.655p (1999 - 0.624p) per ordinary share Second interim dividend declared of Nil p (1999 - 0.648p) per ordinary ... -

Page 40

38 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Notes to the Consolidated Financial Statements continued 9 Tangible ï¬xed assets Cost 1 April 1999 Exchange movements Acquisitions (note 21) Reclassiï¬cations from associated undertakings Additions Disposals ... -

Page 41

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 39 Notes to the Consolidated Financial Statements continued 10 Fixed asset investments continued Joint ventures and associated undertakings The Group's share of its joint ventures and associated undertakings comprises:... -

Page 42

... Consolidated Financial Statements continued 13 Creditors: amounts falling due within one year 2000 £m 1999 £m Bank loans, other loans and overdrafts Commercial paper Trade creditors Amounts owed to associated undertakings Taxation Other taxes and social security costs Other creditors Dividends... -

Page 43

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 41 Notes to the Consolidated Financial Statements continued 15 Financial liabilities Net debt Liquid investments Cash at bank and in hand Debt due in one year or less, or on demand Debt due after one year (30) (159) ... -

Page 44

...the fair value of the consideration for the acquisition of Mannesmann AG as at 31 March 2000. The following methods and assumptions were used to estimate the fair values shown above. Fixed asset investments (excluding investments in joint ventures and associated undertakings) - The net book value of... -

Page 45

... Plc Annual Report & Accounts for the year ended 31 March 2000 43 Notes to the Consolidated Financial Statements continued 17 Provisions for liabilities and charges Deferred taxation £m Post employment beneï¬ts £m Other provisions £m Total £m 1 April 1999 Exchange movements Acquisitions... -

Page 46

44 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Notes to the Consolidated Financial Statements continued 18 Called up share capital 2000 Number £m Number 1999 £m Authorised Ordinary shares of US$0.10 each 7% cumulative ï¬xed rate shares of £1 each Ordinary ... -

Page 47

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 45 Notes to the Consolidated Financial Statements continued 18 Called up share capital continued Options A summary of the options outstanding at 31 March 2000 to subscribe for shares in the Company is provided in the ... -

Page 48

46 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Notes to the Consolidated Financial Statements continued 19 Reserves Share premium account £m Merger reserve £m Other reserve £m Proï¬t and loss account £m 1 April 1999 Shares issued in respect of the merger ... -

Page 49

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 47 Notes to the Consolidated Financial Statements continued 21 Acquisitions and disposals Merger with AirTouch Communications, Inc. Balance sheet at acquisition £m (1) (1 Reclassiï¬cation (2) £m Fair (1 value (2) ... -

Page 50

48 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Notes to the Consolidated Financial Statements continued 21 Acquisitions and disposals continued Pre-merger results of AirTouch Communications, Inc. The summarised proï¬t and loss accounts and statements of total ... -

Page 51

... Group's balance sheet. 23 Capital commitments 2000 £m 1999 £m Contracted for but not provided 442 -------- 161 -------- 24 Contingent liabilities 2000 £m 1999 £m Guarantees and indemnities of bank or other facilities including those in respect of the Group's joint ventures, associated... -

Page 52

...year comprised issues of new ordinary shares in relation to the merger with AirTouch Communications, Inc. and the acquisition of Mannesmann AG. Further details are included in note 18. 26 Analysis of net debt 1 April 1999 £m Cash ï¬,ow £m Acquisitions (excluding cash & overdrafts) £m Other non... -

Page 53

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 51 Notes to the Consolidated Financial Statements continued 27 Directors Aggregate emoluments of the directors of the Company were as follows: 2000 £000 1999 £000 Salaries and fees Bonuses Incentive schemes Beneï¬... -

Page 54

... of Vodafone AirTouch's and Bell Atlantic's US cellular, PCS and paging assets. Following the anticipated completion of the merger between Bell Atlantic Corp. and GTE Corp., the Group will have a 45% shareholding in the new venture. On 12 April 2000, the acquisition of Mannesmann AG received... -

Page 55

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 53 Company Balance Sheet at 31 March 2000 Note 2000 £m 1999 £m Fixed assets Investments 31 55,416 -------- 3,222 -------- Current assets Debtors 32 7,554 572 Creditors: amounts falling due within one year 33 ... -

Page 56

54 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Notes to the Company Balance Sheet 31 Fixed asset investments Subsidiary undertakings £m Associated undertakings £m Other Investments £m Total £m Cost 1 April 1999 Exchange movements Additions Disposals 31 ... -

Page 57

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 55 Notes to the Company Balance Sheet 35 Deferred taxation continued 2000 Amount provided £m Amount unprovided £m Amount provided £m 1999 Amount unprovided £m Asset arising from other timing differences - ... -

Page 58

...Vodafone Value Added and Data Services Limited Vodafone AirTouch Global Commercial Services Limited Vodafone Finance Limited Vodafone AirTouch Group Services Limited Vodafone AirTouch International Holdings BV (1) Libertel NV Libertel Netwerk BV Libertel Verkoop en Services BV Vodafone Malta Limited... -

Page 59

..., 1209 Orange Street, Wilmington, Delaware, 19801 USA. The Group's investment in these ventures is subject to a partnership arrangement that confers joint control. Principal associated undertakings Vodafone AirTouch Plc's principal associated undertakings all have share capital consisting solely of... -

Page 60

... between US Generally Accepted Accounting Principles ("US GAAP") and UK Generally Accepted Accounting Principles ("UK GAAP") that are signiï¬cant to Vodafone AirTouch Plc. The principles are set out on page 59. Net income and earnings per ordinary share 2000 £m 1999 £m Net income as reported in... -

Page 61

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 59 United States Accounting Principles continued Summary of differences between accounting principles generally accepted in the UK and the US The consolidated ï¬nancial statements are prepared in accordance with ... -

Page 62

... under a joint venture arrangement with Bell Atlantic or the acquisition of Mannesmann AG, for which European Commission approval was received on 12 April 2000. Unaudited pro forma proï¬t and loss accounts for the years ended 31 March 2000 and 31 March 1999 2000 £m 1999 £m Group turnover 8,887... -

Page 63

... in restructuring the Group's borrowing facilities as a result of the acquisition of Mannesmann. Pro forma earnings per share 2000 £m 1999 £m Earnings/(loss) for the ï¬nancial year for basic earnings/(loss) per share Amortisation of goodwill Exceptional reorganisation costs, net of attributable... -

Page 64

... ï¬nancial statements prepared in accordance with UK GAAP. UK GAAP requires consolidation of entities controlled by the Group and the equity method of accounting for entities in which the Group has signiï¬cant inï¬,uence but not a controlling interest. Joint ventures are consolidated using the... -

Page 65

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 63 Notes -

Page 66

64 Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Notes -

Page 67

Vodafone AirTouch Plc Annual Report & Accounts for the year ended 31 March 2000 Designed and produced by Barrett Howe Plc. Printed by Pillans & Wilson Greenaway. Printed on elementary chlorine free paper manufactured using woodpulp from sustainable resources. -

Page 68

Vodafone AirTouch Plc Registered Office: The Courtyard, 2-4 London Road, Newbury, Berkshire RG14 1JX, England Tel: +44 (0)1635 33251 Fax: +44 (0)1635 45713 Registered in England No.1833679 www.vodafone.com PRINTED IN UNITED KINGDOM